ICICI Bank 2016 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

Directors’ Report

Annual Report 2015-2016

For the non-executive (part-time) Chairman, the remuneration, in addition to sitting fee includes such xed payments

on such periodicity as may be recommended by the Board and approved by the Members and RBI from time to time,

maintaining a Chairman’s ofce at the Bank’s expense, bearing expenses for travel on ofcial visits and participation

in various forums (both in India and abroad) as Chairman of the Bank and bearing travel/halting/other expenses and

allowances for attending to duties as Chairman of the Bank and any other modes of remuneration as may be permitted

by RBI through any circulars/guidelines as may be issued from time to time.

All the non-executive/independent Directors would be entitled to reimbursement of expenses for attending Board/

Committee Meetings, ofcial visits and participation in various forums on behalf of the Bank.

Performance evaluation of the Board, Committees and Directors

The Bank with the approval of its Board Governance, Remuneration & Nomination Committee has put in place an

evaluation framework for evaluation of the Board, Directors and Chairperson. The Board also carries out an evaluation

of the working of its Audit Committee, Board Governance, Remuneration & Nomination Committee, Corporate Social

Responsibility Committee, Credit Committee, Customer Service Committee, Fraud Monitoring Committee, Information

Technology Strategy Committee, Risk Committee, Stakeholders Relationship Committee and Review Committee for

Identication of Wilful Defaulters/Non Co-operative Borrowers. The evaluation of the Committees is based on the

assessment of the compliance with the terms of reference of the Committees.

The evaluations for the Directors and the Board were undertaken through circulation of two questionnaires, one for the

Directors and the other for the Board which assessed the performance of the Board on select parameters related to

roles, responsibilities and obligations of the Board and functioning of the Committees including assessing the quality,

quantity and timeliness of ow of information between the company management and the Board that is necessary for

the Board to effectively and reasonably perform their duties. The evaluation criteria for the Directors was based on their

participation, contribution and offering guidance to and understanding of the areas which were relevant to them in their

capacity as members of the Board. The evaluation process for wholetime Directors is further detailed under the section

titled “Compensation Policy and Practices”.

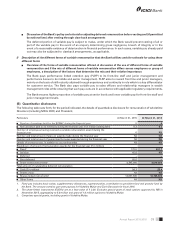

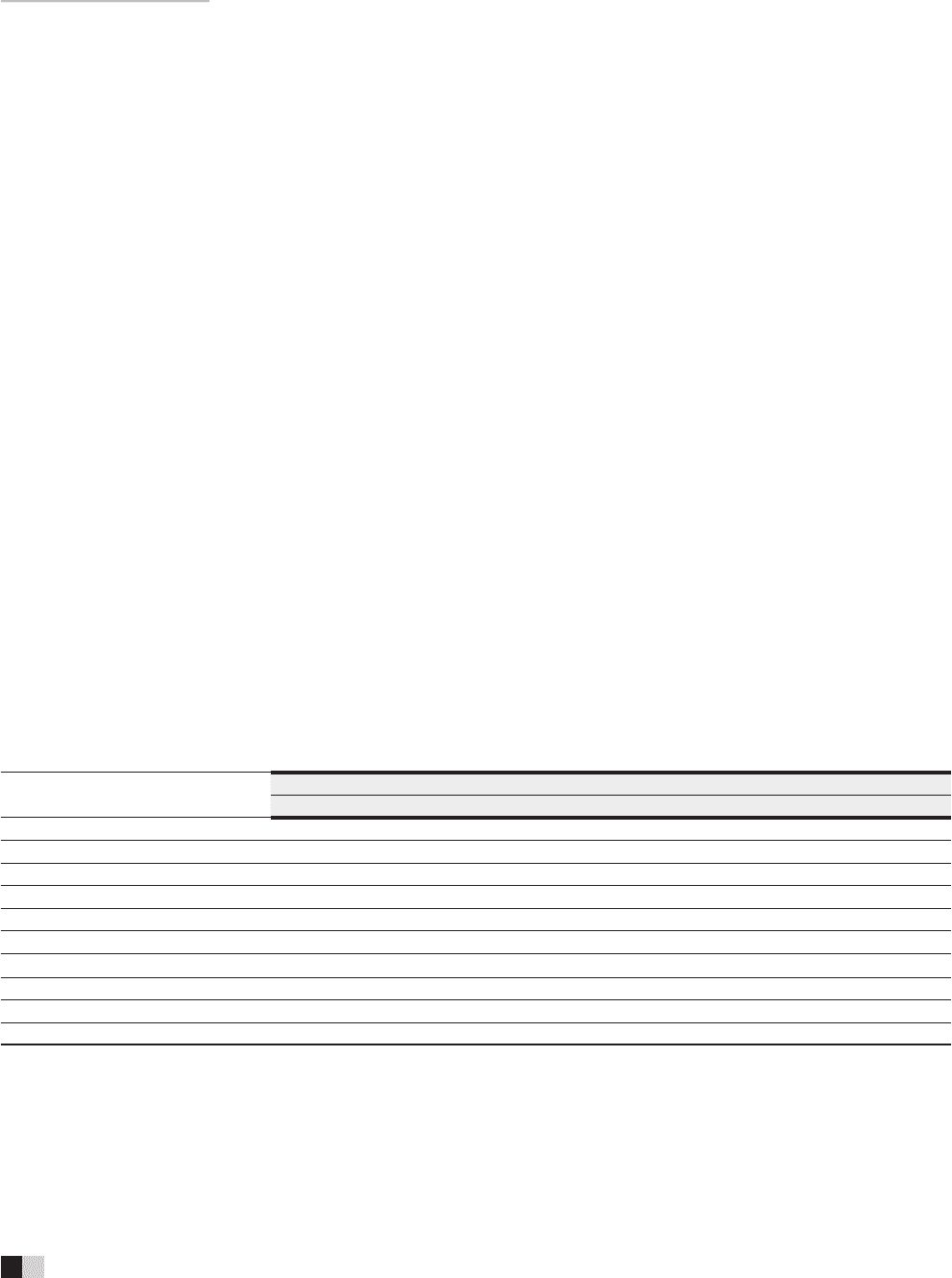

Details of Remuneration paid to wholetime Directors

The Board Governance, Remuneration & Nomination Committee determines and recommends to the Board the amount

of remuneration, including performance bonus and perquisites, payable to the wholetime Directors.

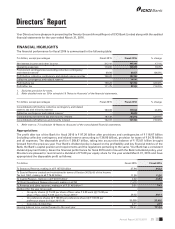

The following table sets out the details of remuneration (including perquisites and retiral benets) paid to wholetime

Directors for scal 2016:

Details of Remuneration (`)

Chanda Kochhar N. S. Kannan K. Ramkumar Vishakha Mulye3Rajiv Sabharwal

Basic 23,192,040 15,321,360 15,321,360 5,065,934 14,481,840

Performance bonus for scal 2016 –––––

Allowances and perquisites216,578,411 12,466,572 13,367,997 4,448,443 12,998,352

Contribution to provident fund 2,783,043 1,838,568 1,838,568 607,912 1,737,816

Contribution to superannuation fund 3,478,810 2,298,204 2,298,204 –2,172,278

Contribution to gratuity fund 1,931,897 1,276,269 1,276,269 421,992 1,206,337

Stock options4 (Numbers)

Fiscal 201611,375,000 685,000 685,000 685,000 685,000

Fiscal 2015 1,450,000 725,000 725,000 –655,000

Fiscal 2014 1,450,000 725,000 725,000 –725,000

1. Options granted for fiscal 2016 are subject to Reserve Bank of India (RBI) approval.

2. Allowances and perquisites exclude stock options exercised during fiscal 2016 which does not constitute remuneration paid to the

wholetime Directors for fiscal 2016.

3. Vishakha Mulye has joined the services of the Bank on December 2, 2015. Pursuant to approval granted by RBI vide its letter dated

January 15, 2016 Vishakha Mulye assumed office as executive Director with effect from January 19, 2016.

4. The above table excludes special grant of stock options approved by RBI in November 2015 aggregating to 2,100,000 for Chanda

Kochhar and 1,000,000 each for N. S. Kannan, K. Ramkumar and Rajiv Sabharwal.