The Hartford 2007 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

150

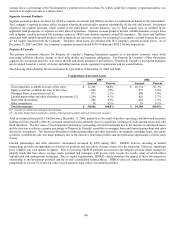

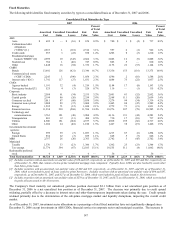

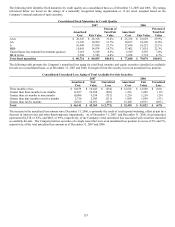

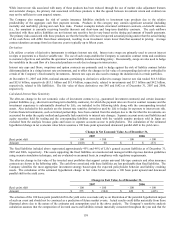

Commercial Mortgage Loans

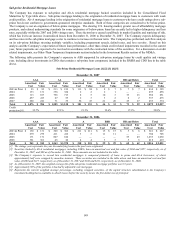

Commercial real estate market cash flow fundamentals have been solid with mortgage delinquencies near all time lows. Recently,

however, commercial real estate rents and property values have begun to soften. The following tables represent the Company’ s

exposure to CMBS bonds and commercial real estate CDOs by credit quality and vintage year.

CMBS – Bonds [1]

December 31, 2007

AAA AA A BBB

BB and Below Total

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

2003 & Prior $ 2,666 $ 2,702 $ 495 $ 502 $ 289 $ 292 $ 30 $ 32 $ 46 $ 49 $ 3,526 $ 3,577

2004 709 708 89 87 130 128 23 21 — — 951 944

2005 1,280 1,258 479 454 404 389 85 76 24 21 2,272 2,198

2006 2,975 2,910 415 395 763 739 456 400 24 22 4,633 4,466

2007 1,365 1,342 461 431 240 220 190 165 3 3 2,259 2,161

Total $ 8,995 $ 8,920 $ 1,939 $ 1,869 $ 1,826 $ 1,768 $ 784 $ 694 $ 97 $ 95 $ 13,641 $ 13,346

Credit

protection 23.8% 16.4% 13.6% 6.8% 3.7% 20.6%

December 31, 2006

AAA AA A BBB

BB and Below Total

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

2003 & Prior $ 3,435 $ 3,463 $ 617 $ 623 $ 525 $ 529 $ 91 $ 96 $ 53 $ 65 $ 4,721 $ 4,776

2004 882 867 103 100 129 127 27 27 — — 1,141 1,121

2005 1,473 1,457 694 687 555 551 237 237 5 5 2,964 2,937

2006 2,471 2,489 462 465 1,046 1,055 496 497 35 35 4,510 4,541

Total $ 8,261 $ 8,276 $ 1,876 $ 1,875 $ 2,255 $ 2,262 $ 851 $ 857 $ 93 $ 105 $ 13,336 $ 13,375

[1] The vintage year represents the year the pool of loans was originated.

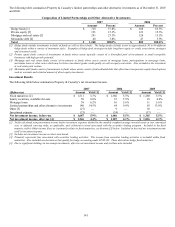

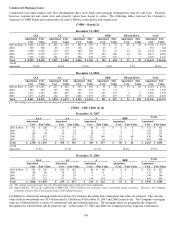

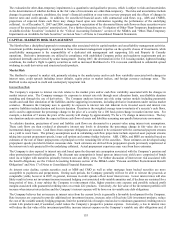

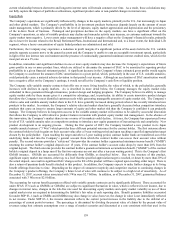

CMBS – CRE CDOs [1] [2]

December 31, 2007

AAA AA

A BBB

Total

Amortized

Cost Fair Value

Amortized

Cost Fair Value

Amortized

Cost Fair Value

Amortized

Cost Fair Value

Amortized

Cost Fair Value

2003 & Prior $ 361 $ 288 $ 119 $ 95 $ 44 $ 36 $ 8 $ 6 $ 532 $ 425

2004 97 77 32 25 12 9 2 2 143 113

2005 120 99 30 24 10 8 2 1 162 132

2006 521 472 136 112 222 160 51 40 930 784

2007 251 219 121 100 81 64 23 17 476 400

Total $ 1,350 $ 1,155 $ 438 $ 356 $ 369 $ 277 $ 86 $ 66 $ 2,243 $ 1,854

Credit

protection

31.5%

27.1%

16.7%

10.4%

27.5%

December 31, 2006

AAA AA

A BBB

Total

Amortized

Cost Fair Value

Amortized

Cost Fair Value

Amortized

Cost Fair Value

Amortized

Cost Fair Value

Amortized

Cost Fair Value

2003 & Prior $ 324 $ 320 $ 106 $ 105 $ 40 $ 40 $ 6 $ 6 $ 476 $ 471

2004 86 86 28 28 11 11 2 2 127 127

2005 111 111 28 28 9 9 1 1 149 149

2006 539 537 97 96 154 154 54 54 844 841

Total $ 1,060 $ 1,054 $ 259 $ 257 $ 214 $ 214 $ 63 $ 63 $ 1,596 $ 1,588

[1] The vintage year represents the year the underlying loans in the pool were originated.

[2] Approximately 50% of the underlying CMBS CRE CDO collateral are seasoned, below investment grade securities. However, the Company

primarily invests in the AAA tranche of the CDO capital structure.

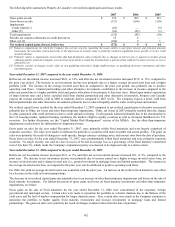

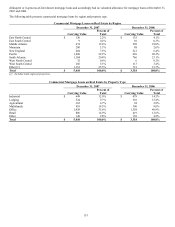

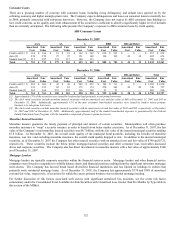

In addition to commercial mortgage-backed securities, the company has whole loan commercial real estate investments. The carrying

value of these investments was $5.4 billion and $3.3 billion as of December 31, 2007 and 2006, respectively. The Company’s mortgage

loans are collateralized by a variety of commercial and agricultural properties. The mortgage loans are geographically dispersed

throughout the United States and by property type. At December 31, 2007 and 2006, the Company held no impaired, restructured,