The Hartford 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 92

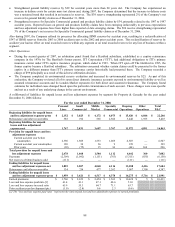

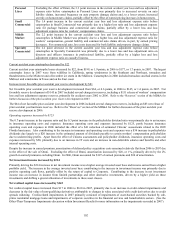

estimates and incorporated modeling using actuarial techniques that have recently been developed within the actuarial profession.

Based on the results of this analysis the Company changed its previous estimate and increased the percentage of ultimate claim

costs expected to be paid after 20 years of development. As an example, within Small Commercial and Middle Market, this

development percentage was increased from 8% to 9%. The $120 of reserve strengthening represented a change in estimate which

was 3% of the Company’ s net reserves for workers’ compensation claims as of December 31, 2004.

• Released reserves for workers’ compensation losses in Small Commercial and Middle Market by $75 related to accident years 2003

and 2004. The state of California instituted reforms to its workers’ compensation laws that began in 2003 and continued through

2005. In addition, in this same time frame, the Company was taking underwriting actions to improve workers’ compensation

underwriting performance. Management recognized that the combination of the Company’ s underwriting initiatives and the state of

California changes could, over time, improve the Company’s workers’ compensation experience. Verification of this improvement

as a probable outcome, however, would require sufficient supporting evidence. While there appeared to be some favorable trends

emerging in late 2004 with respect to accident year 2003 and while early indications on accident year 2004 were favorable, senior

reserving actuaries and senior management were uncertain that these favorable trends were real and would be sustained. In the

third quarter of 2005, management concluded that sufficient evidence existed in the actuarial data and methods to support a release

of reserves. The actuarial work was further supported by a review of underwriting metrics, supporting the effectiveness of the

actions taken, and by discussions with claim handlers involved with the California workers’ compensation business. The $75

reserve release represented a change in estimate which was 2% of the Company’ s net reserves for workers’ compensation claims as

of December 31, 2004.

• Released prior accident year reserves for allocated loss adjustment expenses by $120, largely as the result of cost reduction

initiatives implemented by the Company to reduce allocated loss adjustment expenses for both legal and non-legal expenses as well

as improved actuarial techniques. The improved actuarial techniques included an analysis of claims involving legal expenses

separate from claims that do not involve legal expenses. This analysis included a review of the trends in the number of claims

involving legal expenses, the average expenses incurred and trends in legal expenses. The release of $95 in Personal Lines

represented 5% of Personal Lines net reserves as of December 31, 2004.

• Strengthened general liability reserves within Middle Market by $40 for accident years 2000-2003 due to higher than anticipated

loss payments beyond four years of development. The $40 reserve strengthening represented 2% of the Company’ s net reserves for

general liability claims as of December 31, 2004.

• Strengthened reserves for loss and loss adjustment expenses related to the third quarter 2004 hurricanes by a total of $33. The main

drivers of the increase were late-reported claims for condominium assessments and increases in the costs of building materials and

contracting services.

• Within the Specialty Commercial segment, there were other offsetting positive and negative adjustments to prior accident year

reserves. The principal offsetting adjustments were a release of reserves for directors and officers insurance related to accident

years 2003 and 2004 and strengthening of prior accident year reserves for contracts that provide auto financing gap coverage and

auto lease residual value coverage; the release and offsetting strengthening were each approximately $80.

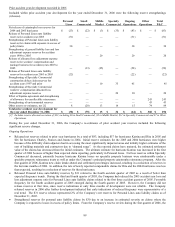

Other Operations

• Strengthened assumed reinsurance reserves by $85, principally for accident years 1997 through 2001. In recent years, the Company

has seen an increase in reported losses above previous expectations and this increase in reported losses contributed to the reserve re-

estimates. Assumed reinsurance exposures are inherently less predictable than direct insurance exposures because the Company

may not receive notice of a reinsurance claim until the underlying direct insurance claim is mature. The reserve strengthening of

$85 represents 6% of the $1.3 billion of net assumed reinsurance reserves within Other Operations as of December 31, 2004.

• Strengthened environmental reserves by $37 as a result of an environmental reserve evaluation completed during the third quarter

of 2005. While the review found no underlying cause or change in the claim environment, loss estimates for individual cases

changed based upon the particular circumstances of each account. The $37 of reserve strengthening represented 1% of the

Company’ s net reserves for asbestos and environmental claims as of December 31, 2004.