The Hartford 2007 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-20

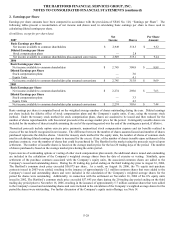

1. Basis of Presentation and Accounting Policies (continued)

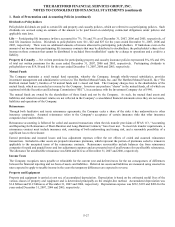

Accounting and Financial Statement Presentation of Derivative Instruments and Hedging Activities

Derivative instruments are recognized on the consolidated balance sheets at fair value. As of December 31, 2007 and 2006,

approximately 89% and 84% of derivatives, respectively, based upon notional values, were priced by valuation models, which utilize

independent market data, while the remaining 11% and 16%, respectively, were priced by broker quotations. The derivatives are

valued using mid-market level inputs that are predominantly observable in the market place. Inputs used to value derivatives include,

but are not limited to, interest swap rates, foreign currency forward and spot rates, credit spreads, interest and equity volatility and

equity index levels. The Company performs a monthly analysis on the derivative valuation which includes both quantitative and

qualitative analysis. Examples of procedures performed include, but are not limited to, review of pricing statistics and trends, back

testing recent trades, analyzing changes in the market environment and monitoring trading volume. This discussion on derivative

pricing excludes the GMWB rider and associated reinsurance contracts as well as the embedded derivatives associated with the GMAB

product, which are discussed in the preceding paragraphs under “Accounting for Guaranteed Benefits Offered with Variable Annuities”

section.

On the date the derivative contract is entered into, the Company designates the derivative as (1) a hedge of the fair value of a

recognized asset or liability (“fair-value” hedge), (2) a hedge of the variability in cash flows of a forecasted transaction or of amounts to

be received or paid related to a recognized asset or liability (“cash-flow” hedge), (3) a foreign-currency fair-value or cash-flow hedge

(“foreign-currency” hedge), (4) a hedge of a net investment in a foreign operation (“net investment” hedge) or (5) held for other

investment and/or risk management purposes, which primarily involve managing asset or liability related risks which do not qualify for

hedge accounting.

Fair-Value Hedges

Changes in the fair value of a derivative that is designated and qualifies as a fair-value hedge, along with the changes in the fair value

of the hedged asset or liability that is attributable to the hedged risk, are recorded in current period earnings with any differences

between the net change in fair value of the derivative and the hedged item representing the hedge ineffectiveness. Periodic cash flows

and accruals of income/expense (“periodic derivative net coupon settlements”) are recorded in the line item of the consolidated

statements of operations in which the cash flows of the hedged item are recorded.

Cash-Flow Hedges

Changes in the fair value of a derivative that is designated and qualifies as a cash-flow hedge are recorded in AOCI and are reclassified

into earnings when the variability of the cash flow of the hedged item impacts earnings. Gains and losses on derivative contracts that

are reclassified from AOCI to current period earnings are included in the line item in the consolidated statements of operations in which

the cash flows of the hedged item are recorded. Any hedge ineffectiveness is recorded immediately in current period earnings as net

realized capital gains and losses. Periodic derivative net coupon settlements are recorded in the line item of the consolidated statements

of operations in which the cash flows of the hedged item are recorded.

Foreign-Currency Hedges

Changes in the fair value of derivatives that are designated and qualify as foreign-currency hedges are recorded in either current period

earnings or AOCI, depending on whether the hedged transaction is a fair-value hedge or a cash-flow hedge, respectively. Any hedge

ineffectiveness is recorded immediately in current period earnings as net realized capital gains and losses. Periodic derivative net

coupon settlements are recorded in the line item of the consolidated statements of operations in which the cash flows of the hedged item

are recorded.

Net Investment in a Foreign Operation Hedges

Changes in fair value of a derivative used as a hedge of a net investment in a foreign operation, to the extent effective as a hedge, are

recorded in the foreign currency translation adjustments account within AOCI. Cumulative changes in fair value recorded in AOCI are

reclassified into earnings upon the sale or complete, or substantially complete, liquidation of the foreign entity. Any hedge

ineffectiveness is recorded immediately in current period earnings as net realized capital gains and losses. Periodic derivative net

coupon settlements are recorded in the line item of the consolidated statements of operations in which the cash flows of the hedged item

are recorded.