The Hartford 2007 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276

|

|

153

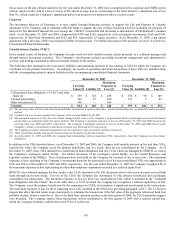

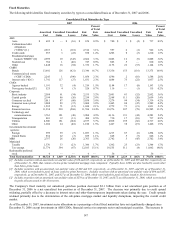

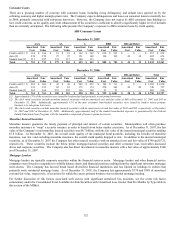

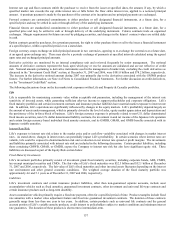

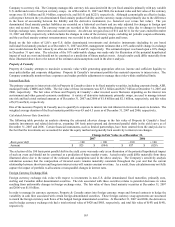

The following table identifies fixed maturities by credit quality on a consolidated basis as of December 31, 2007 and 2006. The ratings

referenced below are based on the ratings of a nationally recognized rating organization or, if not rated, assigned based on the

Company’ s internal analysis of such securities.

Consolidated Fixed Maturities by Credit Quality

2007 2006

Amortized

Cost

Fair Value

Percent of

Total Fair

Value

Amortized

Cost

Fair Value

Percent of

Total Fair

Value

AAA $ 28,547 $ 28,318 35.4% $ 23,216 $ 23,629 29.9%

AA 11,326 10,999 13.7% 10,107 10,298 13.0%

A 16,999 17,030 21.3% 17,696 18,251 23.1%

BBB 15,093 14,974 18.7% 17,402 17,655 22.3%

United States Government/Government agencies 5,165 5,229 6.5% 5,529 5,507 7.0%

BB & below 3,594 3,505 4.4% 3,658 3,734 4.7%

Total fixed maturities $ 80,724 $ 80,055 100.0% $ 77,608 $ 79,074 100.0%

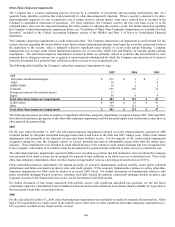

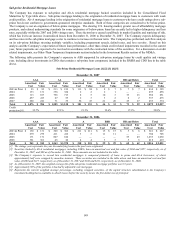

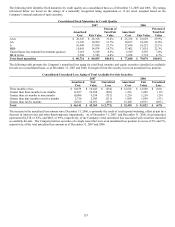

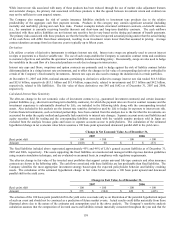

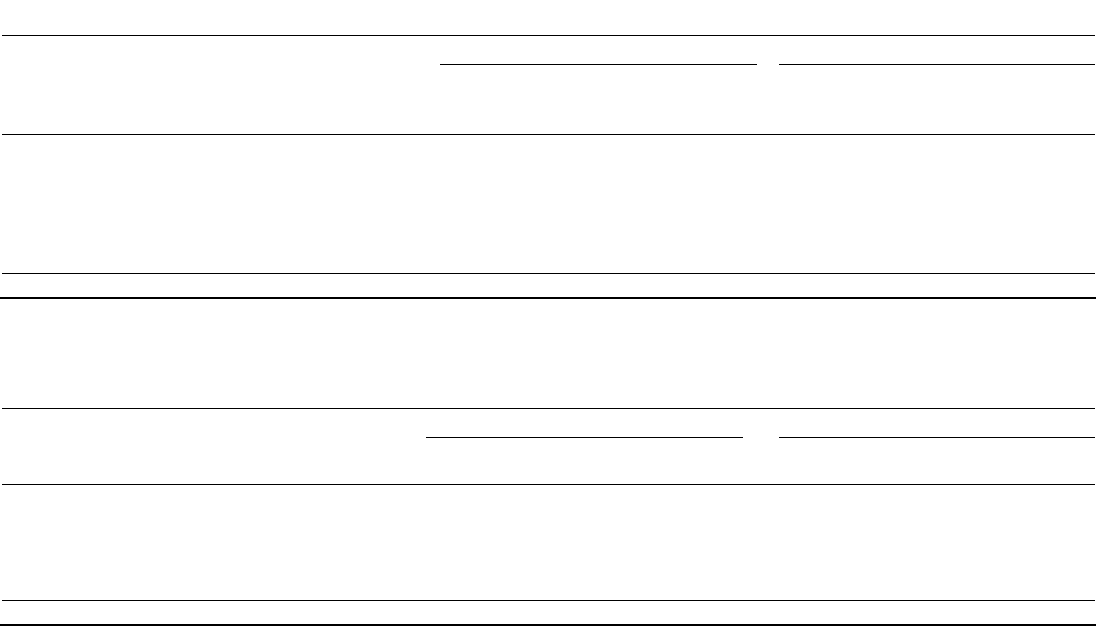

The following table presents the Company’ s unrealized loss aging for total fixed maturity and equity securities classified as available-

for-sale on a consolidated basis, as of December 31, 2007 and 2006, by length of time the security was in an unrealized loss position.

Consolidated Unrealized Loss Aging of Total Available-for-Sale Securities

2007 2006

Amortized

Cost

Fair

Value

Unrealized

Loss

Amortized

Cost

Fair

Value

Unrealized

Loss

Three months or less $ 10,879 $ 10,445 $ (434) $ 12,601 $ 12,500 $ (101)

Greater than three months to six months 11,857 10,954 (903) 1,261 1,242 (19)

Greater than six months to nine months 10,086 9,354 (732) 1,239 1,210 (29)

Greater than nine months to twelve months 2,756 2,545 (211) 1,992 1,959 (33)

Greater than twelve months 10,563 10,071 (492) 15,402 14,911 (491)

Total $ 46,141 $ 43,369 $ (2,772) $ 32,495 $ 31,822 $ (673)

The increase in the unrealized loss amount since December 31, 2006, is primarily the result of credit spread widening, offset in part by a

decrease in interest rates and other-than-temporary impairments. As of December 31, 2007, and December 31, 2006, fixed maturities

represented $2,538, or 92%, and $663, or 99%, respectively, of the Company’ s total unrealized loss associated with securities classified

as available-for-sale. The Company held no securities of a single issuer that were at an unrealized loss position in excess of 2% and 5%,

respectively, of the total unrealized loss amount as of December 31, 2007 and 2006.