The Hartford 2007 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20

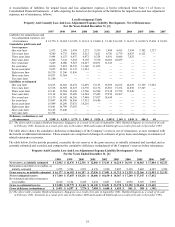

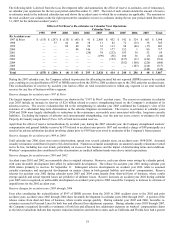

impact in controlling costs than was originally estimated. In 2007, the Company released reserves for Middle Market general liability

claims and Small Commercial package business claims as reported losses have emerged favorably to previous expectations. In

addition, catastrophe reserves related to the 2004 and 2005 hurricanes developed favorably in 2006.

Within professional liability business, during calendar year 2005 reserves were released for directors and officers insurance on accident

years 2003 and 2004 due to favorable developments, while prior accident year reserves were strengthened for contracts that provide

auto financing gap coverage and auto lease residual value coverage. In 2003, the Company stopped writing contracts that provide auto

financing gap coverage and auto lease residual value coverage.

Ceded Reinsurance

The Hartford cedes insurance risk to reinsurance companies. Reinsurance does not relieve The Hartford of its primary liability and, as

such, failure of reinsurers to honor their obligations could result in losses to The Hartford. The Hartford evaluates the risk transfer of

its reinsurance contracts, the financial condition of its reinsurers and monitors concentrations of credit risk. The Company’s monitoring

procedures include careful initial selection of its reinsurers, structuring agreements to provide collateral funds where possible, and

regularly monitoring the financial condition and ratings of its reinsurers. Reinsurance accounting is followed for ceded transactions

when the risk transfer provisions of Statement of Financial Accounting Standard No. 113, “Accounting and Reporting for Reinsurance

of Short-Duration and Long-Duration Contracts,” (“SFAS 113”) have been met. For further discussion, see Note 6 of Notes to

Consolidated Financial Statements.

For Property & Casualty operations, these reinsurance arrangements are intended to provide greater diversification of business and limit

The Hartford’s maximum net loss arising from large risks or catastrophes. A major portion of The Hartford’ s property and casualty

reinsurance is effected under general reinsurance contracts known as treaties, or, in some instances, is negotiated on an individual risk

basis, known as facultative reinsurance. The Hartford also has in-force excess of loss contracts with reinsurers that protect it against a

specified part or all of a layer of losses over stipulated amounts.

In accordance with normal industry practice, Life is involved in both the cession and assumption of insurance with other insurance and

reinsurance companies. As of December 31, 2007, the Company's policy for the largest amount of life insurance retained on any one

life by any one of the life operations doubled from $5 to $10 compared to the corresponding 2006 and 2005 periods. In addition, Life

has reinsured the majority of the minimum death benefit guarantees as well as 18% of the guaranteed minimum withdrawal benefits

offered in connection with its variable annuity contracts. Life also assumes reinsurance from other insurers. For the years ended

December 31, 2007, 2006 and 2005, Life did not make any significant changes in the terms under which reinsurance is ceded to other

insurers.

Investment Operations

The Hartford’s investment portfolios are primarily divided between Life and Property & Casualty. The investment portfolios of Life

and Property & Casualty are managed by HIMCO. HIMCO manages the portfolios to maximize economic value, while attempting to

generate the income necessary to support the Company’s various product obligations, within internally established objectives,

guidelines and risk tolerances. The portfolio objectives and guidelines are developed based upon the asset/liability profile, including

duration, convexity and other characteristics within specified risk tolerances. The risk tolerances considered include, for example, asset

and credit issuer allocation limits, maximum portfolio below investment grade holdings and foreign currency exposure. The Company

attempts to minimize adverse impacts to the portfolio and the Company’ s results of operations from changes in economic conditions

through asset allocation limits, asset/liability duration matching and through the use of derivatives. For further discussion of HIMCO’ s

portfolio management approach, see the Investments - General section of the MD&A.

In addition to managing the general account assets of the Company, HIMCO is also a Securities and Exchange Commission (“SEC”)

registered investment advisor for third party institutional clients, a sub-advisor for certain mutual funds and serves as the sponsor and

collateral manager for capital markets transactions. HIMCO specializes in investment management that incorporates proprietary

research and active management within a disciplined risk framework to provide value added returns versus peers and benchmarks. As

of December 31, 2007 and 2006, the fair value of HIMCO’s total assets under management was approximately $148.7 billion and

$131.2 billion, respectively, of which $10.9 billion and $7.2 billion, respectively, were held in HIMCO managed third party accounts.

Regulation and Premium Rates

Insurance companies are subject to comprehensive and detailed regulation and supervision throughout the United States. The extent of

such regulation varies, but generally has its source in statutes which delegate regulatory, supervisory and administrative powers to state

insurance departments. Such powers relate to, among other things, the standards of solvency that must be met and maintained; the

licensing of insurers and their agents; the nature of and limitations on investments; establishing premium rates; claim handling and

trade practices; restrictions on the size of risks which may be insured under a single policy; deposits of securities for the benefit of

policyholders; approval of policy forms; periodic examinations of the affairs of companies; annual and other reports required to be filed

on the financial condition of companies or for other purposes; fixing maximum interest rates on life insurance policy loans and

minimum rates for accumulation of surrender values; and the adequacy of reserves and other necessary provisions for unearned

premiums, unpaid losses and loss adjustment expenses and other liabilities, both reported and unreported.

Most states have enacted legislation that regulates insurance holding company systems such as The Hartford. This legislation provides

that each insurance company in the system is required to register with the insurance department of its state of domicile and furnish

information concerning the operations of companies within the holding company system which may materially affect the operations,