ICICI Bank 2016 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53Annual Report 2015-2016

COMPLIANCE CERTIFICATE OF THE AUDITORS

ICICI Bank has annexed to this report, a certicate obtained from the statutory auditors, M/s B S R & Co. LLP, Chartered

Accountants, regarding compliance of conditions of Corporate Governance as stipulated in Securities and Exchange

Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015.

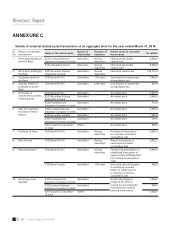

EMPLOYEE STOCK OPTION SCHEME

The Bank has an Employee Stock Option Scheme (ESOS/Scheme) which was instituted in scal 2000 to enable the

employees and wholetime Directors of ICICI Bank and its subsidiaries to participate in future growth and nancial

success of the Bank. The ESOS aims at achieving the twin objectives of (i) aligning employee interest to that of the

shareholders; and (ii) retention of talent. Through employee stock option grants, the Bank seeks to foster a culture of

long-term sustainable value creation. The Scheme is in compliance with the SEBI (Share Based Employee Benets)

Regulations, 2014 and the below disclosures are available at www.icicibank.com/aboutus/annual.page. Pursuant to SEBI

(Share Based Employee Benets) Regulations, 2014, options are granted by the Board Governance, Remuneration &

Nomination Committee (BGRNC) and noted by the Board.

The Scheme was initially approved by the Members at their meeting held on February 21, 2000 and thereafter further

amended through resolutions at the General Meetings held on September 20, 2004 and June 25, 2012 and vide a postal

ballot resolution passed on April 22, 2016. The Bank has upto April 28, 2016 granted 423.62 million stock options from

time to time aggregating to 7.28% of the issued equity capital of the Bank at April 28, 2016. As per the ESOS, as amended

from time to time, the maximum number of options granted to any employee/Director in a year is limited to 0.05% of ICICI

Bank’s issued equity shares at the time of the grant, and the aggregate of all such options is limited to 10% of ICICI Bank’s

issued equity shares on the date of the grant (equivalent to 581.52 million shares of face value ` 2 each at April 28, 2016).

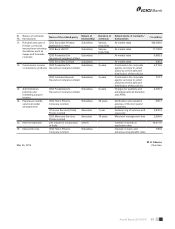

Options granted after April 1, 2014 vest in a graded manner over a three year period, with 30%, 30% and 40% of the

grant vesting in each year, commencing from the end of 12 months from the date of the grant, other than the following:

250,000 options granted in April 2014 would vest in equal proportions on April 30, 2017 and April 30, 2018.

Options granted in September 2015 would vest in equal proportions on April 30, 2018 and April 30, 2019. The

unvested options would lapse upon termination of employment due to retirement (including pursuant to early/

voluntary retirement scheme).

Options granted prior to April 1, 2014 vest in a graded manner over a four-year period, with 20%, 20%, 30% and 30% of

the grants vesting in each year commencing from the end of 12 months from the date of grant, other than the following:

Options granted in April 2009 vested in a graded manner over a ve year period with 20%, 20%, 30% and 30% of the

grant vesting in each year, commencing from the end of 24 months from the date of the grant.

The grant approved by the Board at its Meeting held on October 29, 2010 (for which RBI approval for grant to

wholetime Directors was received in January 2011), vested 50% on April 30, 2014 and the balance 50% vested on

April 30, 2015.

Options granted in September 2011 vest in a graded manner over a ve year period with 15%, 20%, 20% and 45%

of the grant vesting in each year, commencing from end of 24 months from the date of grant.

The price for options granted (except for grants approved on October 29, 2010 where the grant price was the average

closing price of the ICICI Bank stock on the stock exchange during the six months upto October 28, 2010) is equal to the

closing price on the stock exchange which recorded the highest trading volume preceding the date of grant of options

in line with the SEBI regulations.

Pursuant to the postal ballot resolution dated April 22, 2016 approved by the Members, the denition of exercise period

has been modied from the period commencing from the date of vesting of Options and ending on the later of (i) the

tenth anniversary of the date of grant of Options or (ii) the fth anniversary of the date of vesting of Options to the period

commencing from the date of vesting of Options and ending on the tenth anniversary of the date of vesting of Options.