ICICI Bank 2016 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

Annual Report 2015-2016142

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

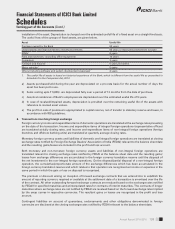

12. Provisions, contingent liabilities and contingent assets

The Bank estimates the probability of any loss that might be incurred on outcome of contingencies on the basis of

information available up to the date on which the nancial statements are prepared. A provision is recognised when

an enterprise has a present obligation as a result of a past event and it is probable that an outow of resources will be

required to settle the obligation, in respect of which a reliable estimate can be made. Provisions are determined based

on management estimates of amounts required to settle the obligation at the balance sheet date, supplemented

by experience of similar transactions. These are reviewed at each balance sheet date and adjusted to reect the

current management estimates. In cases where the available information indicates that the loss on the contingency is

reasonably possible but the amount of loss cannot be reasonably estimated, a disclosure to this effect is made in the

nancial statements. In case of remote possibility neither provision nor disclosure is made in the nancial statements.

The Bank does not account for or disclose contingent assets, if any.

The Bank estimates the probability of redemption of customer loyalty reward points using an actuarial method by

employing an independent actuary and accordingly makes provision for these reward points. Actuarial valuation is

determined based on certain assumptions regarding mortality rate, discount rate, cancellation rate and redemption

rate.

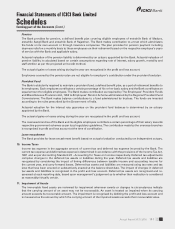

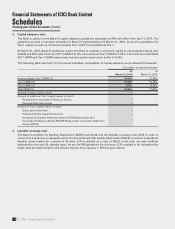

13. Earnings per share (EPS)

Basic and diluted earnings per share are computed in accordance with Accounting Standard 20 – Earnings per share.

Basic earnings per share is calculated by dividing the net prot or loss after tax for the year attributable to equity

shareholders by the weighted average number of equity shares outstanding during the year.

Diluted earnings per share reect the potential dilution that could occur if contracts to issue equity shares were

exercised or converted during the year. Diluted earnings per equity share is computed using the weighted average

number of equity shares and dilutive potential equity shares outstanding during the year, except where the results

are anti-dilutive.

14. Lease transactions

Lease payments for assets taken on operating lease are recognised as an expense in the prot and loss account over

the lease term on straight line basis.

15. Cash and cash equivalents

Cash and cash equivalents include cash in hand, balances with RBI, balances with other banks and money at call and

short notice.