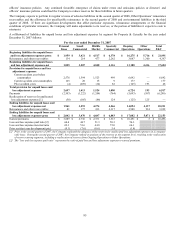

The Hartford 2007 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 90

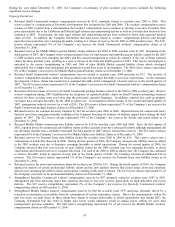

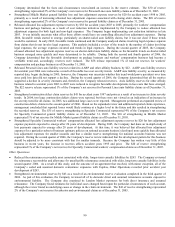

Company determined that the facts and circumstances necessitated an increase in the reserve estimate. The $30 of reserve

strengthening represented 2% of the Company’ s net reserves for Personal Lines auto liability claims as of December 31, 2005.

• Strengthened Middle Market general liability loss and loss adjustment expense reserves by $20 for accident years 1998 to 2005,

primarily as a result of increasing allocated loss adjustment expenses associated with closing older claims. The $20 of reserve

strengthening represented 2% of the Company’ s net reserves for general liability claims as of December 31, 2005.

• Released allocated loss adjustment expense reserves by $58 for accident years 2003 to 2005, primarily for workers’ compensation

business and package business, as a result of cost reduction initiatives implemented by the Company to reduce allocated loss

adjustment expenses for both legal and non-legal expenses. The Company began implementing cost reduction initiatives in late

2003. It was initially uncertain what effect those efforts would have on controlling allocated loss adjustment expenses. During

2004, favorable trends started to emerge, particularly on shorter-tailed auto liability claims, but it was not clear if these trends

would be sustained. In early 2005, favorable trends continued and the Company analyzed claims involving legal expenses separate

from claims that do not involve legal expenses. This analysis included a review of the trends in the number of claims involving

legal expenses, the average expenses incurred and trends in legal expenses. During the second quarter of 2005, the Company

released allocated loss adjustment expense reserves on shorter-tailed auto liability claims as the favorable trends on shorter-tailed

business emerged more quickly and were determined to be reliable. During both the second and fourth quarter of 2006, the

Company determined that the favorable development on package business and workers’ compensation business had become a

verifiable trend and, accordingly, reserves were reduced. The $58 release represented 1% of total net reserves for workers’

compensation and package business as of December 31, 2005.

• Released Personal Lines auto liability reserves related to AARP and other affinity business by $22. AARP auto liability reserves

for accident year 2004 were reduced as a result of favorable loss cost severity trends. AARP auto liability severity, as measured by

reported data, began declining in 2005; however, the Company was uncertain whether this trend would prove persistent over time

since paid loss data did not support a decline. During the second quarter of 2006, the Company determined that all the metrics

supported a decline in severity estimates and, therefore, the Company released reserves. Auto liability reserves for other affinity

business related to accident years 2003 to 2005 were reduced to recognize favorable developments in loss costs that have emerged.

The $22 reserve release represented 1% of the Company’ s net reserves for Personal Lines auto liability claims as of December 31,

2005.

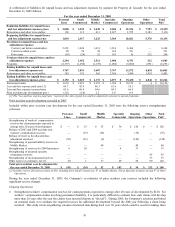

• Strengthened construction defect claim reserves by $45 for accident years 1997 and prior as a result of an increase in claim severity

trends. In 2004, two large construction defects claims were reported, but these were not viewed as an indication of an increase in

the severity trend for all claims. In 2005, two additional large cases were reported. Management performed an expanded review of

construction defects claims in the second quarter of 2006. Based on the expanded review and additional reported claim experience,

management concluded that reported losses would likely continue at a higher level in the future and this resulted in strengthening

the recorded reserves. The $35 of reserve strengthening in Specialty Commercial represented 4% of the Company’ s net reserves

for Specialty Commercial general liability claims as of December 31, 2005. The $10 of strengthening in Middle Market

represented 1% of net reserves for Middle Market general liability claims as of December 31, 2005.

• Strengthened Specialty Commercial workers’ compensation allocated loss adjustment expense reserves by $20 for loss adjustment

expense payments expected to emerge after 20 years of development. During 2005, the Company had done an in-depth study of

loss payments expected to emerge after 20 years of development. At that time, it was believed that allocated loss adjustment

expenses for a particular subset of business (primary policies on national accounts business) developed more quickly than allocated

loss adjustment expenses for smaller insureds and that a similar reserve strengthening for national accounts business was not

required. During the second quarter of 2006, the Company's reserve review indicated that the development pattern for this business

should be adjusted to be more consistent with that for smaller insureds. Because the Company has written very little of this

business in recent years, the increase in reserves affects accident years 1995 and prior. The $20 of reserve strengthening

represented 1% of the Company’ s net reserves for Specialty Commercial workers’ compensation claims as of December 31, 2005.

Other Operations

• Reduced the reinsurance recoverable asset associated with older, longer-term casualty liabilities by $243. The Company reviewed

the reinsurance recoverables and allowance for uncollectible reinsurance associated with older, long-term casualty liabilities in the

second quarter 2006. As a result of this study, and the outcome of an agreement that resolved, with minor exception, all of the

Company’ s ceded and assumed domestic reinsurance exposures with Equitas, Other Operations recorded prior accident year

development of $243.

• Strengthened environmental reserves by $43 as a result of an environmental reserve evaluation completed in the third quarter of

2006. As part of this evaluation, the Company reviewed all of its domestic direct and assumed reinsurance accounts exposed to

environmental liability. The Company also examined its London Market exposures for both direct insurance and assumed

reinsurance. The Company found estimates for individual cases changed based upon the particular circumstances of each account,

although the review found no underlying cause or change in the claim environment. The $43 of reserve strengthening represented

2% of the Company’s net reserves for asbestos and environmental claims as of December 31, 2005.