ICICI Bank 2016 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2015-2016 173

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

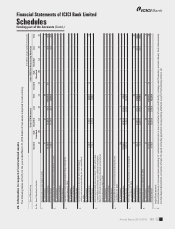

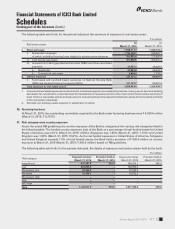

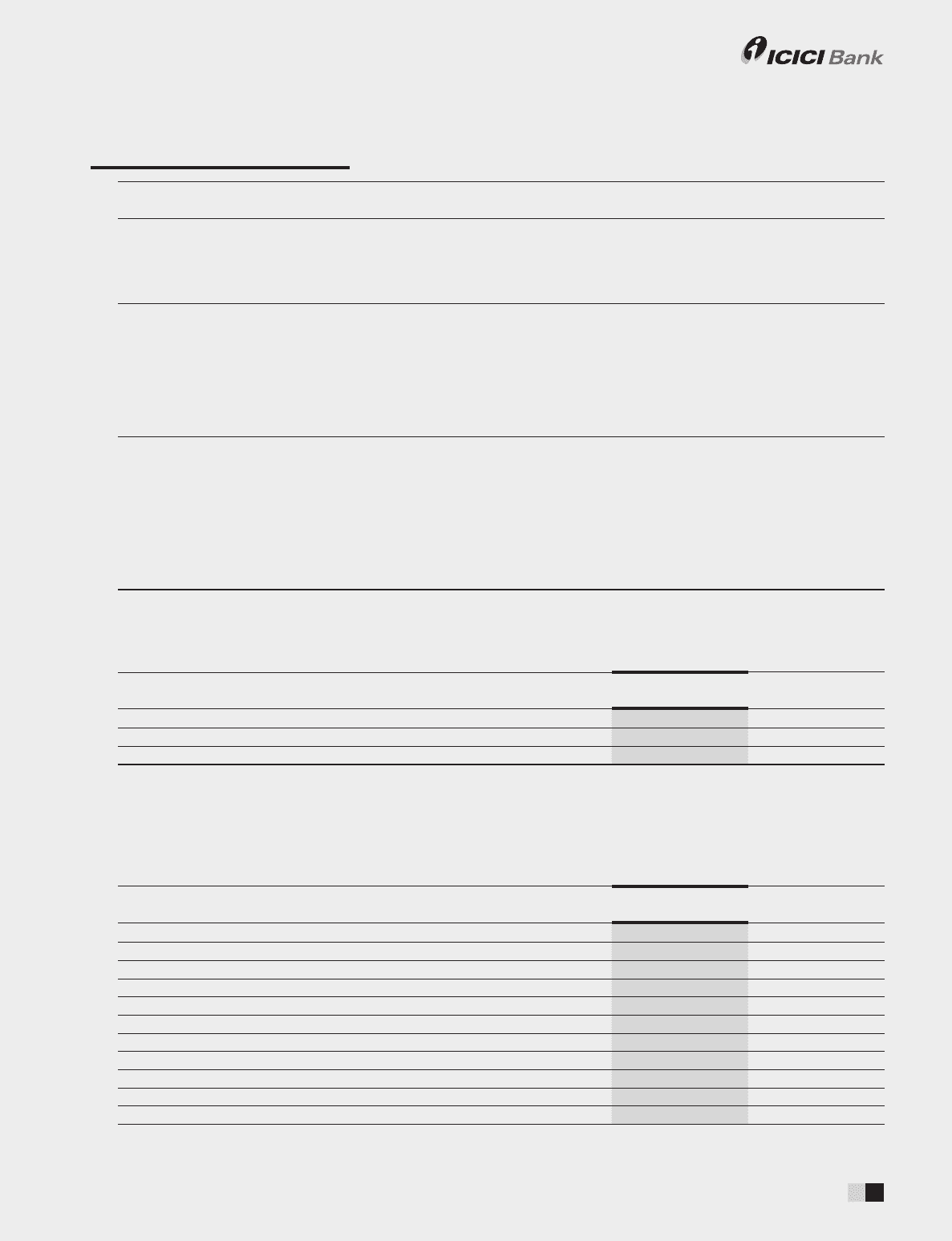

Sr. no. Contingent liability Brief Description

4. Guarantees given on

behalf of constituents,

acceptances, endorse-

ments and other

obligations

This item represents the guarantees and documentary credits issued by the Bank in favour

of third parties on behalf of its customers, as part of its trade nance banking activities with

a view to augment the customers’ credit standing. Through these instruments, the Bank

undertakes to make payments for its customers’ obligations, either directly or in case the

customers fail to fulll their nancial or performance obligations.

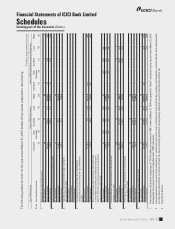

5. Currency swaps, interest

rate swaps, currency

options and interest rate

futures

This item represents the notional principal amount of various derivative instruments which

the Bank undertakes in its normal course of business. The Bank offers these products to its

customers to enable them to transfer, modify or reduce their foreign exchange and interest

rate risks. The Bank also undertakes these contracts to manage its own interest rate and

foreign exchange positions. With respect to the transactions entered into with its customers,

the Bank generally enters into off-setting transactions in the inter-bank market. This results in

generation of a higher number of outstanding transactions, and hence a large value of gross

notional principal of the portfolio, while the net market risk is lower.

6. Other items for which the

Bank is contingently liable

Other items for which the Bank is contingently liable primarily include the amount of

government securities bought/sold and remaining to be settled on the date of nancial

statements. This also includes the value of sell down options and other facilities pertaining

to securitisation, the notional principal amounts of credit derivatives, amount applied in

public offers under Application Supported by Blocked Amounts (ASBA), bill re-discounting,

amount transferred to the RBI under the Depositor Education and Awareness Fund (DEAF),

exposure under partial credit enhancement, commitment towards contribution to venture

fund and the amount that the Bank is obligated to pay under capital contracts. Capital

contracts are job orders of a capital nature which have been committed.

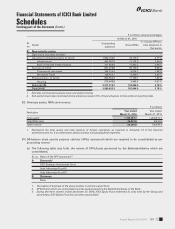

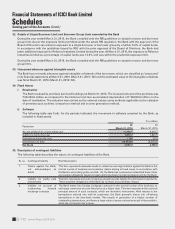

36. Insurance business

The following table sets forth, for the periods indicated, the break-up of income derived from insurance business.

` in million

Sr.

No. Nature of income Year ended

March 31, 2016

Year ended

March 31, 2016

1. Income from selling life insurance policies 7,667.7 6,325.7

2. Income from selling non-life insurance policies 735.1 678.2

3. Income from selling mutual fund/collective investment scheme products 1,794.5 2,426.6

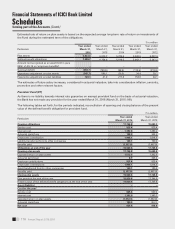

37. Employee benets

Pension

The following tables set forth, for the periods indicated, movement of the present value of the dened benet

obligation, fair value of plan assets and other details for pension benets.

` in million

Particulars Year ended

March 31, 2015

Year ended

March 31, 2014

Opening obligations 12,999.9 10,209.9

Service cost 251.0 217.8

Interest cost 1,034.7 943.5

Actuarial (gain)/loss 1,594.7 3,174.7

Liabilities extinguished on settlement (1,554.0) (1,381.1)

Benets paid (134.7) (164.9)

Obligations at the end of year 14,191.6 12,999.9

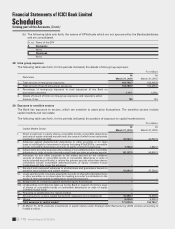

Opening plan assets, at fair value 10,103.4 9,018.8

Expected return on plan assets 902.9 743.3

Actuarial gain/(loss) (4.1) 104.7

Assets distributed on settlement (1,726.7) (1,534.6)