The Hartford 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

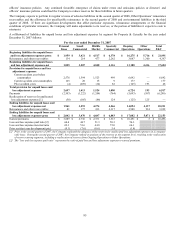

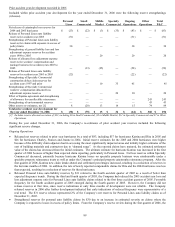

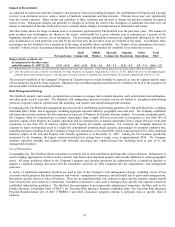

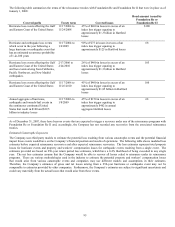

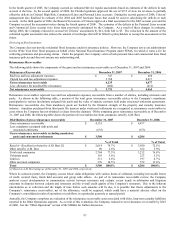

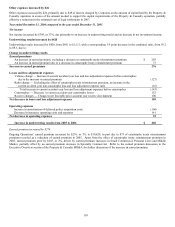

The following table summarizes the terms of the reinsurance treaties with Foundation Re and Foundation Re II that were in place as of

January 1, 2008:

Covered perils

Treaty term

Covered losses

Bond amount issued by

Foundation Re or

Foundation Re II

Hurricane loss events affecting the Gulf

and Eastern Coast of the United States

11/17/2004 to

11/24/2008

45% of $400 in losses in excess of an

index loss trigger equating to

approximately $1.3 billion in Hartford

losses

$180

Hurricane and earthquake loss events

which occur in the year following a

large hurricane or earthquake event that

has an estimated occurrence probability

of 1-in-100 years

11/17/2004 to

1/6/2009

90% of $75 in losses in excess of an

index loss trigger equating to

approximately $125 in Hartford losses

68

Hurricane loss events affecting the Gulf

and Eastern Coast of the United States

and loss events arising from California,

Pacific Northwest, and New Madrid

earthquakes.

2/17/2006 to

2/24/2010

26% of $400 in losses in excess of an

index loss trigger equating to

approximately $1.3 billion in Hartford

losses

105

Hurricane loss events affecting the Gulf

and Eastern Coast of the United States

11/17/2006 to

11/26/2010

45% of $400 in losses in excess of an

index loss trigger equating to

approximately $1.85 billion in Hartford

losses

180

Annual aggregate of hurricane,

earthquake and tornado/hail events in

the continuous continental United

States that result in $100 and $29.5

billion in industry losses

11/17/2006 to

1/8/2009

45% of $150 in losses in excess of an

index loss trigger equating to

approximately $462 in annual

aggregate Hartford losses

68

As of December 31, 2007, there have been no events that are expected to trigger a recovery under any of the reinsurance programs with

Foundation Re or Foundation Re II and, accordingly, the Company has not recorded any recoveries from the associated reinsurance

treaties.

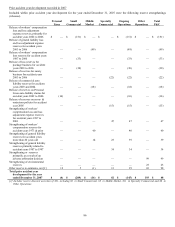

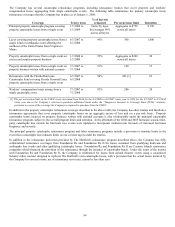

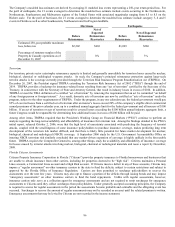

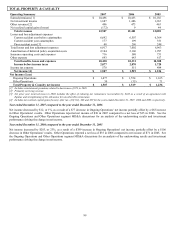

Estimated Catastrophe Exposures

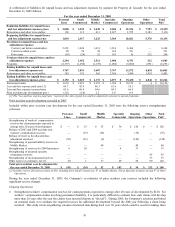

The Company uses third party models to estimate the potential loss resulting from various catastrophe events and the potential financial

impact those events would have on the Company’ s financial position and results of operations. The following table shows modeled loss

estimates before expected reinsurance recoveries and after expected reinsurance recoveries. The loss estimates represent total property

losses for hurricane events and property and workers’ compensation losses for earthquake events resulting from a single event. The

estimates provided are based on 250-year return period loss estimates, which have a 0.4% likelihood of being exceeded in any single

year. The net loss estimates assume that the Company would be able to recover all losses ceded to reinsurers under its reinsurance

programs. There are various methodologies used in the industry to estimate the potential property and workers’ compensation losses

that would arise from various catastrophe events and companies may use different models and assumptions in their estimates.

Therefore, the Company’ s estimates of gross and net losses arising from a 250-year hurricane or earthquake event may not be

comparable to estimates provided by other companies. Furthermore, the Company’ s estimates are subject to significant uncertainty and

could vary materially from the actual losses that would arise from these events.