The Hartford 2007 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

156

long-term interest rates rise dramatically within a six to twelve month time period, certain Life businesses may be exposed to

disintermediation risk. Disintermediation risk refers to the risk that policyholders will surrender their contracts in a rising interest rate

environment requiring the Company to liquidate assets in an unrealized loss position. In conjunction with the interest rate risk

measurement and management techniques, certain of Life’ s fixed income product offerings have market value adjustment provisions at

contract surrender.

Since the Company matches, and actively manages its assets and liabilities, an interest environment with an inverted yield curve (i.e.

short-term interest rates are higher than intermediate-term or long-term interest rates) does not significantly impact the Company’ s

profits or operations. As noted above, the absolute level of interest rates is more significant than the shape of the yield curve.

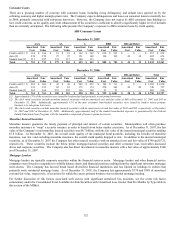

Credit Risk

The Company is exposed to credit risk within our investment portfolio and through derivative counterparties. Credit risk relates to the

uncertainty of an obligor’ s continued ability to make timely payments in accordance with the contractual terms of the instrument or

contract. The Company manages credit risk through established investment credit policies which address quality of obligors and

counterparties, credit concentration limits, diversification requirements and acceptable risk levels under expected and stressed scenarios.

These policies are regularly reviewed and approved by senior management and by the Company’ s Board of Directors.

Derivative counterparty credit risk is measured as the amount owed to the Company based upon current market conditions and potential

payment obligations between the Company and its counterparties. Credit exposures are generally quantified daily, netted by

counterparty for each legal entity of the Company and collateral is pledged to and held by, or on behalf of, the Company to the extent

the current value of derivative instruments exceeds the exposure policy thresholds which do not exceed $10. The Company also

minimizes the credit risk in derivative instruments by entering into transactions with high quality counterparties rated A2/A or better.

In addition to counterparty credit risk, the Company enters into credit derivative instruments, including credit default, index and total

return swaps, in which the Company assumes credit risk from or reduces credit risk to a single entity, referenced index, or asset pool, in

exchange for periodic payments. For further information on credit derivatives, see the “Investment Credit Risk” section.

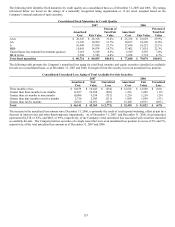

The Company is also exposed to credit spread risk related to security market price and cash flows associated with changes in credit

spreads. Credit spreads widening will reduce the fair value of the investment portfolio and will increase net investment income on new

purchases. This will also result in losses associated with credit based non-qualifying derivatives where the Company assumes credit

exposure. If issuer credit spreads increase significantly or for an extended period of time, it would likely result in higher other-than-

temporary impairments. Credit spreads tightening will reduce net investment income associated with new purchases of fixed maturities

and increase the fair value of the investment portfolio.

Equity Risk

The Company does not have significant equity risk exposure from invested assets. The Company’s primary exposure to equity risk

relates to the potential for lower earnings associated with certain of the Life’ s businesses such as variable annuities where fee income is

earned based upon the fair value of the assets under management. In addition, Life offers certain guaranteed benefits, primarily

associated with variable annuity products, which increases the Company’ s potential benefit exposure as the equity markets decline. For

a further discussion, see Life Equity Risk in this section of the MD&A.

The Company is also subject to equity risk based upon the assets that support its pension plans. The asset allocation mix is reviewed on

a periodic basis. In order to minimize risk, the pension plans maintain a listing of permissible and prohibited investments. In addition,

the pension plans have certain concentration limits and investment quality requirements imposed on permissible investment options.

For further discussion of equity risk associated with the pension plans, see the Critical Accounting Estimates section of the MD&A

under “Pension and Other Postretirement Benefit Obligations” and Note 17 of Notes to Consolidated Financial Statements.

Foreign Currency Exchange Risk

The Company’ s foreign currency exchange risk is related to non–U.S. dollar denominated investments, which primarily consist of fixed

maturity investments, the investment in and net income of the Japanese Life operation, and non-U.S. dollar denominated liability

contracts, including its GMDB, GMAB, and GMIB benefits associated with its Japanese variable annuities, and a yen denominated

individual fixed annuity product. A portion of the Company’ s foreign currency exposure is mitigated through the use of derivatives.

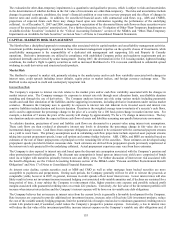

Derivative Instruments

The Company utilizes a variety of derivative instruments, including swaps, caps, floors, forwards, futures and options through one of

four Company-approved objectives: to hedge risk arising from interest rate, equity market, credit spread including issuer default, price

or currency exchange rate risk or volatility; to manage liquidity; to control transaction costs; or to enter into replication transactions.

Interest rate, volatility, dividend, credit default and index swaps involve the periodic exchange of cash flows with other parties, at

specified intervals, calculated using agreed upon rates or other financial variables and notional principal amounts. Generally, no cash or

principal payments are exchanged at the inception of the contract. Typically, at the time a swap is entered into, the cash flow streams

exchanged by the counterparties are equal in value.