The Hartford 2007 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-25

1. Basis of Presentation and Accounting Policies (continued)

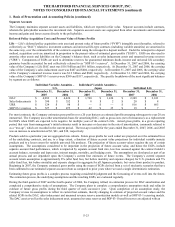

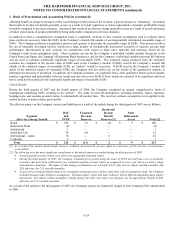

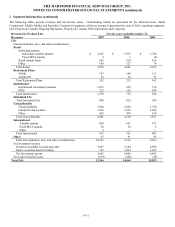

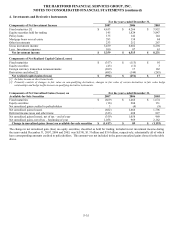

The after-tax impact on the Company’ s assets and liabilities as a result of the unlock during the fourth quarter of 2006 was as follows:

Segment

After-tax (charge) benefit

DAC

and

PVFP

Unearned

Revenue

Reserves

Death and

Income

Benefit

Reserves [1]

Sales

Inducement

Assets

Total

Retail $ (116) $ 5 $ (10) $ 3 $ (118)

Retirement Plans 20 — — — 20

Individual Life (49) 31 — — (18)

International – Japan 26 — 27 — 53

Corporate (13) — — — (13)

Total $ (132) $ 36 $ 17 $ 3 $ (76)

[1] As a result of the unlock, death benefit reserves, in the Retail, increased $294, pre-tax, offset by an increase of $279, pre-tax, in

reinsurance recoverables.

An “unlock” only revises EGPs to reflect current best estimate assumptions. The Company must also test the aggregate recoverability

of the DAC and sales inducement assets by comparing the amounts deferred to the present value of total EGPs. In addition, the

Company routinely stress tests its DAC and sales inducement assets for recoverability against severe declines in its separate account

assets, which could occur if the equity markets experienced a significant sell-off, as the majority of policyholders’ funds in the separate

accounts is invested in the equity market. As of December 31, 2007, the Company believed U.S. individual and Japan individual

variable annuity separate account assets could fall, through a combination of negative market returns, lapses and mortality, by at least

54% and 69%, respectively, before portions of its DAC and sales inducement assets would be unrecoverable.

Property & Casualty — The Property & Casualty operations also incur costs, including commissions, premium taxes and certain

underwriting and policy issuance costs, that vary with and are related primarily to the acquisition of property and casualty insurance

business. These costs are deferred and amortized ratably over the period the related premiums are earned. Deferred acquisition costs

are reviewed to determine if they are recoverable from future income, and if not, are charged to expense. Anticipated investment

income is considered in the determination of the recoverability of deferred policy acquisition costs. For the years ended December 31,

2007, 2006 and 2005, no amount of deferred policy acquisition costs was charged to expense based on determination of recoverability.

Reserve for Future Policy Benefits and Unpaid Losses and Loss Adjustment Expenses

Life — Liabilities for the Company’ s group life and disability contracts as well its individual term life insurance policies include

amounts for unpaid losses and future policy benefits. Liabilities for unpaid losses include estimates of amounts to fully settle known

reported claims as well as claims related to insured events that the Company estimates have been incurred but have not yet been

reported. Liabilities for future policy benefits are calculated by the net level premium method using interest, withdrawal and mortality

assumptions appropriate at the time the policies were issued. The methods used in determining the liability for unpaid losses and future

policy benefits are standard actuarial methods recognized by the American Academy of Actuaries. For the tabular reserves, discount

rates are based on the Company’ s earned investment yield and the morbidity/mortality tables used are standard industry tables modified

to reflect the Company’ s actual experience when appropriate. In particular, for the Company’ s group disability known claim reserves,

the morbidity table for the early durations of claim is based exclusively on the Company’ s experience, incorporating factors such as

gender, elimination period and diagnosis. These reserves are computed such that they are expected to meet the Company’ s future

policy obligations. Future policy benefits are computed at amounts that, with additions from estimated premiums to be received and

with interest on such reserves compounded annually at certain assumed rates, are expected to be sufficient to meet the Company’ s

policy obligations at their maturities or in the event of an insured’ s death. Changes in or deviations from the assumptions used for

mortality, morbidity, expected future premiums and interest can significantly affect the Company’ s reserve levels and related future

operations and, as such, provisions for adverse deviation are built into the long-tailed liability assumptions.

Certain contracts classified as universal life-type may also include additional death or other insurance benefit features, such as

guaranteed minimum death or income benefits offered with variable annuity contracts or no lapse guarantees offered with universal life

insurance contracts. An additional liability is established for these benefits by estimating the expected present value of the benefits in

excess of the projected account value in proportion to the present value of total expected assessments. Excess benefits is accrued as a

liability as actual assessments are recorded. Determination of the expected value of excess benefits and assessments are based on a

range of scenarios and assumptions including those related to market rates of return and volatility, contract surrender rates and

mortality experience. Revisions to assumptions are made consistent with the Company’ s process for a DAC unlock. See Life Deferred

Policy Acquisition Costs and Present value of Future Benefits in this Note.