The Hartford 2007 Annual Report Download - page 250

Download and view the complete annual report

Please find page 250 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-73

17. Pension Plans and Postretirement Health Care and Life Insurance Benefit Plans (continued)

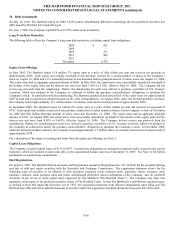

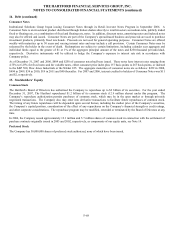

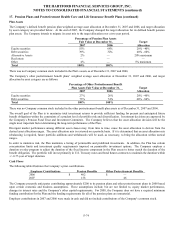

The fair value of assets for pension benefits, and hence the funded status, presented in the table above exclude assets of $138 and $94

held in rabbi trusts and designated for the non-qualified pension plans as of December 31, 2007 and 2006, respectively. The increase in

the assets held in rabbi trusts is primarily due to a $34 contribution made by the Company in December 2007. The assets do not qualify

as plan assets and, therefore, have been excluded from the table above. The assets consist of equity and fixed income securities and are

available to pay benefits for certain retired, terminated and active participants. Such assets are available to the Company’ s general

creditors in the event of insolvency. To the extent the fair value of these trusts were included in the table above, pension plan assets

would have been $4,095 and $3,749 as of December 31, 2007 and 2006, respectively, and the funded status of pension benefits would

have been $382 and $145 as of December 31, 2007 and 2006, respectively.

The accumulated benefit obligation for all defined benefit pension plans was $3,655 and $3,486 as of December 31, 2007 and 2006,

respectively.

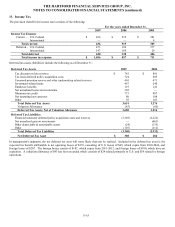

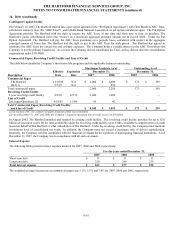

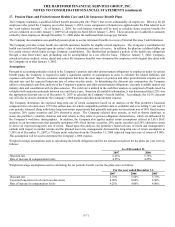

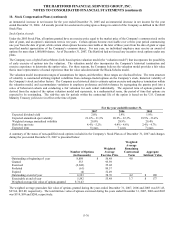

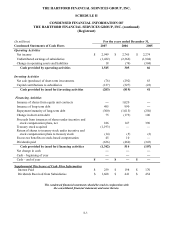

The following table provides information for The Hartford’ s defined benefit pension plans with an accumulated benefit obligation in

excess of plan assets as of December 31, 2007 and 2006.

2007 2006

Projected benefit obligation $ 262 $ 223

Accumulated benefit obligation 256 211

Fair value of plan assets — —

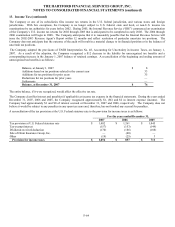

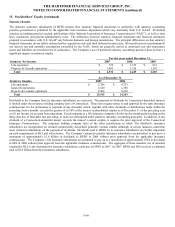

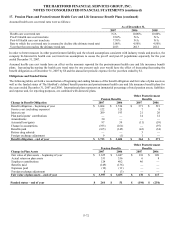

Components of Net Periodic Benefit Cost

Total net periodic benefit cost for the years ended December 31, 2007, 2006 and 2005 include the following components:

Pension Benefits Other Postretirement Benefits

2007 2006 2005 2007 2006 2005

Service cost $ 128 $ 128 $ 116 $ 7 $ 8 $ 12

Interest cost 209 193 182 21 20 27

Expected return on plan assets (283) (244) (221) (8) (8) (9)

Amortization of prior service credit (13) (13) (13) (6) (23) (23)

Amortization of actuarial loss 90 88 73 — — 5

Net periodic benefit cost $ 131 $ 152 $ 137 $ 14 $ (3) $ 12

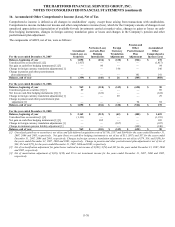

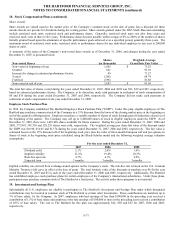

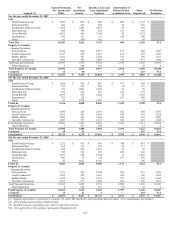

Amounts recognized in other comprehensive income for the year ended December 31, 2007 were as follows:

Pension Benefits

Other

Postretirement Benefits

2007 2007

Amortization of net loss $ (90) $ —

Amortization of prior service credit 13 6

Net gain arising during the year (139) (10)

Prior service cost arising during the year 31 —

Total recognized in other comprehensive income $ (185) $ (4)

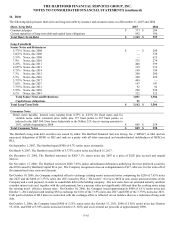

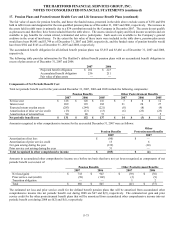

Amounts in accumulated other comprehensive income on a before tax basis that have not yet been recognized as components of net

periodic benefit cost consist of:

Pension Benefits Other Postretirement Benefits

2007 2006 2007 2006

Net loss/(gain) $ 718 $ 947 $ (39) $ (30)

Prior service cost/(credit) (58) (102) (3) (9)

Transition obligation — — 1 2

Total $ 660 $ 845 $ (41) $ (37)

The estimated net loss and prior service credit for the defined benefit pension plans that will be amortized from accumulated other

comprehensive income into net periodic benefit cost during 2008 are $47 and $(9), respectively. The estimated net gain and prior

service credit for the other postretirement benefit plans that will be amortized from accumulated other comprehensive income into net

periodic benefit cost during 2008 are $(2) and $(1), respectively.