ICICI Bank 2016 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

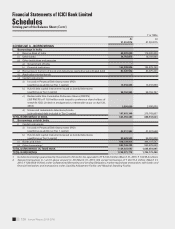

Annual Report 2015-2016 137

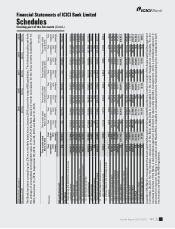

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

6. Costs including brokerage and commission pertaining to investments, paid at the time of acquisition, are charged

to the prot and loss account. Cost of investments is computed based on the First-In-First-Out (FIFO) method.

7. Equity investments in subsidiaries/joint ventures are categorised as ‘Held to Maturity’ in accordance with

RBI guidelines. The Bank assesses these investments for any permanent diminution in value and appropriate

provisions are made.

8. Prot/loss on sale of investments in the ‘Held to Maturity’ category is recognised in the prot and loss account

and prot is thereafter appropriated (net of applicable taxes and statutory reserve requirements) to Capital

Reserve. Prot/loss on sale of investments in ‘Available for Sale’ and ‘Held for Trading’ categories is recognised

in the prot and loss account.

9. Market repurchase and reverse repurchase transactions are accounted for as borrowing and lending transactions

respectively in accordance with the extant RBI guidelines. The transactions with RBI under Liquidity Adjustment

Facility (LAF) are accounted for as borrowing and lending transactions.

10. Broken period interest (the amount of interest from the previous interest payment date till the date of purchase/

sale of instruments) on debt instruments is treated as a revenue item.

11. At the end of each reporting period, security receipts issued by the asset reconstruction companies are valued in

accordance with the guidelines applicable to such instruments, prescribed by RBI from time to time. Accordingly,

in cases where the cash ows from security receipts issued by the asset reconstruction companies are limited

to the actual realisation of the nancial assets assigned to the instruments in the concerned scheme, the Bank

reckons the net asset value obtained from the asset reconstruction company from time to time, for valuation of

such investments at each reporting period end. The security receipts which are outstanding and not redeemed

as at the end of the resolution period are treated as loss assets and are fully provided for.

12. The Bank follows trade date method of accounting for purchase and sale of investments, except for government

of India and state government securities where settlement date method of accounting is followed in accordance

with RBI guidelines.

13. The Bank undertakes short sale transactions in dated central government securities in accordance with RBI

guidelines. The short positions are categorised under HFT category and are marked to market. The mark-to-

market loss is charged to prot and loss account and gain, if any, is ignored as per RBI guidelines.

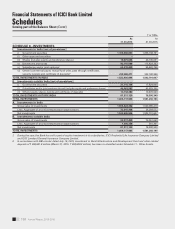

3. Provision/write-offs on loans and other credit facilities

The Bank classies its loans and investments, including at overseas branches and overdues arising from crystallised

derivative contracts, into performing and NPAs in accordance with RBI guidelines. Loans and advances held at the

overseas branches that are identied as impaired as per host country regulations for reasons other than record of

recovery, but which are standard as per the extant RBI guidelines, are classied as NPAs to the extent of amount

outstanding in the host country. Further, NPAs are classied into sub-standard, doubtful and loss assets based on the

criteria stipulated by RBI.

In the case of corporate loans and advances, provisions are made for sub-standard and doubtful assets at rates

prescribed by RBI. Loss assets and the unsecured portion of doubtful assets are provided/written-off as per the

extant RBI guidelines. For loans and advances booked in overseas branches, which are standard as per the extant

RBI guidelines but are classied as NPAs based on host country guidelines, provisions are made as per the host

country regulations. For loans and advances booked in overseas branches, which are NPAs as per the extant RBI

guidelines and as per host country guidelines, provisions are made at the higher of the provisions required under

RBI regulations and host country regulations. Provisions on homogeneous retail loans and advances, subject to

minimum provisioning requirements of RBI, are assessed at a borrower level, on the basis of the ageing of the loans

in the non-performing category. In respect of loans classied as fraud, the entire amount, without considering the

value of security, is provided for over a period of four quarters starting from the quarter in which fraud has been

detected. In accounts where there has been delay in reporting the fraud to the RBI, the entire amount is provided

immediately. In respect of borrowers classied as non-cooperative borrowers, willful defaulters and NPAs covered

under distressed assets framework of RBI, the Bank makes accelerated provisions as per extant RBI guidelines.