The Hartford 2007 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

businesses have relatively high barriers to entry and there have been few new entrants into the group benefits insurance market over the

past few years.

Based on LIMRA market share data for in-force premiums as of June 30, 2007, Group Benefits is the second largest group disability

carrier and the third largest group life insurance carrier. The relatively large size and underwriting capacity of the Company’ s business

provides it with market opportunities not available to smaller competitors.

International

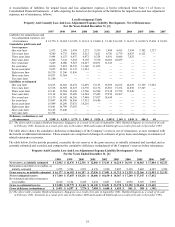

International, which has operations located in Japan, Brazil, Ireland and the United Kingdom, provides investments, retirement savings

and other insurance and savings products to individuals and groups outside the United States and Canada. International revenues were

$847, $736 and $494 in 2007, 2006 and 2005, respectively. Net income for International was $223, $231 and $75 in 2007, 2006 and

2005, respectively. International’ s total assets were $41.6 billion and $33.8 billion as of December 31, 2007 and 2006, respectively.

The Company’s Japan operation, Hartford Life Insurance K.K. (“HLIKK”), continues to grow and remains the largest distributor of

variable annuities in Japan, based on assets under management. The Company also sells yen and U.S. dollar denominated fixed

annuities in Japan. With assets under management of $37.6 billion, $31.3 billion and $26.1 billion as of December 31, 2007, 2006 and

2005, respectively, the Japan operation is the largest component of International with net income of $253, $252 and $101 in 2007, 2006

and 2005, respectively.

The Company’s Japan operation sells both variable and fixed individual annuity products through a wide distribution network of

Japan’ s broker-dealer organizations, banks and other financial institutions and independent financial advisors. The Company is one of

the largest sellers of individual retail variable annuities in Japan with sales of $6.3 billion, $5.8 billion and $10.7 billion in 2007, 2006

and 2005, respectively.

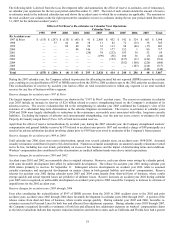

In February 2007, Life introduced a new variable annuity product called “3 Win” to complement its existing variable annuity product

offerings in Japan. 3 Win is the first product offered by the Company which combines guaranteed minimum accumulation benefits and

income benefits in the same product. The new product has been favorably received by the market with the new product accounting for

42% of Japan’ s variable annuity sales for 2007. The success of the Company’ s enhanced product offerings will ultimately be based on

customer acceptance in an increasingly competitive environment.

International’ s other operations include a 50% owned joint venture in Brazil and a startup operation in Europe. The Brazil joint venture

operates under the name Icatu-Hartford and distributes pension, life insurance and other insurance and savings products through broker-

dealer organizations and various partnerships. The Company’ s European operation, Hartford Life Limited, began selling unit-linked

investment bonds and pension products in the United Kingdom in April 2005. Unit-linked bonds and pension products are similar to

variable annuities marketed in the United States and Japan. Hartford Life Limited established its operations in Dublin, Ireland with a

branch office in London to help market and service its business in the United Kingdom.

Principal Products

Individual Variable Annuities — The Company earns fees, based on policyholders’ account values, for managing variable annuity

assets and maintaining policyholder accounts. The Company uses specified portions of the periodic deposits paid by a customer to

purchase units in one or more mutual funds as directed by the customer, who then assumes the investment performance risks and

rewards. These products offer the policyholder a variety of equity and fixed income options. Additionally, International sells variable

annuity contracts that offer various guaranteed minimum death and living benefits.

Policyholders may make deposits of varying amounts at regular or irregular intervals, and the value of these assets fluctuates in

accordance with the investment performance of the funds selected by the policyholder. To encourage persistency, many of the

Company’ s individual variable annuities are subject to withdrawal restrictions and surrender charges. Surrender charges range up to 7%

of the contract’ s deposits, less withdrawals, and reduce to zero on a sliding scale, usually within seven years from the deposit date. In

Japan, individual variable annuity account values of $35.8 billion, as of December 31, 2007, have grown from $29.7 billion, as of

December 31, 2006, and $24.6 billion, as of December 31, 2005.

Fixed MVA Annuities — Fixed MVA annuities are fixed rate annuity contracts that guarantee a specific sum of money to be paid in the

future, either as a lump sum or as monthly income. In the event that a policyholder surrenders a policy prior to the end of the guarantee

period, the MVA feature adjusts the contract’ s cash surrender value with respect to any changes in crediting rates for newly issued

contracts, thereby protecting the Company from losses due to higher interest rates at the time of surrender. The amount of lump sum or

monthly income payments will not fluctuate due to adverse changes in the Company’ s investment return, mortality experience or

expenses. The Company’ s primary fixed MVA annuities in Japan are yen and dollar denominated with terms varying from five to ten

years with an average term to maturity of approximately seven years. In Japan, account values of fixed MVA annuities were $1.8

billion, $1.7 billion and $1.5 billion as of December 31, 2007, 2006 and 2005, respectively.

Marketing and Distribution

The International distribution network is based on management’ s strategy of developing and utilizing multiple and competing

distribution channels to achieve the broadest distribution to reach target customers. The success of the Company’ s marketing and

distribution system depends on its product offerings, fund performance, successful utilization of wholesaling, quality of customer

service, financial regulations or laws that impact distribution and relationships with securities firms, banks and other financial

institutions, and independent financial advisors (through which the sale of the Company’ s retail investment products to customers is