The Hartford 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

reinsurance projection based on the terms of any applicable facultative and treaty reinsurance, including an estimate of how incurred but

not reported losses will ultimately be ceded by reinsurance agreement. Accordingly, the Company’ s estimate of reinsurance

recoverables is subject to similar risks and uncertainties as the estimate of the gross reserve for unpaid losses and loss adjustment

expenses.

The Company provides an allowance for uncollectible reinsurance, reflecting management’ s best estimate of reinsurance cessions that

may be uncollectible in the future due to reinsurers’ unwillingness or inability to pay. The Company analyzes recent developments in

commutation activity between reinsurers and cedants, recent trends in arbitration and litigation outcomes in disputes between reinsurers

and cedants and the overall credit quality of the Company’ s reinsurers. Where its contracts permit, the Company secures future claim

obligations with various forms of collateral, including irrevocable letters of credit, secured trusts, funds held accounts and group-wide

offsets. The allowance for uncollectible reinsurance was $404 as of December 31, 2007, including $267 related to Other Operations and

$137 related to Ongoing Operations.

Due to the inherent uncertainties as to collection and the length of time before reinsurance recoverables become due, it is possible that

future adjustments to the Company’ s reinsurance recoverables, net of the allowance, could be required, which could have a material

adverse effect on the Company’s consolidated results of operations or cash flows in a particular quarter or annual period.

The Hartford, like other insurance companies, categorizes and tracks its insurance reserves for its segments by “line of business”, such

as property, auto physical damage, auto liability, commercial multi-peril package business, workers’ compensation, general liability

professional liability and fidelity and surety. Furthermore, The Hartford regularly reviews the appropriateness of reserve levels at the

line of business level, taking into consideration the variety of trends that impact the ultimate settlement of claims for the subsets of

claims in each particular line of business. In addition, within the Other Operations segment, the Company has reserves for asbestos and

environmental (“A&E”) claims. Adjustments to previously established reserves, which may be material, are reflected in the operating

results of the period in which the adjustment is determined to be necessary. In the judgment of management, information currently

available has been properly considered in the reserves established for losses and loss adjustment expenses. Incurred but not reported

(“IBNR”) reserves represent the difference between the estimated ultimate cost of all claims and the actual reported loss and loss

adjustment expenses (“reported losses”). Reported losses represent cumulative loss and loss adjustment expenses paid plus case

reserves for outstanding reported claims. Company actuaries evaluate the total reserves (IBNR and case reserves) on an accident year

basis. An accident year is the calendar year in which a loss is incurred, or, in the case of claims-made policies, the calendar year in

which a loss is reported.

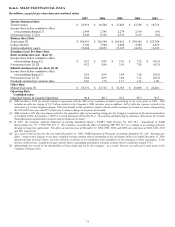

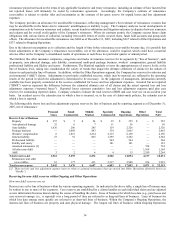

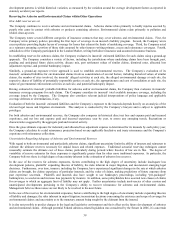

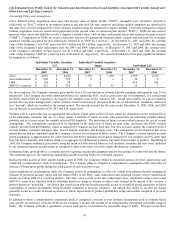

The following table shows loss and loss adjustment expense reserves by line of business and by reporting segment as of December 31,

2007, net of reinsurance:

Personal

Lines

Small

Commercial

Middle

Market

Specialty

Commercial

Ongoing

Operations

Other

Operations

Total

P&C

Reserve Line of Business

Property $ 257 $ 5 $ 54 $ 39 $ 355 $ — $ 355

Auto physical damage 32 6 7 11 56 — 56

Auto liability 1,636 286 285 119 2,326 — 2,326

Package business — 1,088 843 134 2,065 — 2,065

Workers’ compensation 6 1,815 2,214 2,115 6,150 — 6,150

General liability 27 91 865 1,399 2,382 — 2,382

Professional liability — — — 564 564 — 564

Fidelity and surety — — — 181 181 — 181

Assumed reinsurance [1] — — — — — 724 724

All other non-A&E — — — — — 1,164 1,164

A&E 3 2 6 4 15 2,249 2,264

Total reserves-net 1,961 3,293 4,274 4,566 14,094 4,137 18,231

Reinsurance and other

recoverables

81

177

413

2,317

2,988

934

3,922

Total reserves-gross $ 2,042 $ 3,470 $ 4,687 $ 6,883 $ 17,082 $ 5,071 $ 22,153

[1] These net loss and loss adjustment expense reserves relate to assumed reinsurance that was moved into Other Operations (formerly known as

“HartRe”).

Reserving for non-A&E reserves within Ongoing and Other Operations

How non-A&E reserves are set

Reserves are set by line of business within the various reporting segments. As indicated in the above table, a single line of business may

be written in one or more of the segments. Case reserves are established by a claims handler on each individual claim and are adjusted

as new information becomes known during the course of handling the claim. Lines of business for which loss data (e.g., paid losses and

case reserves) emerge (i.e., is reported) over a long period of time are referred to as long-tail lines of business. Lines of business for

which loss data emerge more quickly are referred to as short-tail lines of business. Within the Company’ s Ongoing Operations, the

shortest-tail lines of business are property and auto physical damage. The longest tail lines of business within Ongoing Operations