ICICI Bank 2016 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

Directors’ Report

Annual Report 2015-2016

The terms of reference of the Board Committees as mentioned earlier, their composition and attendance of the respective

Members at the various Committee Meetings held during scal 2016 are set out below:

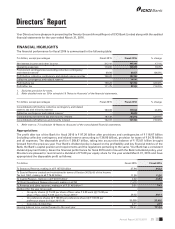

II. Audit Committee

Terms of Reference

The Audit Committee provides direction to the audit function and monitors the quality of internal and statutory audit. The

responsibilities of the Audit Committee include examining the nancial statements and auditors’ report and overseeing

the nancial reporting process to ensure fairness, sufciency and credibility of nancial statements, recommendation of

appointment, terms of appointment and removal of central and branch statutory auditors and chief internal auditor and

xation of their remuneration, approval of payment to statutory auditors for other permitted services rendered by them,

review and monitor with the management the auditor’s independence, performance and effectiveness of audit process,

review of functioning of Whistle Blower Policy, review of the quarterly and annual nancial statements before submission

to the Board, review of the adequacy of internal control systems and the internal audit function, review of compliance with

inspection and audit reports and reports of statutory auditors, review of the ndings of internal investigations, approval

of transactions with related parties or any subsequent modications, review of statement of signicant related party

transactions, review of management letter/letters on internal control weaknesses issued by statutory auditors, reviewing with

the management the statement of uses/application of funds raised through an issue (public issue, rights issue, preferential

issue, etc.), the statement of funds utilised for the purposes other than those stated in the offer document/prospectus/notice

and the report submitted by the monitoring agency, monitoring the utilisation of proceeds of a public or rights issue and

making appropriate recommendations to the Board to take steps in this matter, discussion on the scope of audit with external

auditors and examination of reasons for substantial defaults, if any, in payment to stakeholders, valuation of undertakings

or assets, evaluation of risk management systems, scrutiny of inter-corporate loans and investments. The Audit Committee

is also empowered to appoint/oversee the work of any registered public accounting rm, establish procedures for receipt

and treatment of complaints received regarding accounting and auditing matters and engage independent counsel as also

provide for appropriate funding for compensation to be paid to any rm/advisors. In addition, the Audit Committee also

exercises oversight on the regulatory compliance function of the Bank. The Audit Committee is also empowered to approve

the appointment of the CFO (i.e., the wholetime Finance Director or any other person heading the nance function or

discharging that function) after assessing the qualications, experience and background, etc. of the candidate.

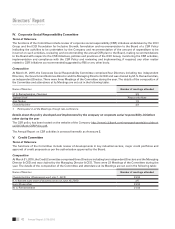

Composition

At March 31, 2016, the Audit Committee comprised of four independent Directors and was chaired by Homi Khusrokhan,

an independent Director. There were eight Meetings of the Committee during the year.

The details of the composition of the Committee and attendance at its Meetings are set out in the following table:

Name of Member Number of meetings attended

Homi Khusrokhan, Chairman 8/8

Dileep Choksi, Alternate Chairman 8/8

M. S. Ramachandran 8/8

V. Sridar 7/8

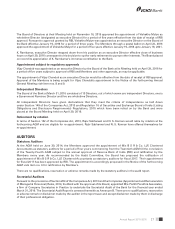

III. Board Governance, Remuneration & Nomination Committee

Terms of Reference

The functions of the Committee include recommending appointments of Directors to the Board, identifying persons

who are qualied to become Directors and who may be appointed in senior management in accordance with the criteria

laid down and recommending to the Board their appointment and removal, formulate a criteria for the evaluation of the

performance of the wholetime/independent Directors and the Board and to extend or continue the term of appointment

of independent Director on the basis of the report of performance evaluation of independent Directors, recommending

to the Board a policy relating to the remuneration for the Directors, key managerial personnel and other employees,

recommending to the Board the remuneration (including performance bonus and perquisites) to wholetime Directors

(WTDs), commission and fee payable to non-executive Directors subject to applicable regulations, approving the policy

for and quantum of bonus payable to the members of the staff including senior management and key managerial

personnel, formulating the criteria for determining qualications, positive attributes and independence of a Director,

framing policy on Board diversity, framing guidelines for the Employees Stock Option Scheme (ESOS) and decide on the

grant of the Bank’s stock options to employees and WTDs of the Bank and its subsidiary companies.