The Hartford 2007 Annual Report Download - page 247

Download and view the complete annual report

Please find page 247 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-70

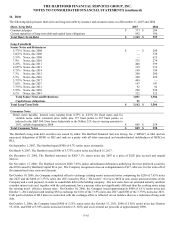

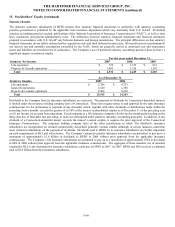

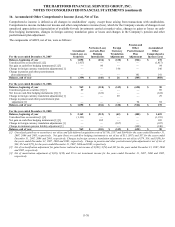

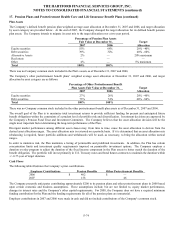

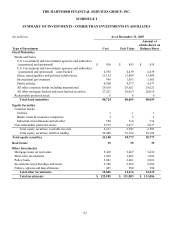

16. Accumulated Other Comprehensive Income (Loss), Net of Tax

Comprehensive income is defined as all changes in stockholders’ equity, except those arising from transactions with stockholders.

Comprehensive income includes net income and other comprehensive income (loss), which for the Company consists of changes in net

unrealized appreciation or depreciation of available-for-sale investments carried at market value, changes in gains or losses on cash-

flow hedging instruments, changes in foreign currency translation gains or losses and changes in the Company’ s pension and other

postretirement plan adjustment.

The components of AOCI, net of tax, were as follows:

For the year ended December 31, 2007

Unrealized

Gain (Loss) on

Securities

Net Gain (Loss)

on Cash-Flow

Hedging

Instruments

Foreign

Currency

Translation

Adjustments

Pension and

Other

Postretirement

Plan

Adjustment

Accumulated

Other

Comprehensive

Income (Loss)

Balance, beginning of year $ 1,058 $ (234) $ (120) $ (526) $ 178

Unrealized loss on securities [1] [2] (1,417) — — — (1,417)

Net gain on cash-flow hedging instruments [1] [3] — 94 — — 94

Change in foreign currency translation adjustments [1] — — 146 — 146

Change in pension and other postretirement

plan adjustment [1]

—

—

—

141

141

Balance, end of year $ (359) $ (140) $ 26 $ (385) $ (858)

For the year ended December 31, 2006

Balance, beginning of year $ 969 $ (110) $ (149) $ (620) $ 90

Unrealized gain on securities [1] [2] 89 — — — 89

Net loss on cash-flow hedging instruments [1] [3] — (124) — — (124)

Change in foreign currency translation adjustments [1] — — 29 — 29

Change in pension and other postretirement plan

adjustment [1]

—

—

—

94

94

Balance, end of year $ 1,058 $ (234) $ (120) $ (526) $ 178

For the year ended December 31, 2005

Balance, beginning of year $ 2,162 $ (215) $ (42) $ (480) $ 1,425

Unrealized loss on securities [1] [2] (1,193) — — — (1,193)

Net gain on cash-flow hedging instruments [1] [3] — 105 — — 105

Change in foreign currency translation adjustments [1] — — (107) — (107)

Change in minimum pension liability adjustment [1] — — — (140) (140)

Balance, end of year $ 969 $ (110) $ (149) $ (620) $ 90

[1] Unrealized gain/loss on securities is net of tax and Life deferred acquisition costs of $(718), $137 and $(644) for the years ended December 31,

2007, 2006 and 2005, respectively. Net gain (loss) on cash-flow hedging instruments is net of tax of $51, $(67) and $57 for the years ended

December 31, 2007, 2006 and 2005, respectively. Changes in foreign currency translation adjustments are net of tax of $79, $16, and $(58) for

the years ended December 31, 2007, 2006 and 2005, respectively. Change in pension and other postretirement plan adjustment is net of tax of

$48, $51 and $(75) for the years ended December 31, 2007, 2006 and 2005, respectively.

[2] Net of reclassification adjustment for gains/losses realized in net income of $(192), $(74) and $45 for the years ended December 31, 2007, 2006

and 2005, respectively.

[3] Net of amortization adjustment of $(20), $(38) and $5 to net investment income for the years ended December 31, 2007, 2006 and 2005,

respectively.