The Hartford 2007 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-16

1. Basis of Presentation and Accounting Policies (continued)

Fair Value Under SFAS 157

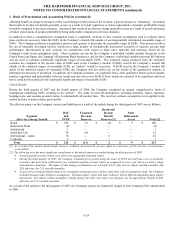

The Company’ s SFAS 157 fair value is calculated as an aggregation of the following components: Pre-SFAS 157 Fair Value, Actively-

Managed Volatility Adjustment, Credit Standing Adjustment, Market Illiquidity Premium and Behavior Risk Margin. The resulting

aggregation is reconciled or calibrated, if necessary, to market information that is, or may be, available to the Company, but may not be

observable by other market participants, including reinsurance discussions and transactions. The Company believes the aggregation of

each of these components, as necessary and as reconciled or calibrated to the market information available to the Company, results in

an amount that the Company would be required to transfer for a liability, or receive for an asset, to market participants in an active

liquid market, if one existed, for those market participants to assume the risks associated with the guaranteed minimum benefits, the

related reinsurance and customized derivatives, required to be fair valued. Each of the components described below are unobservable

in the market place and require subjectivity by the Company in determining their value.

• Actively-Managed Volatility Adjustment. This component incorporates the basis differential between the observable index

implied volatilities used to calculate the Pre-SFAS 157 component and the actively-managed funds underlying the variable annuity

product. The Actively-Managed Volatility Adjustment is calculated using historical fund and weighted index volatilities.

• Credit Standing Adjustment. This component makes an adjustment that market participants would make to reflect the risk that

GMWB obligations or the GMWB reinsurance recoverables will not be fulfilled (“nonperformance risk”). SFAS 157 explicitly

requires nonperformance risk to be reflected in fair value. The Company calculates the Credit Standing Adjustment by using

default rates provided by rating agencies, adjusted for market recoverability.

• Market Illiquidity Premium. This component makes an adjustment that market participants would require to reflect that GMWB

obligations are illiquid and have no market observable exit prices in the capital markets. The Market Illiquidity Premium was

determined using inputs that are identified in customized derivative transactions that the Company has entered into to hedge

GMWB related risks.

• Behavior Risk Margin. This component adds a margin that market participants would require for the risk that the Company’ s

assumptions about policyholder behavior used in the Pre-SFAS 157 model could differ from actual experience. The Behavior Risk

Margin is calculated by taking the difference between adverse policyholder behavior assumptions and the best estimate

assumptions used in the Pre-SFAS 157 model using the Company’ s long-term view on interest rates and volatility. The adverse

assumptions incorporate adverse dynamic lapse behavior, greater utilization of the withdrawal features, and the potential for

contract holders to shift their investment funds into more aggressive investments when allowed.

SFAS 157 Transition

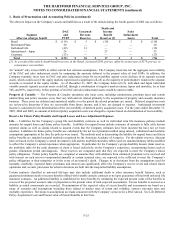

Pending the release and potential impact of adopting the proposed FASB Staff Position, “Measuring Liabilities under FASB Statement

No. 157”, if any, the Company expects the impact of adopting SFAS 157 for guaranteed benefits accounted for under SFAS 133 and

the related reinsurance, to be recorded in the first quarter of 2008, will be a reduction to net income of $200-$300, after the effects of

DAC amortization and income taxes. In addition, net realized capital gains and losses that will be recorded in 2008 and future years are

also likely to be more volatile than amounts recorded in prior years. Furthermore, adoption of SFAS 157 will result in a lower variable

annuity fee income for new business issued in 2008 as fees attributed to the embedded derivative will increase consistent with

incorporating additional risk margins and other indicia of “exit value” in the valuation of the embedded derivative. The Company is

still evaluating potential changes to its hedging program as a result of the adoption of SFAS 157. However, based on analysis to date,

the Company does not expect significant changes in any of its hedging targets. The loss deferred in accordance with EITF 02-3 of $51

for the customized derivatives used to hedge a portion of the GMWB risk will be recognized in retained earnings upon the adoption of

SFAS 157. In addition, the change in value of the customized derivatives due to the initial adoption of SFAS 157 of $35 will also be

recorded in retained earnings with subsequent changes in fair value recorded in net realized capital gains (losses) in net income. The

Company’ s adoption of SFAS 157 will not materially impact the fair values of other derivative instruments used to hedge guaranteed

minimum benefits, as those instruments are composed primarily of Level 1 and Level 2 inputs and as a result, the Company was

already using market observable transactions to value those hedging instruments. Additionally, the adoption of SFAS 157 will not have

a significant impact on the fair values of the Company’ s other financial instruments.