The Hartford 2007 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134

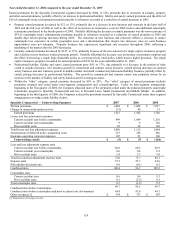

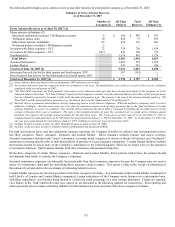

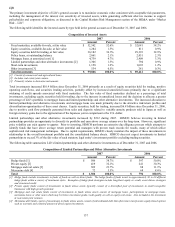

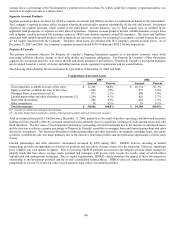

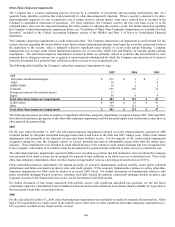

The following table sets forth, for the years ended December 31, 2007, 2006 and 2005, paid and incurred loss activity by the three

categories of claims for asbestos and environmental.

Paid and Incurred Losses and Loss Adjustment Expenses (“LAE”) Development – Asbestos and Environmental

Asbestos [1] Environmental [1]

2007

Paid

Losses & LAE

Incurred

Losses & LAE

Paid

Losses & LAE

Incurred

Losses & LAE

Gross

Direct $ 251 $ (289) $ 90 $ 43

Assumed – Domestic 112 72 16 —

London Market 31 76 8 —

Total 394 (141) 114 43

Ceded (107) 184 (21) (15)

Net $ 287 $ 43 $ 93 $ 28

2006

Gross

Direct $ 346 $ 5 $ 45 $ 57

Assumed – Domestic 199 4 50 (25)

London Market 66 — 9 3

Total 611 9 104 35

Ceded (248) 305 2 27

Net $ 363 $ 314 $ 106 $ 62

2005

Gross

Direct $ 349 $ 10 $ 50 $ 14

Assumed – Domestic 70 (4) 21 —

London Market 61 — 9 —

Total 480 6 80 14

Ceded (271) 23 (3) 38

Net $ 209 $ 29 $ 77 $ 52

[1] Excludes asbestos and environmental paid and incurred loss and LAE reported in Ongoing Operations. Total gross losses and LAE incurred in

Ongoing Operations for the twelve months ended December 31, 2007, 2006, and 2005 includes $9, $10 and $17, respectively, related to asbestos

and environmental claims. Total gross losses and LAE paid in Ongoing Operations for the twelve months ended December 31, 2007, 2006, and

2005 includes $10, $12 and $23, respectively, related to asbestos and environmental claims.

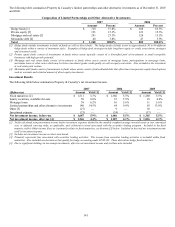

A number of factors affect the variability of estimates for asbestos and environmental reserves including assumptions with respect to the

frequency of claims, the average severity of those claims settled with payment, the dismissal rate of claims with no payment and the

expense to indemnity ratio. The uncertainty with respect to the underlying reserve assumptions for asbestos and environmental adds a

greater degree of variability to these reserve estimates than reserve estimates for more traditional exposures. While this variability is

reflected in part in the size of the range of reserves developed by the Company, that range may still not be indicative of the potential

variance between the ultimate outcome and the recorded reserves. The recorded net reserves as of December 31, 2007 of $2.26 billion

($2.00 billion and $257 for asbestos and environmental, respectively) is within an estimated range, unadjusted for covariance, of $1.88

billion to $2.60 billion. The process of estimating asbestos and environmental reserves remains subject to a wide variety of

uncertainties, which are detailed in the “Critical Accounting Estimates—Property & Casualty Reserves, Net of Reinsurance” section of

Management’ s Discussion and Analysis of Financial Condition and Results of Operations. The Company believes that its current

asbestos and environmental reserves are reasonable and appropriate. However, analyses of further developments could cause the

Company to change its estimates and ranges of its asbestos and environmental reserves, and the effect of these changes could be

material to the Company’ s consolidated operating results, financial condition and liquidity. If there are significant developments that

affect particular exposures, reinsurance arrangements or the financial condition of particular reinsurers, the Company will make

adjustments to its reserves or to the amounts recoverable from its reinsurers.

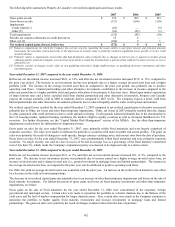

Consistent with the Company’ s long-standing reserving practices, the Company will continue to review and monitor its reserves in the

Other Operations segment regularly and, where future developments indicate, make appropriate adjustments to the reserves. For a

discussion of the Company’ s reserving practices, please see the “Critical Accounting Estimates—Property & Casualty Reserves, Net of

Reinsurance” section of Management’ s Discussion and Analysis of Financial Condition and Results of Operations.