The Hartford 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

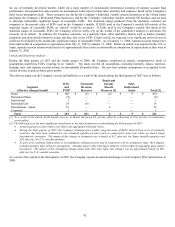

well as credit risk charges previously allocated between Life Other and each of Life’ s reporting segments. All segment data for prior

reporting periods have been adjusted to reflect the current segment reporting.

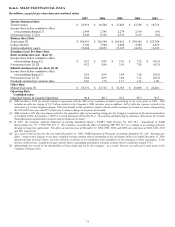

Property & Casualty is organized into five reporting segments: the underwriting segments of Personal Lines, Small Commercial, Middle

Market and Specialty Commercial (collectively “Ongoing Operations”), and the Other Operations segment. Through Property &

Casualty the Company provides a number of coverages, as well as insurance-related services, to businesses throughout the United

States, including workers’ compensation, property, automobile, liability, umbrella, specialty casualty, marine, livestock, fidelity and

surety, professional liability and director’ s and officer’ s liability coverages. Property & Casualty also provides automobile,

homeowners, and home-based business coverage to individuals throughout the United States, as well as insurance-related services to

businesses. In 2007, Property & Casualty changed its reporting segments to reflect the current manner by which its chief operating

decision maker views and manages the business. All segment data for prior reporting periods have been adjusted to reflect the current

segment reporting.

Many of the principal factors that drive the profitability of The Hartford’ s Life and Property & Casualty operations are separate and

distinct. Management considers this diversification to be a strength of The Hartford that distinguishes the Company from many of its

peers. To present its operations in a more meaningful and organized way, management has included separate overviews within the Life

and Property & Casualty sections of the MD&A. For further overview of Life’ s profitability and analysis, see page 54. For further

overview of Property & Casualty’ s profitability and analysis, see page 76.

CRITICAL ACCOUNTING ESTIMATES

The preparation of financial statements, in conformity with accounting principles generally accepted in the United States of America

(“U.S. GAAP”), requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses

during the reporting period. Actual results could differ from those estimates.

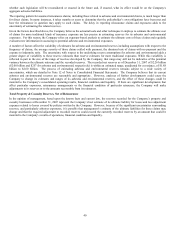

The Company has identified the following estimates as critical in that they involve a higher degree of judgment and are subject to a

significant degree of variability: property and casualty reserves, net of reinsurance; life estimated gross profits used in the valuation and

amortization of assets and liabilities associated with variable annuity and other universal life-type contracts; living benefits required to

be fair valued; valuation of investments and derivative instruments; evaluation of other-than-temporary impairments on available-for-

sale securities; pension and other postretirement benefit obligations; and contingencies relating to corporate litigation and regulatory

matters. In developing these estimates management makes subjective and complex judgments that are inherently uncertain and subject

to material change as facts and circumstances develop. Although variability is inherent in these estimates, management believes the

amounts provided are appropriate based upon the facts available upon compilation of the financial statements.

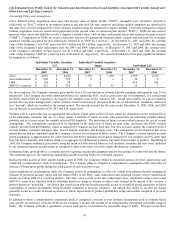

Property and Casualty Reserves, Net of Reinsurance

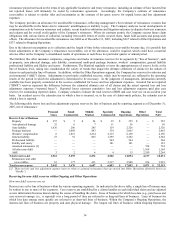

The Hartford establishes property and casualty reserves to provide for the estimated costs of paying claims under insurance policies

written by the Company. These reserves include estimates for both claims that have been reported and those that have not yet been

reported, and include estimates of all expenses associated with processing and settling these claims. Estimating the ultimate cost of

future losses and loss adjustment expenses is an uncertain and complex process. This estimation process is based largely on the

assumption that past developments are an appropriate predictor of future events and involves a variety of actuarial techniques that

analyze experience, trends and other relevant factors. Reserve estimates can change over time because of unexpected changes in the

external environment. Potential external factors include (1) changes in the inflation rate for goods and services related to covered

damages such as medical care, hospital care, auto parts, wages and home repair, (2) changes in the general economic environment that

could cause unanticipated changes in the claim frequency per unit insured, (3) changes in the litigation environment as evidenced by

changes in claimant attorney representation in the claims negotiation and settlement process, (4) changes in the judicial environment

regarding the interpretation of policy provisions relating to the determination of coverage and/or the amount of damages awarded for

certain types of damages, (5) changes in the social environment regarding the general attitude of juries in the determination of liability

and damages, (6) changes in the legislative environment regarding the definition of damages and (7) new types of injuries caused by

new types of injurious exposure: past examples include breast implants, lead paint and construction defects. Reserve estimates can also

change over time because of changes in internal company operations. Potential internal factors include (1) periodic changes in claims

handling procedures, (2) growth in new lines of business where exposure and loss development patterns are not well established or (3)

changes in the quality of risk selection in the underwriting process. In the case of assumed reinsurance, all of the above risks apply. In

addition, changes in ceding company case reserving and reporting patterns can create additional factors that need to be considered in

estimating the reserves. Due to the inherent complexity of the assumptions used, final claim settlements may vary significantly from the

present estimates, particularly when those settlements may not occur until well into the future.

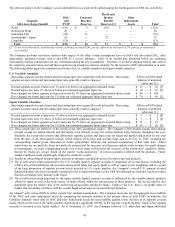

Through both facultative and treaty reinsurance agreements, the Company cedes a share of the risks it has underwritten to other

insurance companies. The Company’s net reserves for loss and loss adjustment expenses include anticipated recovery from reinsurers

on unpaid claims. The estimated amount of the anticipated recovery, or reinsurance recoverable, is net of an allowance for uncollectible

reinsurance.

Reinsurance recoverables include an estimate of the amount of gross loss and loss adjustment expense reserves that may be ceded under

the terms of the reinsurance agreements, including incurred but not reported unpaid losses. The Company calculates its ceded