ICICI Bank 2016 Annual Report Download

Download and view the complete annual report

Please find the complete 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ON THE MOVE

Leadership in banking

through technology

22ND ANNUAL REPORT AND ACCOUNTS

2015 - 2016

AT YOUR PLACE AT OUR PLACE

Table of contents

-

Page 1

Leadership in banking through technology 22 ANNUAL REPORT AND ACCOUNTS ND ON THE M OVE 2015 - 2016 L AT OUR P P AT YOUR L ACE ACE -

Page 2

...from Executive Directors Banking on the Move Banking at Your Place Banking at Our Place Promoting Inclusive Growth Awards Directors' Report Auditor's Certificate on Corporate Governance Business Overview Management's Discussion and Analysis Key Financial Indicators: Last Ten Years REGISTERED OFFICE... -

Page 3

...banking app in the country. Pockets, launched just over a year ago, is India's first and largest digital wallet launched by a bank...more on page 12 ...AT OUR PLACE The banking experience at our branches today is a confluence of personalised human connect and technology-enabled services. Wait times... -

Page 4

ICICI Bank at a Glance ICICI Bank, the country's largest private sector bank, offers a comprehensive range of products and services through a multichannel delivery network. ICICI Bank continues to be at the forefront of technological innovation to provide simplicity and convenience in banking, in ... -

Page 5

...18,216 Largest retail network of 18,216 branches and ATMs among private sector banks Funds Transfer 150+ SERVICES iMobile, the most comprehensive banking app in India, offers over 150 services ` 3 TRILLION Annual Report 2015-2016 Digital channels recorded over ` 3 trillion worth of transactions... -

Page 6

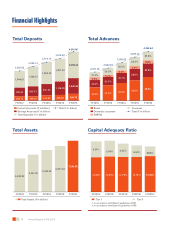

....64 21.6% 4.3% 3,387.03 24.3% 26.5% 4.4% 27.5% Current Accounts (` in billion) Savings Accounts (` in billion) Term Deposits (` in billion) Total (` in billion) Retail Domestic corporate SMEAG Overseas Total (` in billion) Total Assets Capital Adequacy Ratio 5.84% 5.94% 4.92% 4.24% 3.55... -

Page 7

... PAT Consolidated PAT 111.75 98.10 83.25 64.65 97.26 76.43 96.04 110.41 122.47 101.80 FY2012 FY2013 FY2014 FY2015 FY2016 FY2012 FY2013 FY2014 FY2015 FY2016 Standalone Profit after Tax (PAT) (` in billion) Consolidated Profit after Tax (PAT) (` in billion) Annual Report 2015-2016 5 -

Page 8

...strategy of its international operations in line with the new global environment. The corporate segment, where the Bank had in earlier years supported industrial and infrastructure investment critical to India's growth, has experienced challenges. The Bank has calibrated growth in its corporate loan... -

Page 9

... by the insurance businesses of the Group was demonstrated during the year through investments in each of the subsidiaries. This further adds to the Group's financial strength and its platform for capitalising on the vast growth potential for financial services in India. The Board of Directors is... -

Page 10

... corporate sector. While retail asset quality was healthy and stable, the challenges facing the corporate sector impacted the asset quality metrics and profitability of banks. Other segments of financial services, like insurance and mutual funds, witnessed healthy growth. 8 Annual Report 2015-2016 -

Page 11

...proposed dividend of ` 5 per equity share. We continued to strengthen our position across the financial sector. Our insurance subsidiaries maintained their leadership position among private sector players. ICICI Prudential Asset Management Company became the largest mutual fund in India, with assets... -

Page 12

... Director Rajiv Sabharwal Executive Director Vishakha Mulye Executive Director Vijay Chandok Executive Director (Designate) Subject to RBI approval GROUP EXECUTIVES Rakesh Jha Chief Financial Officer Maninder Juneja Shilpa Kumar SENIOR GENERAL MANAGERS Sanjay Chougule Head-Group Internal... -

Page 13

... were largely to higher rated corporates. In the new financial year, the Wholesale Banking Group will continue to focus on enhancing the quality of the portfolio and the quality of earnings by further developing our expertise in products, processes and technology to meet client requirements and... -

Page 14

... 3.6 million downloads of Pockets, India's largest digital wallet by a bank Consumers today are increasingly demanding more and more services on the move. ICICI Bank continues to deploy cutting-edge technology to deliver innovative banking solutions on mobile devices. 12 Annual Report 2015-2016 -

Page 15

.... Customers can use mVisa to scan a QR code available at the merchant outlet, enter the bill amount and confirm the payment by entering their debit card PIN. A firstof-its-kind service in the world, mVisa ensures that the transactions are faster and more convenient. Annual Report 2015-2016 13 -

Page 16

... application, which brings 150+ banking services on a single platform. It offers a range of essential banking features such as funds transfer, bill payment, checking account balance and opening fixed and recurring deposits. In addition, users can also now add payees, personalise their debit cards... -

Page 17

...also the most comprehensive banking app in India and encashed any time of the day, all days of the week including holidays, without the need to walk into a branch. Another feature of eftCheques allows customers to scan a cheque they have received and upload the image before depositing the cheque in... -

Page 18

... 4.2 million bank accounts opened through Tab Banking since inception From opening bank accounts to transferring money anywhere in the world, the Bank's technology solutions empower customers to fulfil their banking needs, without stepping out of their homes or offices. 16 Annual Report 2015-2016 -

Page 19

... Indians to send money abroad from any bank in India to any bank overseas, within one international working day. The service is available round the clock and funds can be transferred in 16 currencies. From opening bank accounts to transferring money anywhere in the world, the Bank's technology... -

Page 20

...facility in India, Smart Vault is available round-the-clock Fully automated, state-of-the-art branches available round-theclock, kiosks that offer a complete suite of banking services and many other innovations are redefining the customer experience at ICICI Bank today. 18 Annual Report 2015-2016 -

Page 21

.... A first-of-its-kind device in the country, Insta Banking kiosk enables customers to access their accounts, transfer funds, print statements, pay bills and avail many other banking services. At bank branches, customers are required to fill in various forms to submit their transaction requests like... -

Page 22

... course at ICICI Academy ICICI Academy added four new courses in fiscal 2016, namely: tractor mechanic, lab assistant at diagnostic centres, two & three wheeler service technician and retail sales. With these additions, ICICI Academy now offers training in 13 courses. It also provides training in... -

Page 23

...total number to 55 School Management Committees (SMCs) in 150 schools were made operational and 1,140 SMC members were trained ICICI RSETIs secured 'AA' grade under Category II in the grading exercise carried out by the Ministry of Rural Development, Government of India in July 2015. Annual Report... -

Page 24

... has been to support rural development. This involves adopting a holistic approach to improve livelihoods and enhance access to financial services. The Bank has developed an extensive network of branches and Business Correspondents (BCs) to strengthen efforts in this space. Training is provided to... -

Page 25

... Fund to help the people affected by the floods. The donation comprised contribution from the salaries of the employees of ICICI Bank and its group companies, as well as the companies themselves. (ii) Daan Utsav The annual event organised by the Bank in partnership with Give India provided customers... -

Page 26

... Research Advisory under the 'Banking Financial Services and Insurance' category. 'Best Local Trade Finance Bank in India' at Global Trade Review Asia Leaders in Trade Awards 2015. 'Best Foreign Exchange Bank' in India, at FinanceAsia's 2015 Country Banking Achievement Awards. 'Best Private Sector... -

Page 27

... and the regulations pertaining to the same. Your Bank has a consistent dividend payment history. Given the financial performance for fiscal 2016 and in line with the Bank's dividend policy, your Directors are pleased to recommend a dividend of ` 5.00 per equity share for the year ended March... -

Page 28

.... 25 in schedule 18 'notes to accounts' of the financial statements. Includes dividend for the prior year paid on shares issued after the balance sheet date and prior to the record date. 4. PARTICULARS OF LOANS, GUARANTEES OR INVESTMENTS The provisions of Section 186(4) of the Companies Act, 2013... -

Page 29

... of the Companies Act, 2013 and Regulation 16 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 which have been relied on by the Bank and were placed at the Board Meeting held on April 29, 2016. Retirement by rotation In terms of Section... -

Page 30

...the Board reviews risk management policies of the Bank pertaining to credit, market, liquidity, operational, outsourcing risks and business continuity management. The Committee also reviews the Risk Appetite & Enterprise Risk Management frameworks, Internal Capital Adequacy Assessment Process (ICAAP... -

Page 31

...of India. Whistle Blower Policy The Bank has formulated a Whistle Blower Policy. The policy comprehensively provides an opportunity for any employee/ Director of the Bank to raise any issue concerning breaches of law, accounting policies or any act resulting in financial Annual Report 2015-2016 29 -

Page 32

...Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, the certification by the Managing Director & CEO and Chief Financial Officer on the financial statements and internal controls relating to financial reporting has been obtained. Board of Directors ICICI Bank... -

Page 33

...terms of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, the number of Committees (Audit Committee and Stakeholders Relationship Committee) of public limited companies in which a Director is a member/chairman were within the limits provided... -

Page 34

... on internal control weaknesses issued by statutory auditors, reviewing with the management the statement of uses/application of funds raised through an issue (public issue, rights issue, preferential issue, etc.), the statement of funds utilised for the purposes other than those stated in the offer... -

Page 35

... by the Board from time to time within the limits as provided under Companies Act, 2013 and related rules. RBI vide its guidelines dated June 1, 2015 regarding Compensation of nonexecutive Directors (NEDs) (except part-time Chairman) of Private Sector Banks has permitted payment of profit related... -

Page 36

... working of its Audit Committee, Board Governance, Remuneration & Nomination Committee, Corporate Social Responsibility Committee, Credit Committee, Customer Service Committee, Fraud Monitoring Committee, Information Technology Strategy Committee, Risk Committee, Stakeholders Relationship Committee... -

Page 37

... the scheme(s) and rule(s) applicable from time to time. In line with the staff loan policy applicable to specified grades of employees who fulfill prescribed eligibility criteria to avail loans for purchase of residential property, the wholetime Directors are also eligible for housing loans subject... -

Page 38

..., business lines), including the extent to which it is applicable to foreign subsidiaries and branches The Compensation Policy of the Bank as last amended and approved by the BGRNC and the Board at its Meeting held on September 16, 2015, pursuant to the guidelines issued by RBI, covers all employees... -

Page 39

... policy. The total number of permanent employees governed by the compensation policy of the Bank at March 31, 2016 was 72,175. b) Information relating to the design and structure of remuneration processes Key features and objectives of remuneration policy The Bank has under the guidance of the Board... -

Page 40

... metrics for the Bank, top level business lines and individuals The main performance metrics include profits, loan growth, deposit growth, risk metrics (such as quality of assets), compliance with regulatory norms, refinement of risk management processes and customer service. The specific metrics... -

Page 41

...pay includes basic salary, supplementary allowances, superannuation, contribution to provident fund and gratuity fund by the Bank. The amount contains part year payouts for Vishakha Mulye and Zarin Daruwala for fiscal 2016. The share-linked instruments (ESOPs) are at a face value of ` 2.00. Excludes... -

Page 42

...to these sectors. This is over and above provisions made for non-performing and restructured loans as per Reserve Bank of India (RBI) guidelines. In view of the above, the Bank's profit after tax (PAT) was ` 97.26 billion in FY2016 compared to ` 111.75 billion in FY2015. 40 Annual Report 2015-2016 -

Page 43

...Financial Officer P . Sanker, Company Secretary 0.049% 0.033% 0.033% 0.033% 0.031% 0.021% 0.018% (x) The key parameters for any variable component of remuneration availed by the directors; The Bank's compensation policy and practices are in line with the guidelines issued by the RBI in January 2012... -

Page 44

... the website of the Company http://www.icicibank.com/managed-assets/docs/aboutus/ICICI-Bank-CSR-Policy.pdf. The Annual Report on CSR activities is annexed herewith as Annexure E. V. Credit Committee Terms of Reference The functions of the Committee include review of developments in key industrial... -

Page 45

... Ramachandran, Chairman K. V. Kamath (upto close of business hours on June 30, 2015) V. Sridar Alok Tandon Chanda Kochhar Number of meetings attended 6/6 0/1 6/6 0/6 6/6 VII. Fraud Monitoring Committee Terms of Reference The Committee monitors and reviews all the frauds involving an amount of ` 10... -

Page 46

... close of business hours on June 30, 2015) V. Sridar Chanda Kochhar Number of meetings attended 4/4 1/1 4/4 4/4 IX. Risk Committee Terms of Reference The functions of the Committee are to review ICICI Bank's risk management policies pertaining to credit, market, liquidity, operational, outsourcing... -

Page 47

... Sanker, Senior General Manager (Legal) is the Company Secretary of the Bank and acts as the Compliance Officer of the Bank in accordance with the requirements of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015. 76 shareholder complaints... -

Page 48

... Meeting Annual General Meeting Day, Date Monday, June 29, 2015 Monday, June 30, 2014 Resolution Private placement of securities under Section 42 of the Companies Act, 2013 1) Amendment to Articles of Association of the Bank pursuant to The Banking Laws (Amendment) Act, 2012 2) Borrowing limits... -

Page 49

... financial results, official news releases, analyst call transcripts and presentations are also available on the Bank's website. The Management's Discussion & Analysis forms part of the Annual Report. General Shareholder Information Annual General Meeting Twenty-Second AGM Day, Date & Time Monday... -

Page 50

... SIX Exchange Regulation, Selnaustrasse 30, P .O. Box 1758, CH-8021 Zurich, Switzerland. Market Price Information The reported high and low closing prices and volume of equity shares of ICICI Bank traded during fiscal 2016 on BSE and NSE are set out in the following table: Month April 2015 May 2015... -

Page 51

... and in the physical form with the total issued/paid up equity share capital of ICICI Bank. Certificates issued in this regard are placed before the Stakeholders Relationship Committee and filed with BSE and NSE, where the equity shares of ICICI Bank are listed. Annual Report 2015-2016 49 -

Page 52

... Pursuant to Regulation 53 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, the names and contact details of the debenture trustees for the public issue bonds and privately placed bonds of the Bank are given below: Bank of Maharashtra... -

Page 53

... 31, 2016 Name of the Shareholder Deutsche Bank Trust Company Americas (Depositary for ADS holders) Life Insurance Corporation of India Dodge and Cox International Stock Fund Europacific Growth Fund Carmignac Gestion A\C Carmignac Patrimoine Aberdeen Global Indian Equity (Mauritius) Limited Total No... -

Page 54

... foreign exchange risk position including bullion is managed within the ` 10.00 billion net overnight open position (NOOP) limit approved by the Board of Directors. The Bank does not undertake positions in commodities. The Bank primarily has floating rate linked assets. Wholesale liability raising... -

Page 55

... to any employee/Director in a year is limited to 0.05% of ICICI Bank's issued equity shares at the time of the grant, and the aggregate of all such options is limited to 10% of ICICI Bank's issued equity shares on the date of the grant (equivalent to 581.52 million shares of face value ` 2 each at... -

Page 56

...the employee a right to apply for one equity share of face value of ` 2 of ICICI Bank at ` 244.60 which was the closing price on the stock exchange which recorded the highest trading volume in ICICI Bank shares on April 27, 2016. The grant price is calculated as per the SEBI regulations. Particulars... -

Page 57

.../Central Depository Services (India) Limited. The Companies Act, 2013 and the underlying rules as well as Regulation 36 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, permit the dissemination of financial statements and annual report in... -

Page 58

... Bank of India, Securities and Exchange Board of India, Insurance Regulatory and Development Authority of India and overseas regulators for their continued co-operation, support and guidance. ICICI Bank wishes to thank its investors, the domestic and international banking community, rating agencies... -

Page 59

....9 Share in profit or loss % of total Amount net profit (` in million) 95.5% 97,262.9 Parent ICICI Bank Limited Subsidiaries Indian ICICI Securities Primary Dealership Limited ICICI Securities Limited ICICI Home Finance Company Limited ICICI Trusteeship Services Limited ICICI Investment Management... -

Page 60

... Trading) Regulations, 2015; (c) The Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2009 and amendments from time to time; (d) The Securities and Exchange Board of India (Employee Stock Option Scheme and Employee Stock Purchase Scheme) Guidelines... -

Page 61

...) Regulations, 2013 (n) The Securities and Exchange Board of India (Foreign Portfolio Investors) Regulations, 2014 (vi) Other laws applicable specifically to the Company namely: (a) Banking Regulation Act, 1949, Master Circulars, Notifications and Guidelines issued by the RBI from time to time... -

Page 62

... referred laws, rules, regulations, guidelines, standards etc. 1. 2. Sale of 9% Shareholding in ICICI Lombard General Insurance Company Limited to Fairfax Financial Holdings Limited. Sale of 6% Shareholding in ICICI Prudential Life Insurance Company Limited to Premji Invest & Affiliates (4.0%) and... -

Page 63

... the Company nor of the efficacy or effectiveness with which the management has conducted the affairs of the Company. For Parikh Parekh & Associates Company Secretaries Signature: P . N. Parikh Partner FCS No: 327 CP No: 1228 3. 4. 5. 6. Place: Mumbai Date : April 29, 2016 Annual Report 2015-2016... -

Page 64

... at market competitive rate Outstanding balance at March 31, 2016 in current account deposits maintained for normal banking transactions ` in million 4,990.0 8,605.0 149,110.0 1,025.0 607.8 ICICI Lombard General Subsidiary Insurance Company Limited India Infradebt Limited Associate ICICI Securities... -

Page 65

... and marketing support income Expenses towards service provider arrangements ICICI Prudential Life Subsidiary Insurance Company Limited 6 years 4,290.7 ICICI Home Finance Company Limited I-Process Services (India) Private Limited ICICI Merchant Services Private Limited Life Insurance Corporation... -

Page 66

... Services NIC Code of the product/service 64191 % to total turnover of the Company 100% The Bank is a publicly held banking company engaged in providing a wide range of banking and financial services including retail banking, corporate banking and treasury operations. 64 Annual Report 2015-2016 -

Page 67

... ICICI International Limited, Mauritius Registered Office: IFS Court Twenty Eight, Cybercity Ebene, Mauritius ICICI Investment Management Company Limited Registered Office: ICICI Bank Towers Bandra-Kurla Complex Mumbai 400 051 ICICI Lombard General Insurance Company Limited Registered Office: ICICI... -

Page 68

... 23, Barakhamba Road New Delhi 110 001 ICICI Prudential Pension Funds Management Company Limited Registered Office: ICICI Prulife Towers 1089, Appasaheb Marathe Marg, Prabhadevi Mumbai 400 025 India Infradebt Limited Registered Office: ICICI Bank Towers, Bandra-Kurla Complex Mumbai 400 051 FlNO... -

Page 69

Sr. Name and address of the Company No. 20. I-Process Services (India) Private Limited Registered Office: Acme Plaza, 4th Floor, Unit #408-409 Andheri-Kurla Road, Opp. Sangam Cinema Mumbai 400 059 NIIT Institute of Finance Banking and Insurance Training Limited Registered Office: 8, Balaji Estate, ... -

Page 70

...(s) Venture Capital Funds Insurance Companies FIIs Foreign Venture Capital Funds Other (specify) Foreign Banks FII - DR j) Provident Funds/Pension Funds# Sub-total (B) (1) (2) Non-Institutions a Bodies Corporate i ii b i Indian Overseas Individual shareholders holding nominal share capital upto Rs... -

Page 71

...of the year (April 1, 2015) Top Ten Shareholders Life Insurance Corporation of India Dodge and Cox International Stock Fund Europacific Growth Fund Carmignac Gestion a\c Carmignac Patrimoine Aberdeen Global Indian Equity (Mauritius) Limited Stichting Depository Apg Emerging Markets Equity Pool Bajaj... -

Page 72

...appointed as Chairman effective July 1, 2015 and Vishakha Mulye was appointed as executive Director effective January 19, 2016. # Indicates negligible percentage as a % of total shares of the Company. The cumulative shareholding column reflects the balance as on day end. 70 Annual Report 2015-2016 -

Page 73

... total shares of the Company. The cumulative shareholding column reflects the balance as on day end. V. INDEBTEDNESS ` in Crores Secured Loans excluding deposits Unsecured Loans Deposits Total Indebtedness Indebtedness of the Company including interest outstanding/accrued but not due for payment... -

Page 74

... of India (RBI) vide its letter dated January 15, 2016, Vishakha Mulye assumed office as executive Director with effect from January 19, 2016. Does not include superannuation perquisite, since it is cashed out and hence included in Salary and Allowances for fiscal 2016 - (A). Being a Banking Company... -

Page 75

... % of Profit/Others) Others (A)+(B)+(C) Total Remuneration paid in Fiscal 2016 (excludes Perquisites on Stock Options reported in point 2) VII. PENALTIES / PUNISHMENT/ COMPOUNDING OF OFFENCES: Type A. COMPANY Penalty Punishment Compounding DIRECTORS Penalty Punishment Compounding OTHER OFFICERS IN... -

Page 76

... put up on the Bank's website. Web-link to the Bank's CSR policy: http://www.icicibank.com/managed-assets/docs/about-us/ICICI-Bank-CSR-Policy.pdf 2. The Composition of the CSR Committee The Bank's CSR Committee comprises three independent Directors and the Managing Director & CEO of the Bank, and is... -

Page 77

... Chennai - 38.7 76.5 Pan-India Mumbai and Kolkata 54.0 10.0 5.1 25.7 59.1 Direct 1. Teach to Lead in Mumbai to support their Teach for India fellowship programme. 2. Praxis Business School, Kolkata, supporting a chair for research for the banking sector. Annual Report 2015-2016 75 -

Page 78

... set up to assist consumers in financial distress and provide counselling. - 6. In case the company has failed to spend the 2% of the average net profits of the last three financial years or any part thereof, the company shall provide the reasons for not spending the amount in its Board report... -

Page 79

...of regulation 46 and paragraphs C, D and E of Schedule V of the Securities and Exchange Board of India (Listing Obligations and Disclosure requirements) Regulations, 2015 ('Listing Regulations') for the period 1 December 2015 to 31 March 2016. Management's responsibility The Bank's management takes... -

Page 80

... slippages from restructured loans, for the Indian banking sector. For a detailed discussion of economic developments in fiscal 2016, please refer Management's Discussion & Analysis. BUSINESS REVIEW Retail Banking ICICI Bank has been a pioneer in introducing innovative products and services for its... -

Page 81

...is being made possible by offering them a comprehensive product suite backed by technology. The Bank has set up a robust distribution network over the last few years to reach customers in this market. At March 31, 2016, the Bank had 2,293 branches in rural and semi-urban Annual Report 2015-2016 79 -

Page 82

... opened 2.9 million accounts under the PMJDY scheme as of March 31, 2016, which is the highest among private sector banks. About 89% of these accounts were opened in rural India. The Bank has also issued RuPay cards to these account holders, which are inter-operable across various customer service... -

Page 83

... Banking The Wholesale Banking Group (WBG) provides customised solutions to corporate clients by analysing their specific business and financial needs. It provides an array of financial solutions for working capital finance, export finance, trade, transaction and commercial banking, foreign exchange... -

Page 84

... invested in its overseas operations. During fiscal 2016, ICICI Bank Canada repatriated equity and preference share capital aggregating CAD 87.1 million. ICICI Bank's foreign branches also repatriated a portion of their retained earnings, resulting in exchange rate gains of ` 9.41 billion. India... -

Page 85

... and specific review of key portfolios. A summary of the reviews carried out by the Credit Committee and Risk Committee is reported to the Board of Directors. The Bank has dedicated groups (Risk Management Group, Compliance Group, Corporate Legal Group, Internal Audit Group and Financial Crime... -

Page 86

... Business Intelligence Unit to provide support for analytics, score card development and database management. The credit officers evaluate retail credit proposals on the basis of the product policy vetted by the Credit Risk Management Group and approved by the Committee of Executive Directors. These... -

Page 87

... lending within the exposure limits set by the Board of Directors, in case of retail products. Market Risk Market risk arises when movements in market factors (foreign exchange rates, interest rates, credit spreads and equity prices) impact the Bank's income or the market value of its portfolios... -

Page 88

... and sale of investments also provide liquidity. The Bank's international branches are primarily funded by debt capital market issuances, lines of financing from export credit agencies, syndicated loans, bilateral loans and bank lines, while its international subsidiaries raise deposits from... -

Page 89

... and the Business Leadership Programme help sharpen the skillset of new recruits and focus on making them productive right from "first day first hour". The Sales Academy has been one of the Bank's key strategic initiatives, ensuring the requisite number of ready and trained front-end officers. The... -

Page 90

... through net banking. Rail ticket booking: ICICI Bank is India's first bank to offer railway ticket booking to customers of any bank on its website, in association with Indian Railways Catering and Tourism Corporation Limited (IRCTC). Bulk Immediate Payment Service (IMPS) payments for corporates... -

Page 91

... March 31, 2016, making it the largest asset management company in India. The overall market share in mutual fund business has grown to 13.0% on quarterly average basis compared to 12.5% in fiscal 2015. At March 31, 2016, the closing equity mutual fund AUM (excluding exchange traded funds) has moved... -

Page 92

...to profit after tax of ` 0.01 billion for the year ended March 31, 2015. ICICI Securities During fiscal 2016, the Company introduced innovative products and services using effective technology to aid its 3.8 million retail customers. The Corporate Finance business continued to build a deal pipeline... -

Page 93

... a proactive role in the full realisation of India's potential and contributing positively in all markets where we operate maintaining high standards of governance and ethics; and balancing growth, profitability and risk to deliver and sustain healthy returns on capital Annual Report 2015-2016 91 -

Page 94

... area of financial inclusion, apart from the Pradhan Mantri Jan Dhan Yojana which was announced in fiscal 2015, the government announced several new schemes including pension and insurance schemes and a financial scheme for micro, small and medium enterprises. A scheme to support start-ups was also... -

Page 95

... two years, in the event the sale value is lower than the net book value. This dispensation is available only for non-performing assets sold up to March 31, 2016; In May 2015, RBI issued draft guidelines on net stable funding ratio. According to the draft guidelines, the net stable funding ratio is... -

Page 96

... to five years. Lending by overseas branches and subsidiaries of Indian banks is permitted only for medium term borrowings. Further, in March 2016, RBI issued amendments to the framework and allowed infrastructure NBFCs, asset finance NBFCs and core investment companies to raise ECBs under Track... -

Page 97

... on account of lower growth in China and emerging market economies, divergence in global monetary policy and significant decline in commodity prices including crude oil and metals. Due to the increased level of risks in the business environment, the Indian banking system in general has experienced... -

Page 98

... primarily due to lower applicable tax on sale of equity investments and set-off of carry forward capital losses pertaining to earlier periods. The profit after tax decreased by 13.0% from ` 111.75 billion in fiscal 2015 to ` 97.26 billion in fiscal 2016. Net-worth increased from ` 804.29 billion... -

Page 99

...83 Fiscal 2016 11.32 1.49 16.75 154.32 24.13 34.70 Return on average equity is the ratio of the net profit after tax to the quarterly average equity share capital and reserves. Return on average assets is the ratio of net profit after tax to average assets. Cost represents operating expense. Income... -

Page 100

... Interest spread Net interest margin 1. In accordance with the Reserve Bank of India circular dated July 16, 2015, investment in the Rural Infrastructure and Development Fund and other related deposits has been re-grouped to line item 'Others' under Schedule 11 - Other Assets and interest... -

Page 101

... on other interest-earning assets increased from 5.20% in fiscal 2015 to 5.49% in fiscal 2016 primarily due to an increase in the yield on RIDF and other related deposits and a decrease in average term money lent from overseas locations which is low yielding. Interest on income tax refund was at... -

Page 102

Management's Discussion & Analysis 1. In accordance with RBI circular dated July 16, 2015, investment in the Rural Infrastructure and Development Fund and other related deposits has been re-grouped to line item 'Others' under Schedule 11 - Other Assets. Accordingly, figures of the previous periods ... -

Page 103

... venture funds and security receipts issued by asset reconstruction companies. Profit from treasury-related activities increased from ` 16.93 billion in fiscal 2015 to ` 40.60 billion in fiscal 2016 primarily due to gains on sale of stake in ICICI Prudential Life Insurance Company Limited and ICICI... -

Page 104

Management's Discussion & Analysis government securities. The number of employees was 67,857 at March 31, 2015 and 74,096 at March 31, 2016 (average staff strength was 69,853 for fiscal 2015 and 71,810 for fiscal 2016). The employee base includes sales executives, employees on fixed term contracts ... -

Page 105

...70 billion in fiscal 2016. The effective tax rate decreased from 29.4% in fiscal 2015 to 20.3% in fiscal 2016 primarily due to lower applicable tax on sale of equity investments and set-off of carry forward capital losses pertaining to earlier periods. Financial condition Assets The following table... -

Page 106

...by ` 23.08 billion. At March 31, 2016, the Bank had an outstanding net investment of ` 7.91 billion in security receipts including application money issued by asset reconstruction companies compared to ` 8.41 billion at March 31, 2015. Advances Net advances increased by 12.3% from ` 3,875.22 billion... -

Page 107

...-to-market amount and payables on foreign exchange and derivatives transactions. Equity share capital and reserves Equity share capital and reserves increased from ` 804.29 billion at March 31, 2015 to ` 897.36 billion at March 31, 2016 primarily due to accretion to reserves from profit for the year... -

Page 108

... Risk Management Group under the supervision of the Board and the Risk Committee. The capital adequacy position and assessment is reported to the Board and the Risk Committee periodically. Regulatory capital The Bank is subject to the Basel III guidelines issued by RBI, effective from April 1, 2013... -

Page 109

... three financial years' gross income and is revised on an annual basis at June 30. RWA is arrived at by multiplying the capital charge by 12.5. Internal assessment of capital The capital management framework of the Bank includes a comprehensive internal capital adequacy assessment process conducted... -

Page 110

... result of market conditions and the operating environment. The business and capital plans and the stress testing results of certain key group entities are integrated into the internal capital adequacy assessment process. Based on the internal capital adequacy assessment process, the Bank determines... -

Page 111

... the Bank's internal ratings. The increase in advances to these sectors also included the impact of currency depreciation between March 31, 2015 and March 31, 2016, on the rupee equivalent of foreign currency denominated advances made by overseas branches of the Bank. The following table sets forth... -

Page 112

... to be deposited in funds with government sponsored Indian development banks like the National Bank for Agriculture and Rural Development, the Small Industries Development Bank of India, National Housing Bank, MUDRA Limited and other financial institutions as decided by RBI from time to time, based... -

Page 113

... on account of lower growth in China and emerging market economies, divergence in global monetary policy and significant decline in commodity prices including crude oil and metals. Due to the increased level of risks in the business environment, the Indian banking system in general has experienced... -

Page 114

...and petrochemicals Mining Cement Other industries2 Total 1. 2. 3. Includes home loans, automobile loans, commercial business loans, dealer financing and small ticket loans to small businesses, personal loans, credit cards, rural loans and loans against securities. Other industries primarily include... -

Page 115

... the outstanding portfolio of such loans for which refinancing under the 5/25 scheme has been implemented was ` 42.39 billion at March 31, 2016. The Bank's aggregate net investments in security receipts including application money issued by asset reconstruction companies were ` 7.91 billion at March... -

Page 116

... capital adequacy ratio was 16.60% as against the current requirement of 9.63%. The profit before tax of ICICI Prudential Life Insurance Company Limited increased from ` 16.34 billion in fiscal 2015 to ` 17.72 billion in fiscal 2016 primarily due to an increase in net premium earned and investment... -

Page 117

The profit before tax of ICICI Lombard General Insurance Company Limited increased from ` 6.91 billion in fiscal 2015 to ` 7.08 billion in fiscal 2016 primarily due to an increase in net earned premium and investment income, offset, in part, by an increase in claims and benefits paid and operating ... -

Page 118

... 5.00 Total deposits Total advances Annual Report 2015-2016 Equity capital & reserves Total assets Total capital adequacy ratio Net interest income Net interest margin Profit after tax Earnings per share (Basic)3 Earnings per share (Diluted)3 Return on average equity Dividend per share3... -

Page 119

... financial statements of ICICI Bank Limited ('the Bank'), which comprise the Balance Sheet as at 31 March 2016, the Profit and Loss Account, the Cash Flow Statement for the year then ended, a summary of significant accounting policies and other explanatory information in which are incorporated... -

Page 120

... net cash inflows amounting to ` 12,184 million for the year ended 31 March 2016. These financial statements have been audited by other auditors, duly qualified to act as auditors in the country of incorporation of the said branches, whose reports have been furnished to us by Management of the Bank... -

Page 121

... the Board of Directors, none of the directors is disqualified as on 31 March 2016 from being appointed as a director in terms of Section 164 (2) of the Act; (vii) with respect to the adequacy of the internal financial controls over financial reporting of the Bank and the operating effectiveness of... -

Page 122

... controls over financial reporting of ICICI Bank Limited ('the Bank') as at 31 March 2016 in conjunction with our audit of the standalone financial statements of the Bank for the year ended on that date. MANAGEMENT'S RESPONSIBILITY FOR INTERNAL FINANCIAL CONTROLS 2. The Bank's Board of Directors is... -

Page 123

... were operating effectively as at 31 March 2016, based on the internal control over financial reporting criteria established by the Bank considering the essential components of internal control stated in the Guidance Note on Audit of Internal Financial Controls Over Financial Reporting issued by... -

Page 124

...of India Balances with banks and money at call and short notice Investments Advances Fixed assets Other assets TOTAL ASSETS Contingent liabilities Bills for collection Significant accounting policies and notes to accounts The Schedules referred to above form an integral part of the Balance Sheet. As... -

Page 125

... Bank Limited Profit and Loss Account for the year ended March 31, 2016 ` in '000s Schedule At 31.03.2016 527,394,348 153,230,516 680,624,864 At 31.03.2015 490,911,399 121,761,305 612,672,704 I. Interest earned Other income TOTAL INCOME INCOME 13 14 II. EXPENDITURE Interest expended Operating... -

Page 126

... assets Increase/(decrease) in other liabilities and provisions Refund/(payment) of direct taxes Net cash flow from/(used in) operating activities (i)+(ii)+(iii) Cash flow from investing activities Redemption/sale from/(investments in) subsidiaries and/or joint ventures (including application money... -

Page 127

Financial Statements of ICICI Bank Limited Schedules forming part of the Balance Sheet ` in '000s At 31.03.2016 At 31.03.2015 SCHEDULE 1 - CAPITAL Authorised capital 6,375,000,000 equity shares of ` 2 each (March 31, 2015: 6,375,000,000 equity shares of ` 2 each) 15,000,000 shares of ` 100 each (... -

Page 128

Financial Statements of ICICI Bank Limited Schedules forming part of the Balance Sheet (Contd.) ` in '000s At 31.03.2016 At 31.03.2015 SCHEDULE 2 - RESERVES AND SURPLUS I. Statutory reserve Opening balance Additions during the year Deductions during the year Closing balance 163,205,519 24,316,000... -

Page 129

Financial Statements of ICICI Bank Limited Schedules 3. 4. 5. 6. 7. forming part of the Balance Sheet (Contd.) Represents exchange profit on repatriation of retained earnings from overseas branches. Represents gain on revaluation of premises carried out by the Bank at March 31, 2016. Includes ... -

Page 130

Financial Statements of ICICI Bank Limited Schedules forming part of the Balance Sheet (Contd.) ` in '000s At 31.03.2016 At 31.03.2015 SCHEDULE 4 - BORROWINGS I. Borrowings in India i) ii) iii) Reserve Bank of India Other banks Other institutions and agencies a) Government of India b) Financial ... -

Page 131

Financial Statements of ICICI Bank Limited Schedules forming part of the Balance Sheet (Contd.) ` in '000s At 31.03.2016 At 31.03.2015 48,691,161 2,268,830 41,023,668 43,107,796 23,336,041 158,771,076 317,198,572 SCHEDULE 5 - OTHER LIABILITIES AND PROVISIONS I. Bills payable II. Inter-office ... -

Page 132

... Statements of ICICI Bank Limited Schedules forming part of the Balance Sheet (Contd.) ` in '000s At 31.03.2016 At 31.03.2015 SCHEDULE 8 - INVESTMENTS I. Investments in India [net of provisions] i) ii) iii) iv) v) vi) Government securities Other approved securities Shares (includes equity... -

Page 133

Financial Statements of ICICI Bank Limited Schedules forming part of the Balance Sheet (Contd.) ` in '000s At 31.03.2016 i) Bills purchased and discounted ii) Cash credits, overdrafts and loans repayable on demand iii) Term loans TOTAL ADVANCES B. i) Secured by tangible assets (includes advances ... -

Page 134

Financial Statements of ICICI Bank Limited Schedules 4. 5. forming part of the Balance Sheet (Contd.) Includes depreciation charge amounting to ` 5,501.7 million (March 31, 2015: ` 4,968.7 million). Includes depreciation charge/lease adjustment amounting to ` 192.2 million (March 31, 2015: ` 350.6... -

Page 135

... of equity investment in its subsidiaries, ICICI Prudential Life Insurance Company Limited and ICICI Lombard General Insurance Company Limited. Includes profit/(loss) on sale of assets given on lease. Includes exchange profit/(loss) on repatriation of retained earnings/capital from overseas branches... -

Page 136

Financial Statements of ICICI Bank Limited Schedules forming part of the Profit and Loss Account (Contd.) ` in '000s Year ended 31.03.2016 Year ended 31.03.2015 47,498,752 8,904,434 1,276,509 1,616,167 6,238,893 350,597 7,517 66,793 382,258 2,624,947 8,662,192 3,604,748 7,915,... -

Page 137

... of ICICI Bank Limited Schedules Overview forming part of the Accounts SCHEDULE 17 SIGNIFICANT ACCOUNTING POLICIES ICICI Bank Limited (ICICI Bank or the Bank), incorporated in Vadodara, India is a publicly held banking company engaged in providing a wide range of banking and financial services... -

Page 138

... the RBI guidelines. 4. 5. Treasury bills, commercial papers and certificate of deposits being discounted instruments, are valued at carrying cost. The units of mutual funds are valued at the latest repurchase price/net asset value declared by the mutual fund. 2. 3. 136 Annual Report 2015-2016 -

Page 139

... profit and loss account and profit is thereafter appropriated (net of applicable taxes and statutory reserve requirements) to Capital Reserve. Profit/loss on sale of investments in 'Available for Sale' and 'Held for Trading' categories is recognised in the profit and loss account. Market repurchase... -

Page 140

...1, 2006, the Bank accounts for any loss arising from securitisation immediately at the time of sale and the profit/premium arising from securitisation is amortised over the life of the securities issued or to be issued by the special purpose vehicle to which the assets are sold. With effect from May... -

Page 141

... quarterly average closing rates. Monetary foreign currency assets and liabilities of domestic and integral foreign operations are translated at closing exchange rates notified by Foreign Exchange Dealers' Association of India (FEDAI) relevant to the balance sheet date and the resulting gains/losses... -

Page 142

...them to receive the amount in lieu of such contributions along with their monthly salary during their employment. The amounts so contributed/paid by the Bank to the superannuation fund and NPS or to employee during the year are recognised in the profit and loss account. 140 Annual Report 2015-2016 -

Page 143

Financial Statements of ICICI Bank Limited Schedules Pension forming part of the Accounts (Contd.) The Bank provides for pension, a defined benefit plan covering eligible employees of erstwhile Bank of Madura, erstwhile Sangli Bank and erstwhile Bank of Rajasthan. The Bank makes contribution to a ... -

Page 144

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) 12. Provisions, contingent liabilities and contingent assets The Bank estimates the probability of any loss that might be incurred on outcome of contingencies on the basis of information available up to the ... -

Page 145

... 5. For the purpose of computing the ratio, working funds represent the monthly average of total assets computed for reporting dates of Form X submitted to RBI under Section 27 of the Banking Regulation Act, 1949. Operating profit is profit for the year before provisions and contingencies. For the... -

Page 146

Financial Statements of ICICI Bank Limited Schedules 3. forming part of the Accounts (Contd.) Capital adequacy ratio The Bank is subject to the Basel III capital adequacy guidelines stipulated by RBI with effect from April 1, 2013. The guidelines provide a transition schedule for Basel III ... -

Page 147

... Total net cash outflows 15 Liquidity coverage ratio (%) Annual Report 2015-2016 145 Liquidity of the Bank is managed by the Asset Liability Management Group (ALMG) under the central oversight of the Asset Liability Management Committee (ALCO). For the domestic operations of the Bank, ALMG-India... -

Page 148

..., average level 2 assets primarily consisting of AA- and above rated corporate bonds and commercial papers amounted to ` 33,334.1 million (March 31, 2015: ` 29,028.0 million). At March 31, 2016, top liability products/instruments and their percentage contribution to the total liabilities of the Bank... -

Page 149

...net) and deferred tax asset (net). Includes share capital and reserves and surplus. ` in million For the year ended March 31, 2015 Particulars 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 1. 2. Revenue Less: Inter-segment revenue Total revenue (1)-(2) Segment results Unallocated expenses Operating profit... -

Page 150

Financial Statements of ICICI Bank Limited Schedules Revenue Domestic operations Foreign operations Total forming part of the Accounts (Contd.) The following table sets forth, for the periods indicated, geographical segment revenues. ` in million Year ended March 31, 2016 620,424.0 60,200.9 680,... -

Page 151

Financial Statements of ICICI Bank Limited Schedules Maturity buckets Day 1 2 to 7 days 8 to 14 days 15 to 28 days 29 days to 3 months 3 to 6 months 6 months to 1 year 1 to 3 years 3 to 5 years Above 5 years Total 1. 2. 3. forming part of the Accounts (Contd.) The following table sets forth the ... -

Page 152

... share price as per NSE price volume data during the year ended March 31, 2016 was ` 273.37 (March 31, 2015: ` 311.74). 9. Subordinated debt During the year ended March 31, 2016, the Bank has not raised subordinated debt qualifying for Tier-2 capital (March 31, 2015: Nil). 150 Annual Report 2015... -

Page 153

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) 10. Repurchase transactions The following tables set forth, for the periods indicated, the details of securities sold and purchased under repo and reverse repo transactions respectively including ... -

Page 154

... to approval by the Board of Directors of the Bank on November 16, 2015 the Bank has sold equity shares representing 6% shareholding in ICICI Prudential Life Insurance Company Limited during FY2016 for a total consideration of ` 19,500.0 million. 12. Investment in securities, other than government... -

Page 155

... application money outstanding at March 31, 2015 has been re-classified from Schedule 8 - Investments to Schedule 11 - Other Assets. 13. Sales and transfers of securities to/from Held to Maturity (HTM) category During the year ended March 31, 2016 the value of sales and transfers of securities... -

Page 156

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) 14. CBLO transactions Collateralised Borrowing and Lending Obligation (CBLO) is a discounted money market instrument, established by The Clearing Corporation of India Limited (CCIL) and approved by RBI, ... -

Page 157

Financial Statements of ICICI Bank Limited Schedules Sr. No. 1 Particulars forming part of the Accounts (Contd.) The following table sets forth, for the period indicated, the details of derivative positions. ` in million At March 31, 2016 Currency Interest rate derivative1 derivative2 13,895.2 946... -

Page 158

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) The Bank has no exposure in credit derivative instruments (funded and non-funded) including credit default swaps (CDS) and principal protected structures at March 31, 2016 (March 31, 2015: Nil). The Bank ... -

Page 159

... for balance sheet management and market making purposes whereby the Bank offers derivative products to its customers to enable them to hedge their interest rate risk within the prevalent regulatory guidelines. A FRA is a financial contract between two parties to exchange interest payments for... -

Page 160

Financial Statements of ICICI Bank Limited Schedules Hedging Benchmark AUD LIBOR CHF LIBOR JPY LIBOR SGD SOR USD LIBOR Total Type forming part of the Accounts (Contd.) The following tables set forth, for the periods indicated, the nature and terms of FRA and IRS. ` in million At March 31, 2016 ... -

Page 161

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) 18. Non-Performing Assets The following table sets forth, for the periods indicated, the details of movement of gross non-performing assets (NPAs), net NPAs and provisions. ` in million Particulars At March ... -

Page 162

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) In accordance with RBI guidelines, the loans and advances held at the overseas branches that are identified as impaired as per host country regulations for reasons other than record of recovery, but which ... -

Page 163

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) Outstanding credit enhancement in the form of guarantees for third party originated securitisation transactions amounted to ` 4,089.3 million at March 31, 2016 (March 31, 2015: ` 5,530.3 million) and ... -

Page 164

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) Overseas branches of the Bank, as originators, have sold four loans through direct assignment amounting to ` 6,536.9 million during the year ended March 31, 2016 (March 31, 2015: two loans amounting to ` 1,... -

Page 165

... loan assets subjected to restructuring. Type of Restructuring Sr. No. Asset Classification Details Schedules 1. forming part of the Accounts (Contd.) 2. 3 - - - - - - - - - 4. - 3,336.0 (174.1) - - - - 4,703.7 8,173.8 - - - - 8,039.7 7,999.7 - 1.6 - Financial Statements of ICICI Bank... -

Page 166

... 2,768.5 2,768.5 (c) (d) (e) (a) (c) (d) (e) Others Doubtful Loss Total Standard SubStandard (b) Loss Total Total Doubtful Type of Restructuring SubStandard (b) Schedules forming part of the Accounts (Contd.) Financial Statements of ICICI Bank Limited 164 18 18.4 0.3 (5) (1.6) (0.3) - (1.2) (17... -

Page 167

... Sr. No. Asset Classification Details Schedules 1. forming part of the Accounts (Contd.) 2. 3 - - - - - - - - - 4. - 16,160.5 1,031.8 - - - - 12.4 649.0 - (1.9) (1.9) - 16,171.0 1,678.9 - (4.0) (0.2) - - - - - - - - - - (4.0) (0.2) Financial Statements of ICICI Bank Limited... -

Page 168

... Doubtful Loss Standard (a) 807 27,901.8 1,686.2 8 287.6 78.3 6 762.6 114.4 - - - 188 11,734.6 7,035.5 455 17,523.4 1,072.2 (c) SubStandard (b) Doubtful SubStandard (b) Type of Restructuring Schedules forming part of the Accounts (Contd.) Financial Statements of ICICI Bank Limited 166 17... -

Page 169

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) The interest income on loan accounts under strategic debt restructuring (SDR) scheme of RBI, which has been approved by the Bank, is recognised upon realisation. Accordingly, the interest income on SDR cases... -

Page 170

... Services of which: Commercial real estate Wholesale Trade Personal loans1, of which: Housing Sub-total (B) Total (A+B) 3. 4. 1. 2. Excludes commercial business loans and dealer funding. Sub-sectors have been disclosed where advances exceed 10% of total advances in that sector at reporting date... -

Page 171

... total assets and total revenue of foreign operations as reported in Schedule 18 of the financial statements,note no. 5 on information about business and geographical segments. (IV) Off-balance sheet special purpose vehicles (SPVs) sponsored (which are required to be consolidated as per accounting... -

Page 172

... and guarantees issued on behalf of stock brokers and market makers VI. Loans sanctioned to corporate against the security of shares/bonds/debentures or other securities or on clean basis for meeting promoter's contribution to the equity of new companies in anticipation of raising resources... -

Page 173

..., corporate loans for development of special economic zone, loans to borrowers where servicing of loans is from a real estate activity and exposures to mutual funds/venture capital funds/private equity funds investing primarily in the real estate companies. Excludes non-banking assets acquired... -

Page 174

... the Bank generally enters into off-setting transactions in the inter-bank market. This results in generation of a higher number of outstanding transactions, and hence a large value of gross notional principal of the portfolio, while the net market risk is lower. 2. 3. 172 Annual Report 2015-2016 -

Page 175

... life insurance policies Income from selling non-life insurance policies Income from selling mutual fund/collective investment scheme products Year ended March 31, 2016 7,667.7 735.1 1,794.5 Year ended March 31, 2016 6,325.7 678.2 2,426.6 37. Employee benefits Pension The following tables set forth... -

Page 176

... 'employee benefits' Net cost Actual return on plan assets Expected employer's contribution next year Investment details of plan assets Insurer managed funds2 Government of India securities Corporate bonds Equity securities in listed companies Others Assumptions Discount rate Salary escalation rate... -

Page 177

...'employee benefits' Net cost Actual return on plan assets Expected employer's contribution next year Investment details of plan assets Insurer managed funds Government of India securities Corporate bonds Special deposit schemes Equity Others Assumptions Discount rate Salary escalation rate Estimated... -

Page 178

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) Estimated rate of return on plan assets is based on the expected average long-term rate of return on investments of the Fund during the estimated term of the obligations. Year ended March 31, 2016 6,933.0 7,... -

Page 179

... plan assets Government of India securities Corporate bonds Special deposit scheme Others Assumption Discount rate Expected rate of return on assets Discount rate for the remaining term to maturity of investments Average historic yield on the investment Guaranteed rate of return 1. Included in line... -

Page 180

... a materially adverse effect on its financial results. The following table sets forth, for the periods indicated, the movement in provision for legal and fraud cases, operational risk and other contingencies. ` in million Particulars Opening provision Movement during the year (net) Closing provision... -

Page 181

...ICICI Bank Limited Schedules forming part of the Accounts (Contd.) 40. Details of provisioning pertaining to fraud accounts The following table sets forth for the year ended March 31, 2016, the details of provisioning pertaining to fraud accounts. ` in million Particulars Number of frauds reported... -

Page 182

... Pension Funds Management Company Limited. Associates/joint ventures/other related entities ICICI Strategic Investments Fund1, FINO PayTech Limited, I-Process Services (India) Private Limited, NIIT Institute of Finance, Banking and Insurance Training Limited, Comm Trade Services Limited, ICICI... -

Page 183

...for the year ended March 31, 2016 were with ICICI Investment Management Company Limited amounting to ` 44.0 million (March 31, 2015: ` 40.0 million), ICICI Securities Limited amounting to ` 10.1 million (March 31, 2015: ` 11.2 million) and with I-Process Services (India) Private Limited amounting to... -

Page 184

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) Investment in Certificate of Deposits (CDs)/bonds issued by ICICI Bank During the year ended March 31, 2016, subsidiaries have invested in CDs/bonds issued by the Bank amounting to Nil (March 31, 2015: ` 3,... -

Page 185

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) The material transactions for the year ended March 31, 2016 were with ICICI Securities Limited amounting to ` 351.7 million (March 31, 2015: ` 373.3 million), India Infradebt Limited amounting to ` 88.0 ... -

Page 186

Financial Statements of ICICI Bank Limited Schedules Sale of fixed assets forming part of the Accounts (Contd.) During the year ended March 31, 2016, the Bank sold fixed assets to ICICI Prudential Asset Management company Limited amounting to ` 0.1 million (March 31, 2015: Nil) and to ICICI ... -

Page 187

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) Related party balances The following table sets forth, the balance payable to/receivable from subsidiaries/joint ventures/associates/other related entities/key management personnel and relatives of key ... -

Page 188

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) The following table sets forth, the balance payable to/receivable from subsidiaries/joint ventures/associates/other related entities/key management personnel and relatives of key management personnel at ... -

Page 189

... Bank's remuneration policy (eg. by regions, business lines), including the extent to which it is applicable to foreign subsidiaries and branches The Compensation Policy of the Bank, approved by the Board on January 31, 2012, pursuant to the guidelines issued by RBI, covers all employees of the Bank... -

Page 190

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) Directors and equivalent positions and bonus for employees, including senior management and key management personnel. Alignment of compensation philosophy with prudent risk taking: The Bank seeks to achieve ... -

Page 191

... performance metrics for Bank, top level business lines and individuals The main performance metrics include profits, loan growth, deposit growth, risk metrics (such as quality of assets), compliance with regulatory norms, refinement of risk management processes and customer service. The specific... -

Page 192

... the non-executive directors. The Board at its Meeting held on September 16, 2015, subject to the approval of shareholders and such other regulatory approvals as may be applicable and subject to the availability of net profits at the end of each financial year approved the payment of profit related... -

Page 193

Financial Statements of ICICI Bank Limited Schedules Sr. Related Party No. forming part of the Accounts (Contd.) The following table sets forth, for the periods indicated, the details of related party transactions pertaining to CSR related activities. ` in million Year ended March 31, 2016 450.0 ... -

Page 194

... K. Ramkumar Executive Director Rajiv Sabharwal Executive Director Vishakha Mulye Executive Director Place : Mumbai Date : April 29, 2016 P . Sanker Rakesh Jha Senior General Manager Chief Financial Officer (Legal) & Company Secretary Ajay Mittal Chief Accountant 192 Annual Report 2015-2016 -

Page 195

..., the aforesaid consolidated financial statements give the information required by the Act in the manner so required and give a true and fair view in conformity with the accounting principles generally accepted in India, of the consolidated state of affairs of the ICICI Annual Report 2015-2016 193 -

Page 196

... life policies in force and for policies in respect of which premium has been discontinued but liability exists on standalone financial statements of the Company". (e) The auditors of ICICI Lombard General Insurance Company Limited, the ICICI Group's General Insurance subsidiary have reported, "The... -

Page 197

...companies incorporated in India is disqualified as on 31 March 2016 from being appointed as a director in terms of Section 164 (2) of the Act; (f) with respect to the adequacy of the internal financial controls over financial reporting of the ICICI Group and its associate companies and the operating... -

Page 198

... 2016, we have audited the internal financial controls over financial reporting of ICICI Bank Limited (hereinafter referred to as 'the Holding Company'), its subsidiary companies and associate companies which are companies incorporated in India, as of that date. The respective Board of Directors... -

Page 199

... of Internal Financial Controls Over Financial Reporting issued by the ICAI. The auditors of ICICI Prudential Life Insurance Company, the Group's Life Insurance subsidiary have reported, "We report that the actuarial valuation of liabilities for life policies in force and policies where premium is... -

Page 200

...of India Balances with banks and money at call and short notice Investments Advances Fixed assets Other assets TOTAL ASSETS Contingent liabilities Bills for collection Significant accounting policies and notes to accounts The Schedules referred to above form an integral part of the Balance Sheet. As... -

Page 201

... Transfer to/(from) Revenue and other reserves Dividend (including corporate dividend tax) for the previous year paid during the year Proposed equity share dividend Proposed preference share dividend Corporate dividend tax Balance carried over to balance sheet TOTAL Significant accounting policies... -

Page 202

... K. Ramkumar Executive Director Rajiv Sabharwal Executive Director Vishakha Mulye Executive Director Place : Mumbai Date : April 29, 2016 P . Sanker Rakesh Jha Ajay Mittal Senior General Manager Chief Financial Officer Chief Accountant (Legal) & Company Secretary 200 Annual Report 2015-2016 -

Page 203

Consolidated Financial Statements Schedules forming part of the Consolidated Balance Sheet ` in '000s At 31.03.2016 At 31.03.2015 SCHEDULE 1 - CAPITAL Authorised capital 6,375,000,000 equity shares of ` 2 each (March 31, 2015: 6,375,000,000 equity shares of ` 2 each) 15,000,000 shares of ` 100 ... -

Page 204

Consolidated Financial Statements Schedules forming part of the Consolidated Balance Sheet (Contd.) ` in '000s At 31.03.2016 At 31.03.2015 SCHEDULE 2 - RESERVES AND SURPLUS I. Statutory reserve Opening balance Additions during the year Deductions during the year Closing balance 163,205,519 24,316... -

Page 205

... the year ended March 31, 2015 in accordance with these guidelines. 9. At March 31, 2015, includes amount utilised for creation of deferred tax liability of ICICI Home Finance Company Limited on balance in Special Reserve at March 31, 2014 in accordance with National Housing Board circular dated May... -

Page 206

... Financial Statements Schedules forming part of the Consolidated Balance Sheet (Contd.) ` in '000s At 31.03.2016 At 31.03.2015 SCHEDULE 4 - BORROWINGS I. Borrowings in India i) ii) iii) Reserve Bank of India Other banks Other institutions and agencies a) Government of India b) Financial... -

Page 207

... 217,995,002 Money at call and short notice a) With banks b) With other institutions TOTAL II. Outside India i) ii) In current accounts In other deposit accounts iii) Money at call and short notice TOTAL TOTAL BALANCES WITH BANKS AND MONEY AT CALL AND SHORT NOTICE Annual Report 2015-2016 205 -

Page 208

... Financial Statements Schedules forming part of the Consolidated Balance Sheet (Contd.) ` in '000s At 31.03.2016 At 31.03.2015 SCHEDULE 8 - INVESTMENTS I. Investments in India [net of provisions] i) ii) iii) iv) v) vi) Government securities Other approved securities Shares (includes equity... -

Page 209

Consolidated Financial Statements Schedules forming part of the Consolidated Balance Sheet (Contd.) ` in '000s At 31.03.2016 i) Bills purchased and discounted ii) Cash credits, overdrafts and loans repayable on demand iii) Term loans TOTAL ADVANCES B. i) Secured by tangible assets (includes ... -

Page 210

... Financial Statements Schedules forming part of the Consolidated Balance Sheet (Contd.) ` in '000s At 31.03.2016 At 31.03.2015 - 71,772,042 37,594,663 2,230 875,462 2,050,488 13,598,473 16,134,788 284,508,152 171,162,556 597,698,854 SCHEDULE 11 - OTHER ASSETS I. Inter-office adjustments (net... -

Page 211

... on sale of part of equity investment in ICICI Prudential Life Insurance Company Limited and ICICI Lombard General Insurance Company Limited. Includes profit/(loss) on sale of assets given on lease. Includes exchange profit/(loss) on repatriation of retained earnings/capital from overseas branches... -

Page 212

... on leased assets VII. Directors' fees, allowances and expenses VIII. Auditors' fees and expenses IX. Law charges X. Postages, courier, telephones, etc. XI. Repairs and maintenance XII. Insurance XIII. Direct marketing agency expenses XIV. Claims and benefits paid pertaining to insurance business XV... -

Page 213

... group providing a wide range of banking and financial services including commercial banking, retail banking, project and corporate finance, working capital finance, insurance, venture capital and private equity, investment banking, broking and treasury products and services. ICICI Bank Limited... -

Page 214

.... Country of incorporation Nature of relationship Nature of business Banking Banking Securities broking and merchant banking Holding company Securities broking Securities investment, trading and underwriting Private equity/venture capital fund management Housing finance Trusteeship services Asset... -

Page 215

... currency assets and liabilities of domestic and integral foreign operations are translated at closing exchange rates notified by Foreign Exchange Dealers' Association of India (FEDAI) relevant to the balance sheet date and the resulting gains/losses are included in the profit and loss account. Both... -

Page 216

... Financial Statements Schedules c) e) f) forming part of the Consolidated Accounts (Contd.) Income on discounted instruments is recognised over the tenure of the instrument. d) Dividend income is accounted on an accrual basis when the right to receive the dividend is established. Loan processing... -

Page 217

... to their employees: ICICI Bank Limited ICICI Prudential Life Insurance Company Limited ICICI Lombard General Insurance Company Limited The Employees Stock Option Scheme (the Scheme) of the Bank provides for grant of options on the Bank's equity shares to wholetime directors and employees of the... -

Page 218

... to the credit of policyholders, using the Net Asset Value (NAV) prevailing at the valuation date. An unexpired risk reserve and a reserve in respect of claims incurred but not reported are created, for one year renewable group term insurance. The interest rates used for valuing the liabilities are... -

Page 219

... by the Government of India. Actuarial valuation for the interest rate guarantee on the provident fund balances is determined by an actuary appointed by the Group. The actuarial gains or losses arising during the year are recognised in the profit and loss account. Annual Report 2015-2016 217 -

Page 220

... schemes. The contribution by the overseas branches is recognised in profit and loss account at the time of contribution. The Group provides for leave encashment benefit based on actuarial valuation conducted by an independent actuary. 11. Provisions, contingent liabilities and contingent assets... -

Page 221

... price/net asset value declared by the mutual fund. Costs including brokerage and commission pertaining to investments, paid at the time of acquisition, are charged to the profit and loss account. Cost of investments is computed based on the First-In-First-Out (FIFO) method. g) Profit/loss on sale... -

Page 222

... closing price on the National Stock Exchange (NSE) (or BSE, in case the investments are not listed on NSE). Mutual fund units are valued based on the previous day's net asset value. b. c. Unrealised gains/losses arising due to changes in the fair value of listed equity shares and mutual fund... -

Page 223

... Schedules c. d. forming part of the Consolidated Accounts (Contd.) Mutual fund investments (other than venture capital fund) are stated at fair value, being the closing net asset value at balance sheet date. Investments other than mentioned above are valued at cost. Unrealised gains/losses... -

Page 224

...1, 2006, the Bank accounts for any loss arising from securitisation immediately at the time of sale and the profit/premium arising from securitisation is amortised over the life of the securities issued or to be issued by the special purpose vehicle to which the assets are sold. With effect from May... -

Page 225

... exercised or converted during the year. Diluted earnings per equity share is computed using the weighted average number of equity shares and dilutive potential equity shares issued by the group outstanding during the year, except where the results are anti-dilutive. Annual Report 2015-2016 223 -

Page 226

... Limited, I-Process Services (India) Private Limited, NIIT Institute of Finance Banking and Insurance Training Limited, Comm Trade Services Limited, ICICI Foundation for Inclusive Growth, ICICI Merchant Services Private Limited, India Infradebt Limited, India Advantage Fund-III, India Advantage Fund... -

Page 227

... I-Process Services (India) Private Limited amounting to ` 7.5 million (March 31, 2015: ` 7.1 million) and with ICICI Foundation for Inclusive Growth amounting to ` 3.2 million (March 31, 2015: ` 12.1 million). Brokerage, fees and other expenses During the year ended March 31, 2016, the Group paid... -

Page 228

... Financial Statements Schedules forming part of the Consolidated Accounts (Contd.) During the year ended March 31, 2016, the Group invested in the non-convertible debentures (NCDs) issued by India Infradebt Limited amounting to ` 4,242.0 million (March 31, 2015: ` 800.0 million). During the year... -

Page 229

... the financial year. The following table sets forth, for the periods indicated, the maximum balance payable to/receivable from relatives of key management personnel: Items Deposits Advances Year ended March 31, 2016 93.7 15.0 ` in million Year ended March 31, 2015 42.3 18.2 Annual Report 2015-2016... -

Page 230

... Statements Schedules 3. forming part of the Consolidated Accounts (Contd.) Employee Stock Option Scheme (ESOS) In terms of the ESOS, as amended, the maximum number of options granted to any eligible employee in a financial year shall not exceed 0.05% of the issued equity shares of the Bank... -

Page 231

Consolidated Financial Statements Schedules forming part of the Consolidated Accounts (Contd.) The following table sets forth, the summary of stock options outstanding at March 31, 2016. Range of exercise price (` per share) 60-99 100-199 200-299 300-399 Number of shares arising out of options 2,... -

Page 232

Consolidated Financial Statements Schedules ICICI General: forming part of the Consolidated Accounts (Contd.) ICICI Lombard General Insurance Company has formulated ESOS for their employees. There is no compensation cost for the year ended March 31, 2016 based on the intrinsic value of options. If... -

Page 233

Consolidated Financial Statements Schedules 5. Assets on lease forming part of the Consolidated Accounts (Contd.) Assets taken under operating lease The following table sets forth, for the periods indicated, the details of future rentals payable on operating leases. ` in million Particulars Not ... -

Page 234

... 'employee benefits' Net cost Actual return on plan assets Expected employer's contribution next year Investment details of plan assets Insurer Managed Funds1 Government of India securities Corporate Bonds Equity securities in listed companies Others Assumptions Interest rate Salary escalation rate... -

Page 235

Consolidated Financial Statements Schedules forming part of the Consolidated Accounts (Contd.) Estimated rate of return on plan assets is based on our expectation of the average long-term rate of return on investments of the Fund during the estimated term of the obligations. Experience adjustment ... -

Page 236

...'employee benefits' Net cost Actual return on plan assets Expected employer's contribution next year Investment details of plan assets Insurer managed funds Government of India securities Corporate bonds Special Deposit schemes Equity Others Assumptions Interest rate Salary escalation rate Estimated... -

Page 237

... assets Government of India securities Corporate Bonds Special deposit scheme Others Assumptions Discount rate Expected rate of return on assets Discount rate for the remaining term to maturity of investments Average historic yield on the investment Guaranteed rate of return Annual Report 2015-2016... -

Page 238

... asset (limit in para 59(b)) AS 15 on 'employee benefits') Surplus/(deficit) Experience adjustment on plan assets Experience adjustment on plan liabilities The Group has contributed ` 2,167.6 million to provident fund including Government of India managed employees provident fund for the year ended... -

Page 239

... Trust Limited, ICICI Investment Management Company Limited, ICICI Trusteeship Services Limited, ICICI Kinfra Limited (upto September 30, 2014), I-Ven Biotech Limited (upto December 31, 2015) and ICICI Prudential Pension Funds Management Company Limited. Income, expenses, assets and liabilities are... -

Page 240

... General insurance Inter- segment adjustments Schedules Consolidated Financial Statements forming part of the Consolidated Accounts (Contd.) 238 Sr. no. Particulars 1 Revenue 2 Segment results 3 Unallocated expenses 4 Operating profit (2) - (3) Annual Report 2015-2016 5 Income tax... -

Page 241

...banking business Life insurance General insurance Inter- segment adjustments Sr. no. Particulars 1 Revenue 2 Segment results Schedules 3 Unallocated expenses 4 Operating profit (2) - (3) 5 Income tax expenses (net)/ (net deferred tax credit) 6 Net profit 1 (4) - (5) Other information... -

Page 242

... set forth, for the periods indicated, the geographical segment results. ` in million Revenue Domestic operations Foreign operations Total Year ended March 31, 2016 932,781.3 81,177.2 1,013,958.5 Year ended March 31, 2015 826,474.0 75,688.3 902,162.3 ` in million Assets Domestic operations Foreign... -

Page 243

...Share in profit or loss % of total net profit 95.5% Amount Parent ICICI Bank Limited 897,355.9 97,262.9 Subsidiaries Indian ICICI Securities Primary Dealership Limited ICICI Securities Limited ICICI Home Finance Company Limited ICICI Trusteeship Services Limited ICICI Investment Management Company... -

Page 244

... the Board of Directors of the Bank on November 16, 2015, the Bank sold equity shares representing 6% shareholding in ICICI Prudential Life Insurance Company Limited and 9% shareholding in ICICI Lombard General Insurance Company Limited during the year ended March 31, 2016 for a total consideration... -

Page 245

...The financial information of ICICI Bank Canada have been translated into Indian Rupees at the closing rate at December 31, 2015 of 1 CAD = ` 47.6650. 6. Paid-up share capital does not include share application money. 7. Investments include securities held as stock in trade. 8. Includes dividend paid... -

Page 246