The Hartford 2007 Annual Report Download - page 237

Download and view the complete annual report

Please find page 237 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-60

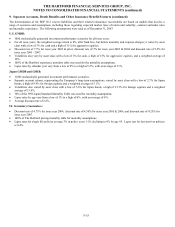

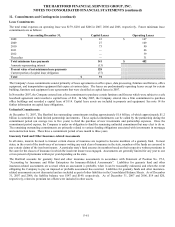

12. Commitments and Contingencies (continued)

It is also not possible to predict changes in the legal and legislative environment and their effect on the future development of asbestos

and environmental claims. Although potential Federal asbestos-related legislation was considered by the Senate in 2006, it is uncertain

whether such legislation will be reconsidered or enacted in the future and, if enacted, what its effect would be on the Company’ s

aggregate asbestos liabilities.

The reporting pattern for assumed reinsurance claims, including those related to asbestos and environmental claims, is much longer

than for direct claims. In many instances, it takes months or years to determine that the policyholder’ s own obligations have been met

and how the reinsurance in question may apply to such claims. The delay in reporting reinsurance claims and exposures adds to the

uncertainty of estimating the related reserves.

Given the factors described above, the Company believes the actuarial tools and other techniques it employs to estimate the ultimate

cost of claims for more traditional kinds of insurance exposure are less precise in estimating reserves for its asbestos and environmental

exposures. For this reason, the Company relies on exposure-based analysis to estimate the ultimate costs of these claims and regularly

evaluates new information in assessing its potential asbestos and environmental exposures.

As of December 31, 2007 and December 31, 2006, the Company reported $2.0 billion and $2.3 billion of net asbestos reserves and

$257 and $322 of net environmental reserves, respectively. The Company believes that its current asbestos and environmental reserves

are appropriate. However, analyses of future developments could cause The Hartford to change its estimates and ranges of its asbestos

and environmental reserves, and the effect of these changes could be material to the Company’s consolidated operating results,

financial condition, and liquidity.

Regulatory Developments

On July 23, 2007, the Company entered into an agreement (the “Agreement”) with the New York Attorney General’ s Office, the

Connecticut Attorney General’ s Office, and the Illinois Attorney General’s Office to resolve (i) the previously disclosed investigations

by these Attorneys General regarding the Company’ s compensation agreements with brokers, alleged participation in arrangements to

submit inflated bids, compensation arrangements in connection with the administration of workers compensation plans and reporting of

workers compensation premium, participation in finite reinsurance transactions, sale of fixed and individual annuities used to fund

structured settlements, and marketing and sale of individual and group variable annuity products and (ii) the previously disclosed

investigation by the New York Attorney General’ s Office of aspects of the Company’s variable annuity and mutual fund operations

related to market timing. In light of the Agreement, the Staff of the Securities and Exchange Commission has informed the Company

that it has determined to conclude its previously disclosed investigation into market timing without recommending any enforcement

action.

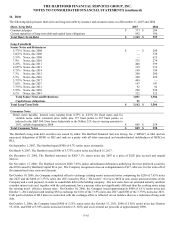

Under the terms of the Agreement, the Company paid $115, of which $84 represents restitution for market timing, $5 represents

restitution for issues relating to the compensation of brokers, and $26 is a civil penalty. After taking into account previously

established reserves, the Company incurred a charge of $30, after-tax, in the second quarter of 2007 for the costs associated with the

settlement. Also pursuant to the terms of the Agreement, the Company agreed to certain conduct remedies, including, among other

things, a ban on paying contingent compensation with respect to any line of property and casualty insurance in which insurers that do

not pay contingent compensation, together with those that have entered into similar settlement agreements, collectively represent at

least 65% of the market.

The Company has announced the implementation of a new program for 2008 to compensate property and casualty agents and brokers

for their performance in personal and standard commercial lines of insurance. Under this new supplemental commission program, the

Company will pay a fixed commission that is based, among other things, on the agent’ s or broker’ s past performance. At this time, it is

not possible to predict with certainty the effect, if any, of this new commission program on the Company’ s sales of insurance in these

lines.

On May 22, 2007, the Company received a subpoena from the Connecticut Attorney General’ s Office requesting information relating

to the Company’ s participation in certain reinsurance facilities. The Company exited the reinsurance market in 2003. The Company is

cooperating fully with the Connecticut Attorney General’ s Office in this matter.