The Hartford 2007 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

Competition

The personal lines automobile and homeowners businesses are highly competitive. Personal lines insurance is written by insurance

companies of varying sizes that sell products through various distribution channels, including independent agents, captive agents and

directly to the consumer. The personal lines market competes on the basis of price; product; service, including claims handling;

stability of the insurer and name recognition. In addition, carriers that distribute products mainly through agents have either increased

commissions or offered additional incentives to those agents to attract new business. To distinguish themselves in the marketplace, top

tier carriers are offering on-line and self service capabilities to agents and consumers. More agents have been using “comparative

rater” tools that allow the agent to compare premium quotes among several insurance companies. The use of comparative rater tools

has further increased price competition.

In the past two years, a number of carriers have increased their advertising in an effort to gain new business and retain profitable

business. This has been particularly true of carriers that sell directly to the consumer. Sales of personal lines insurance directly to the

consumer have been growing faster than sales through agents and now represent a little more than 20% of total industry premium.

Through information technology, carriers will likely further segment their pricing plans to expand market share in what they believe to

be the most profitable segments. Many insurers have reduced their writings of new homeowners business in catastrophe-exposed states

which has intensified competition in areas that are not subject to the same level of catastrophes, such as states in the Midwest. Carriers

with more efficient cost structures will have an advantage in competing for new business through price. Some competitors are

introducing new products at substantially reduced rate levels and the Company expects that top tier carriers will continue to capture an

increasing share of industry revenues and profits.

The Hartford is the twelfth largest personal lines insurer in the United States based on direct written premiums for the year ended

December 31, 2006 according to A.M. Best. A major competitive advantage of The Hartford is the exclusive licensing arrangement

with AARP to provide personal automobile, homeowners and home-based business insurance products to its members. This

arrangement is in effect until January 1, 2020. Management expects favorable “baby boom” demographics to increase AARP

membership during this period.

Small Commercial

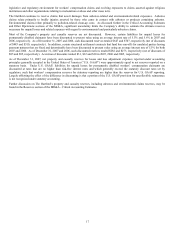

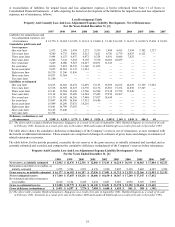

Small Commercial provides standard commercial insurance coverage to small commercial businesses primarily throughout the United

States. Small commercial businesses generally represent companies with up to $5 in annual payroll, $15 in annual revenues or $15 in

total property values. Earned premiums for 2007, 2006 and 2005 were $2.7 billion, $2.7 billion and $2.4 billion, respectively. The

segment had underwriting income of $508, $422 and $232 in 2007, 2006 and 2005, respectively.

Principal Products

Small Commercial offers workers’ compensation, property, automobile, liability and umbrella coverages under several different

products. Some of these coverages are sold together as part of a single multi-peril package policy called Spectrum. The sale of

Spectrum business owners’ package policies and workers’ compensation policies accounts for most of the written premium in the Small

Commercial segment. In the fourth quarter of 2006, The Hartford began to roll out a new “Next Generation Auto” product to Small

Commercial customers. Similar to The Hartford's Next Generation Auto product for AARP business, Next Generation Auto for Small

Commercial offers more coverage options and provides customized pricing based on the policyholder’ s individualized risk

characteristics. As of the end of 2007, Next Generation Auto had been rolled out to 44 states.

Marketing and Distribution

Small Commercial provides insurance products and services through its home office located in Hartford, Connecticut, and multiple

domestic regional office locations and insurance centers. The segment markets its products nationwide utilizing brokers and

independent agents. Brokers and independent agents are not employees of The Hartford. The Company also has relationships with

payroll service providers whereby the Company offers insurance products to customers of the payroll service providers. Agencies are

consolidating such that, in the future, a larger share of premium volume will likely be concentrated with the larger agents.

Competition

The insurance market for small commercial businesses is competitive with insurers seeking to differentiate themselves through product,

price, service and technology. The Hartford competes against a number of large, national carriers as well as regional competitors in

certain territories. Competitors include other stock companies, mutual companies and other underwriting organizations. Companies

writing business for small commercial business distribute their products through agents and other channels.

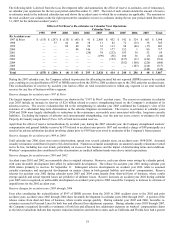

The market for small commercial business has become more competitive as favorable loss costs in the past few years have led carriers

to expand coverage while maintaining relatively flat pricing. Written premium growth rates in the small commercial market have

slowed and underwriting margins will likely decrease as loss costs have begun to rise again. A number of companies have sought to

grow their business by increasing their underwriting appetite and paying higher commissions. Competition is most intense in the

Midwest since the business is less exposed to catastrophe losses and because a number of regional carriers have a significant share of

the market.

Insurance companies have been improving their pricing sophistication and ease of doing business with the agent. Carriers are

developing more sophisticated pricing and predictive modeling tools and have invested in technology to speed up the process of

evaluating a risk and quoting on new business. While price competition has increased as companies seek to retain profitable business,