ICICI Bank 2016 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2015-20168

Message from the Managing Director & CEO

Against this backdrop, at ICICI Bank, we focused on

capitalising on growth opportunities while at the same

time taking necessary steps to address challenges in the

environment. We continued to enhance our franchise, and

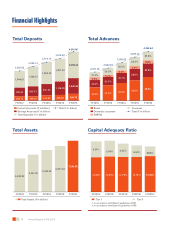

maintained our financial strength with robust capital levels.

I would like to share some highlights for the Bank during

the year.

We sustained robust growth in our retail loan portfolio

which grew by 23.3% and now constitutes 46.6% of

total loans.

We selectively grew our corporate portfolio focusing

on higher rated clients, with a revised limit framework

aimed at reducing concentration risk in the portfolio.

We maintained our healthy funding profile, with an

addition of ` 193.70 billion to savings deposits and

` 93.50 billion to current account deposits, and a CASA

ratio of 45.8%. We expanded our network to 4,450

branches and 13,766 ATMs.

We continued to be at the forefront of leveraging

technology to improve the customer experience. We

were the first bank in India to introduce contactless

mobile payments using smartphones. We introduced

Express Home Loans, the country’s first fully online

process for sanctioning home loans. Our digital wallet,

Pockets, has had over 3.6 million downloads. Our

banking application, iMobile, is the most comprehensive

banking app in the country, offering over 150 services,

many of which are industry firsts.

With our focus on core operating parameters, we

achieved an operating profit of ` 238.63 billion, a year-

on-year growth of 21.0%.

In view of the challenges being experienced by certain

sectors of the economy, the Bank further strengthened

its balance sheet by creating a collective contingency

and related reserve of ` 36.00 billion on a prudent

basis. This is over and above provisions made for non-

performing and restructured loans as per Reserve Bank

of India guidelines.

The Bank’s standalone profit before the above

collective contingency and related reserve and tax

was ` 157.96 billion. Even after taking into account the

above prudent reserving and provision for tax, the Bank

achieved a standalone profit after tax of ` 97.26 billion

and a consolidated profit after tax of ` 101.80 billion.

The global economy experienced challenging conditions

in fiscal 2016, with weak growth and divergent monetary

policies in advanced economies, slowdown in China

and significant decline in commodity prices. The Indian

economy continued to make progress during the year,

with improvement in key macroeconomic parameters

and focused government initiatives to drive sustainable

growth. However, the corporate sector continued to

experience challenges given the prolonged slowdown in

growth in earlier years and the global environment. Credit

growth in the banking sector was moderate, with robust

retail loan demand being offset by muted demand from

the corporate sector. While retail asset quality was healthy

and stable, the challenges facing the corporate sector

impacted the asset quality metrics and profitability of

banks. Other segments of financial services, like insurance

and mutual funds, witnessed healthy growth.