ICICI Bank 2016 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114

Management’s Discussion & Analysis

Annual Report 2015-2016

Retail banking segment

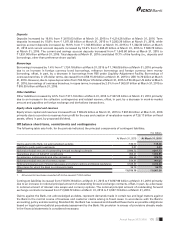

The prot before tax of the retail banking segment increased from ` 27.24 billion in scal 2015 to ` 38.98 billion in scal

2016 due to an increase in net interest income and non-interest income, offset, in part, by an increase in non-interest

expenses and higher provisions.

Net interest income increased by 28.7% from ` 71.42 billion in scal 2015 to ` 91.91 billion in scal 2016 primarily due to

growth in the loan portfolio and an increase in average current account and savings account deposits.

Non-interest income increased by 14.6% from ` 42.77 billion in scal 2015 to ` 49.02 billion in scal 2016, primarily due

to a higher level of loan processing fees, third party product distribution fees, fees from the credit cards business and

transaction banking fees.

Non-interest expenses increased by 13.7% from ` 86.15 billion in scal 2015 to ` 97.97 billion in scal 2016, primarily due

to an increase in the retail lending business and expansion in the branch network. Provision charge increased from ` 0.80

billion in scal 2015 to ` 3.99 billion in scal 2016.

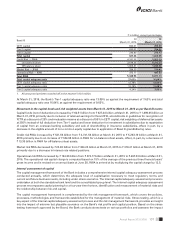

Wholesale banking segment

The wholesale banking segment incurred a loss of ` 12.45 billion in scal 2016 primarily due to an increase in provisions.

Net interest income decreased by 1.0% from ` 84.47 billion in scal 2015 to ` 83.61 billion in scal 2016 primarily due

to the higher additions to non-performing loans, on which interest income is not accrued, offset, in part, by an increase

in net interest income on account of an increase in the portfolio size. Provisions increased from ` 35.39 billion in scal

2015 to ` 108.15 billion in scal 2016 primarily due to an increase in additions to non-performing assets and creation of

a collective contingency and related reserve of ` 36.00 billion on a prudent basis during quarter ended March 31, 2016.

Treasury segment

The prot before tax of the treasury segment increased from ` 64.50 billion in scal 2015 to ` 90.97 billion in scal 2016

primarily due to an increase in non-interest income. The non-interest income was higher primarily due to prot on sale of

stakes in subsidiaries, higher exchange rate gains on repatriation of retained earnings from overseas branches and higher

gains on government securities and other xed income securities.

Other banking segment

The prot before tax of the other banking segment increased from ` 4.22 billion in scal 2015 to ` 4.46 billion in scal 2016

primarily due to higher net interest income.

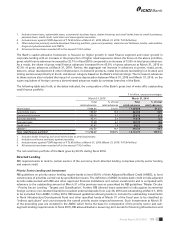

CONSOLIDATED FINANCIALS AS PER INDIAN GAAP

The consolidated prot before collective contingency and related reserve, tax and minority interest decreased by 2.4%

from ` 183.39 billion in scal 2015 to ` 179.04 billion in scal 2016.

The consolidated prot after tax decreased by 16.9% from ` 122.47 billion in scal 2015 to ` 101.80 billion in scal 2016

primarily due to a decrease in the prot of ICICI Bank, ICICI Bank UK PLC, ICICI Bank Canada, ICICI Securities Limited,

ICICI Lombard General Insurance Company Limited and ICICI Securities Primary Dealership Limited, offset, in part, by

an increase in the prot of ICICI Prudential Asset Management Company Limited and ICICI Prudential Life Insurance

Company Limited.

At March 31, 2016, the consolidated Tier-1 capital adequacy ratio was 13.13% as against the regulatory requirement of

7.63% and the consolidated total capital adequacy ratio was 16.60% as against the current requirement of 9.63%.

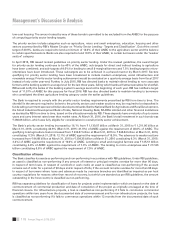

The prot before tax of ICICI Prudential Life Insurance Company Limited increased from ` 16.34 billion in scal 2015 to

` 17.72 billion in scal 2016 primarily due to an increase in net premium earned and investment income and a decrease

in provision for policyholder liabilities, offset, in part, by an increase in transfer to linked funds and operating expenses.

However, prot after tax increased only marginally from ` 16.34 billion in scal 2015 to ` 16.50 billion in scal 2016 due

to a tax charge of ` 1.22 billion in scal 2016 as compared to nil tax charge in scal 2015.