ICICI Bank 2016 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2015-2016194

Group and its associates as at 31 March 2016, and their consolidated prot and their consolidated cash ows for the year

ended on that date.

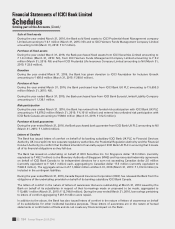

EMPHASIS OF MATTER

We draw attention to Note 15 to the consolidated nancial statements, which provides details with regard to the creation

of provision relating to Funded Interest Term Loan through utilization of reserves pertaining to the year ended 31 March

2015, as permitted by the RBI vide letter dated 6 January 2015. Our opinion is not modied in respect of this matter.

OTHER MATTERS

(a) We did not audit the nancial statements of thirteen subsidiaries, whose nancial statements reect total assets

of Rs. 1,067,124 million as at 31 March 2016, total revenues of Rs. 64,249 million and net cash inows amounting

to Rs. 7,375 million for the year ended on that date, as considered in the consolidated nancial statements. The

consolidated nancial statements also include the ICICI Group’s share of net prot of Rs. 91 million for the year ended

31 March 2016, as considered in the consolidated nancial statements, in respect of an associate, whose nancial

statements and other nancial information have not been audited by us. These nancial statements and other nancial

information have been audited by other auditors whose reports have been furnished to us by Management and our

opinion on the consolidated nancial statements, in so far as it relates to the amounts and disclosures included in

respect of these subsidiaries and associate, and our report in terms of sub-section (3) and (11) of Section 143 of

the Act, insofar as it relates to the aforesaid subsidiaries and associate, is based solely on the reports of the other

auditors.

(b) We have jointly audited with other auditor, the nancial statements of a subsidiary whose nancial statements reect

total assets of Rs. 1,047,662 million as at 31 March 2016, total revenues of Rs. 231,799 million for the year ended 31

March 2016 and net cash inows amounting to Rs. 22,195 million for the year ended 31 March 2016. For the purpose

of the consolidated nancial statements, we have relied upon the work of the other auditor, to the extent of work

performed by them and our report in terms of sub-section (3) and (11) of Section 143 of the Act, insofar as it relates

to this subsidiary, is based solely on the report of the other auditor, to the extent of work performed by them.

(c) The consolidated nancial statements also include the ICICI Group’s share of net prot of Rs. 223 million for the year

ended 31 March 2016, as considered in the consolidated nancial statements, in respect of six associates, whose

nancial statements and other nancial information have not been audited by us. These nancial statements and

other nancial information are unaudited and have been furnished to us by Management and our opinion on the

consolidated nancial statements, in so far as it relates to the amounts and disclosures included in respect of these

associates, and our report in terms of sub-section (3) and (11) of Section 143 of the Act, insofar as it relates to the

aforesaid associates, is based solely on such unaudited nancial statements and other nancial information. In our

opinion and according to the information and explanations given to us by Management, these nancial statements

and other nancial information are not material to the ICICI Group.

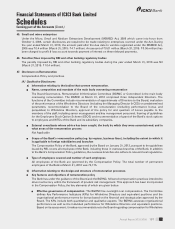

(d) The auditors of ICICI Prudential Life Insurance Company, the ICICI Group’s Life Insurance subsidiary have reported,

“The actuarial valuation of liabilities for life policies in force is the responsibility of the Company’s Appointed Actuary

(the “Appointed Actuary”). The actuarial valuation of these liabilities for life policies in force and for policies in respect

of which premium has been discontinued but liability exists as at March 31, 2016 has been duly certied by the

Appointed Actuary and in his opinion, the assumptions for such valuation are in accordance with the guidelines

and norms issued by the Insurance Regulatory Development Authority (“IRDAI” / “Authority”) and the Institute of

Actuaries of India in concurrence with the Authority. We have relied upon Appointed Actuary’s certicate in this

regard for forming our opinion on the valuation of liabilities for life policies in force and for policies in respect of

which premium has been discontinued but liability exists on standalone nancial statements of the Company”.

(e) The auditors of ICICI Lombard General Insurance Company Limited, the ICICI Group’s General Insurance subsidiary

have reported, “The Actuarial valuation of liabilities in respect of Incurred But Not Reported (‘IBNR’) and Incurred But

Not Enough Reported (‘IBNER’) as at March 31, 2016, other than for reinsurance accepted from Declined Risk Pool (‘DR

Pool’) has been duly certied by the Appointed Actuary of the Company and relied upon by us. The Appointed Actuary

has also certied that the assumptions considered by him for such valuation are in accordance with the guidelines

and norms prescribed by the IRDAI and the Actuarial Society of India in concurrence with the IRDAI. In respect of

reinsurance accepted from DR Pool, IBNR / IBNER has been recognized based on estimates received from DR pool”.

Independent Auditors’ Report