The Hartford 2007 Annual Report Download - page 244

Download and view the complete annual report

Please find page 244 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-67

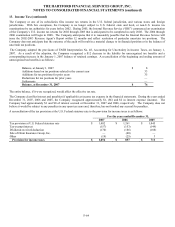

14. Debt (continued)

Contingent Capital Facility

On February 12, 2007, The Hartford entered into a put option agreement (the “Put Option Agreement”) with Glen Meadow ABC Trust,

a Delaware statutory trust (the “ABC Trust”), and LaSalle Bank National Association, as put option calculation agent. The Put Option

Agreement provides The Hartford with the right to require the ABC Trust, at any time and from time to time, to purchase The

Hartford’ s junior subordinated notes (the “Notes”) in a maximum aggregate principal amount not to exceed $500. Under the Put

Option Agreement, The Hartford will pay the ABC Trust premiums on a periodic basis, calculated with respect to the aggregate

principal amount of Notes that The Hartford had the right to put to the ABC Trust for such period. The Hartford has agreed to

reimburse the ABC Trust for certain fees and ordinary expenses. The Company holds a variable interest in the ABC Trust where the

Company is not the primary beneficiary. As a result, the Company did not consolidate the Trust, as they did not meet the consolidation

requirements under FIN 46(R).

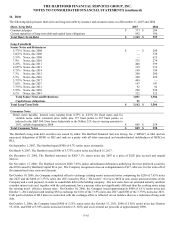

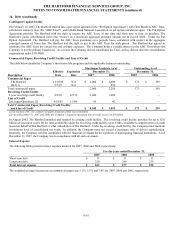

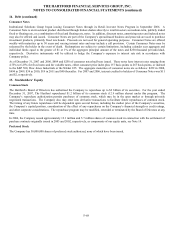

Commercial Paper, Revolving Credit Facility and Line of Credit

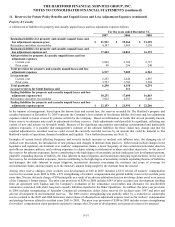

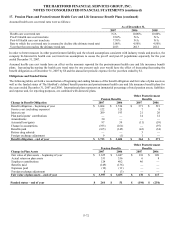

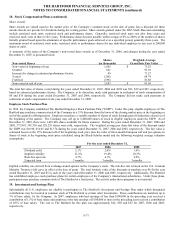

The table below details the Company’ s short-term debt programs and the applicable balances outstanding.

Maximum Available As of Outstanding As of

Effective Expiration December 31,

December 31,

Description Date Date 2007 2006

2007 2006

Commercial Paper

The Hartford 11/10/86 N/A $ 2,000 $ 2,000 $ 373 $ 299

HLI [1] 2/7/97 N/A — 250 — —

Total commercial paper 2,000 2,250 373 299

Revolving Credit Facility

5-year revolving credit facility 8/9/07 8/9/12 2,000 1,600 — —

Line of Credit

Life Japan Operations [2] 9/18/02 1/5/09 45 42 — —

Total Commercial Paper, Revolving Credit Facility

and Line of Credit $

4,045 $

3,892

$ 373 $

299

[1] In January 2007, the commercial paper program of HLI was terminated.

[2] As of December 31, 2007 and 2006, the Company’s Japanese operation line of credit in yen was ¥5 billion.

In August 2007, The Hartford amended and restated its existing credit facility. The revolving credit facility provides for up to $2.0

billion of unsecured credit. Of the total availability under the revolving credit facility, up to $100 is available to support letters of credit

issued on behalf of The Hartford or other subsidiaries of The Hartford. Under the revolving credit facility, the Company must maintain

a minimum level of consolidated net worth. In addition, the Company must not exceed a maximum ratio of debt to capitalization.

Quarterly, the Company certifies compliance with the financial covenants for the syndicate of participating financial institutions. As of

December 31, 2007, the Company was in compliance with all such covenants.

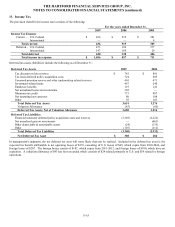

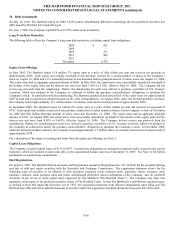

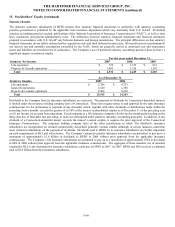

Interest Expense

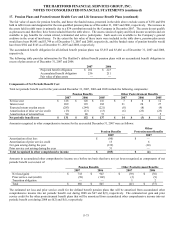

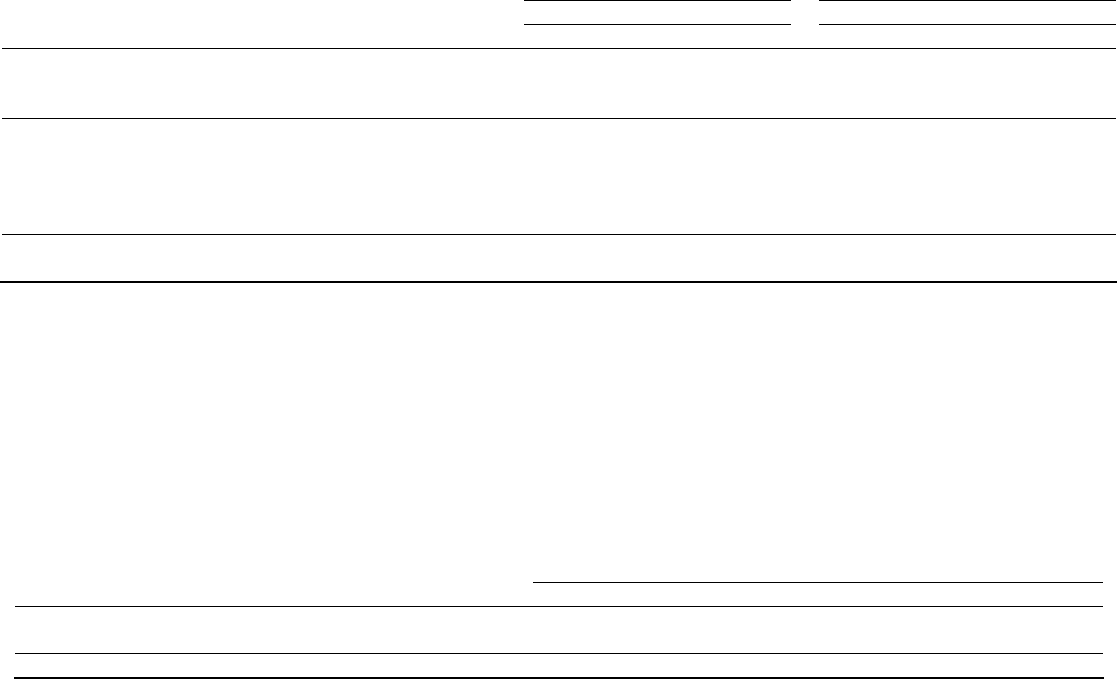

The following table presents interest expense incurred for 2007, 2006 and 2005, respectively.

For the years ended December 31,

2007 2006 2005

Short-term debt $13 $31 $13

Long-term debt 250 246 239

Total interest expense $263 $277 $252

The weighted-average interest rate on commercial paper was 5.1%, 5.3% and 3.4% for 2007, 2006 and 2005, respectively.