The Hartford 2007 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-17

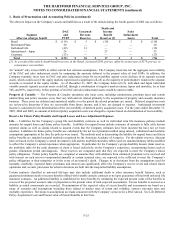

1. Basis of Presentation and Accounting Policies (continued)

Accounting Policies

Investments

The Hartford’ s investments in fixed maturities, which include bonds, redeemable preferred stock and commercial paper; and certain

equity securities, which include common and non-redeemable preferred stocks, are classified as “available-for-sale” and accordingly,

are carried at fair value with the after-tax difference from cost or amortized cost, as adjusted for the effect of deducting the life and

pension policyholders’ share of the immediate participation guaranteed contracts; and certain life and annuity deferred policy

acquisition costs and reserve adjustments, reflected in stockholders’ equity as a component of accumulated other comprehensive

income (“AOCI”). The equity investments associated with the variable annuity products offered in Japan are recorded at fair value and

are classified as “trading” with changes in fair value recorded in net investment income. Policy loans are carried at outstanding

balance, which approximates fair value. Mortgage loans on real estate are recorded at the outstanding principal balance adjusted for

amortization of premiums or discounts and net of valuation allowances, if any. Short-term investments are carried at amortized cost,

which approximates fair value. Other investments primarily consist of limited partnership and other alternative investments and

derivatives instruments. Limited partnerships are accounted for under the equity method and accordingly the Company’s share of

earnings are included in net investment income. Derivatives instruments are carried at fair value.

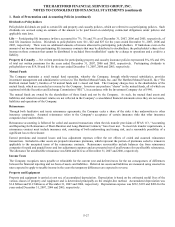

Valuation of Fixed Maturities

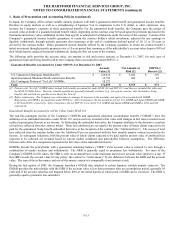

The fair value for fixed maturity securities is largely determined by one of three primary pricing methods: third party pricing service

market prices, independent broker quotations or pricing matrices. Security pricing is applied using a hierarchy or “waterfall” approach

whereby prices are first sought from third party pricing services with the remaining unpriced securities submitted to independent

brokers for prices or lastly priced via a pricing matrix. Typical inputs used by these three pricing methods include, but are not limited

to, reported trades, benchmark yields, issuer spreads, bids, offers, and/or estimated cash flows and prepayments speeds. Based on the

typical trading volumes and the lack of quoted market prices for fixed maturities, third party pricing services will normally derive the

security prices through recent reported trades for identical or similar securities making adjustments through the reporting date based

upon available market observable information as outlined above. If there are no recent reported trades, the third party pricing services

and brokers may use matrix or model processes to develop a security price where future cash flow expectations are developed based

upon collateral performance and discounted at an estimated market rate. Included in the asset-backed securities (“ABS”), collaterized

mortgage obligations (“CMOs”), and mortgage-backed securities (“MBS”) pricing are estimates of the rate of future prepayments of

principal over the remaining life of the securities. Such estimates are derived based on the characteristics of the underlying structure

and prepayment speeds previously experienced at the interest rate levels projected for the underlying collateral. Actual prepayment

experience may vary from these estimates.

Prices from third party pricing services are often unavailable for securities that are rarely traded or are traded only in privately

negotiated transactions. As a result, certain of the Company’ s securities are priced via independent broker quotations which utilize

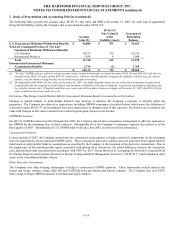

inputs that may be difficult to corroborate with observable market based data. A pricing matrix is used to price securities for which the

Company is unable to obtain either a price from a third party pricing service or an independent broker quotation. The pricing matrix

begins with current spread levels to determine the market price for the security. The credit spreads, as assigned by a nationally

recognized rating agency, incorporate the issuer’ s credit rating and a risk premium, if warranted, due to the issuer’ s industry and the

security’ s time to maturity. The issuer-specific yield adjustments, which can be positive or negative, are updated twice annually, as of

June 30 and December 31, by an independent third party source and are intended to adjust security prices for issuer-specific factors.

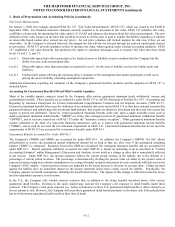

The matrix-priced securities at December 31, 2007 and 2006 primarily consisted of non-144A private placements and have an average

duration of 4.7 and 5.1 years, respectively. The Company assigns a credit rating to these securities based upon an internal analysis of

the issuer’ s financial strength.

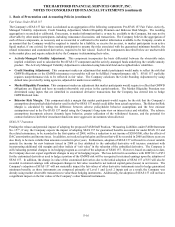

The Company performs a monthly analysis on the prices received from third parties to assess if the prices represent a reasonable

estimate of the fair value. This process involves quantitative and qualitative analysis and is overseen by investment and accounting

professionals. Examples of procedures performed include, but are not limited to, initial and on-going review of third party pricing

services methodologies, review of pricing statistics and trends, back testing recent trades, and monitoring of trading volumes. As a

result of this analysis, if the Company determines there is a more appropriate fair value based upon available market data, the price

received from the third party is adjusted accordingly.