The Hartford 2007 Annual Report Download - page 238

Download and view the complete annual report

Please find page 238 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-61

12. Commitments and Contingencies (continued)

Lease Commitments

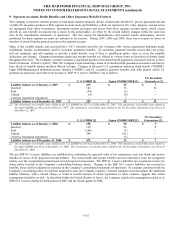

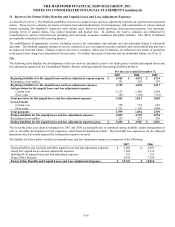

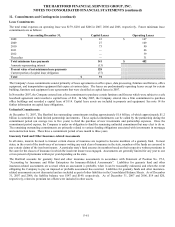

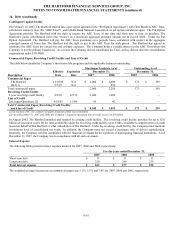

The total rental expenses on operating lease was $179, $201 and $206 in 2007, 2006 and 2005, respectively. Future minimum lease

commitments are as follows:

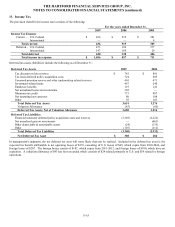

Years ending December 31, Capital Leases Operating Leases

2008 $ 41 $ 147

2009 27 109

2010 73 90

2011 — 66

2012 — 39

Thereafter — 31

Total minimum lease payments 141 $ 482

Amounts representing interest (13)

Present value of net minimum lease payments 128

Current portion of capital lease obligation (37)

Total $ 91

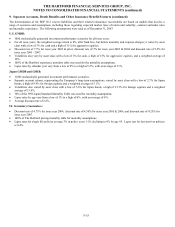

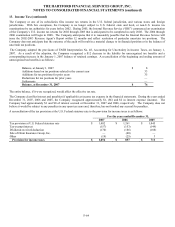

The Company’ s lease commitments consist primarily of lease agreements on office space, data processing, furniture and fixtures, office

equipment, and transportation equipment that expire at various dates. The leases are predominantly operating leases except for certain

building, furniture and equipment lease agreements that were classified as capital leases in 2007.

In November 2007, the Company entered into a firm commitment to purchase certain furniture and fixtures which were subject to a sale

leaseback agreement and recorded a capital lease of $14. In May 2007, the Company entered into a firm commitment to purchase

office buildings and recorded a capital lease of $114. Capital lease assets are included in property and equipment. See note 14 for

further information on capital lease obligations.

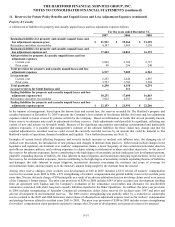

Unfunded Commitments

At December 31, 2007, The Hartford has outstanding commitments totaling approximately $1.6 billion, of which approximately $1.2

billion is committed to fund limited partnership investments. These capital commitments can be called by the partnership during the

commitment period (on average two to five years) to fund the purchase of new investments and partnership expenses. Once the

commitment period expires, the Company is under no obligation to fund the remaining unfunded commitment but may elect to do so.

The remaining outstanding commitments are primarily related to various funding obligations associated with investments in mortgage

and construction loans. These have a commitment period of one month to three years.

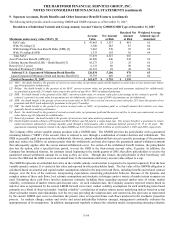

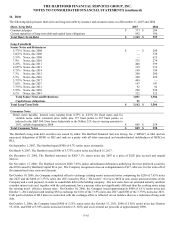

Guaranty Fund and Other Insurance-related Assessments

In all states, insurers licensed to transact certain classes of insurance are required to become members of a guaranty fund. In most

states, in the event of the insolvency of an insurer writing any such class of insurance in the state, members of the funds are assessed to

pay certain claims of the insolvent insurer. A particular state’s fund assesses its members based on their respective written premiums in

the state for the classes of insurance in which the insolvent insurer was engaged. Assessments are generally limited for any year to one

or two percent of premiums written per year depending on the state.

The Hartford accounts for guaranty fund and other insurance assessments in accordance with Statement of Position No. 97-3,

“Accounting by Insurance and Other Enterprises for Insurance-Related Assessments”. Liabilities for guaranty fund and other

insurance-related assessments are accrued when an assessment is probable, when it can be reasonably estimated, and when the event

obligating the Company to pay an imposed or probable assessment has occurred. Liabilities for guaranty funds and other insurance-

related assessments are not discounted and are included as part of other liabilities in the Consolidated Balance Sheets. As of December

31, 2007 and 2006, the liability balance was $147 and $149, respectively. As of December 31, 2007 and 2006, $19 and $20,

respectively, related to premium tax offsets were included in other assets.