The Hartford 2007 Annual Report Download - page 246

Download and view the complete annual report

Please find page 246 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-69

15. Stockholders’ Equity (continued)

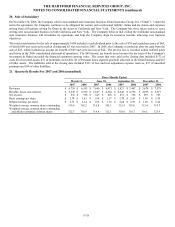

Statutory Results

The domestic insurance subsidiaries of HFSG prepare their statutory financial statements in conformity with statutory accounting

practices prescribed or permitted by the applicable state insurance department which vary materially from U.S. GAAP. Prescribed

statutory accounting practices include publications of the National Association of Insurance Commissioners (“NAIC”), as well as state

laws, regulations and general administrative rules. The differences between statutory financial statements and financial statements

prepared in accordance with U.S. GAAP vary between domestic and foreign jurisdictions. The principal differences are that statutory

financial statements do not reflect deferred policy acquisition costs and limit deferred income taxes, life benefit reserves predominately

use interest rate and mortality assumptions prescribed by the NAIC, bonds are generally carried at amortized cost and reinsurance

assets and liabilities are presented net of reinsurance. The Company’ s use of permitted statutory accounting practices does not have a

significant impact on statutory surplus.

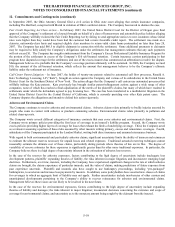

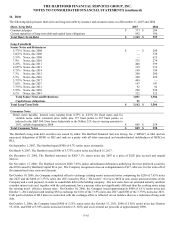

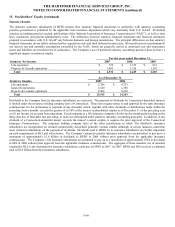

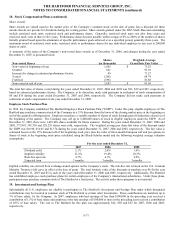

For the years ended December 31,

Statutory Net Income 2007 2006 2005

Life operations $729 $ 1,123 $821

Property & Casualty operations 1,803 1,326 1,382

Total $2,532 $ 2,449 $2,203

As of December 31,

Statutory Surplus 2007 2006

Life operations $ 5,786 $4,733

Japan life operations 1,620 1,380

Property & Casualty operations 8,509 8,230

Total $ 15,915 $14,343

Dividends to the Company from its insurance subsidiaries are restricted. The payment of dividends by Connecticut-domiciled insurers

is limited under the insurance holding company laws of Connecticut. These laws require notice to and approval by the state insurance

commissioner for the declaration or payment of any dividend, which, together with other dividends or distributions made within the

preceding twelve months, exceeds the greater of (i) 10% of the insurer’ s policyholder surplus as of December 31 of the preceding year

or (ii) net income (or net gain from operations, if such company is a life insurance company) for the twelve-month period ending on the

thirty-first day of December last preceding, in each case determined under statutory insurance accounting principles. In addition, if any

dividend of a Connecticut-domiciled insurer exceeds the insurer’ s earned surplus, it requires the prior approval of the Connecticut

Insurance Commissioner. The insurance holding company laws of the other jurisdictions in which The Hartford’ s insurance

subsidiaries are incorporated (or deemed commercially domiciled) generally contain similar (although in certain instances somewhat

more restrictive) limitations on the payment of dividends. Dividends paid to HFSG by its insurance subsidiaries are further dependent

on cash requirements of HLI and other factors. The Company’ s property-casualty insurance subsidiaries are permitted to pay up to a

maximum of approximately $1.6 billion in dividends to HFSG in 2008 without prior approval from the applicable insurance

commissioner. The Company’ s life insurance subsidiaries are permitted to pay up to a maximum of approximately $784 in dividends

to HLI in 2008 without prior approval from the applicable insurance commissioner. The aggregate of these amounts, net of amounts

required by HLI, is the maximum the insurance subsidiaries could pay to HFSG in 2007. In 2007, HFSG and HLI received a combined

total of $2.0 billion from their insurance subsidiaries.