The Hartford 2007 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

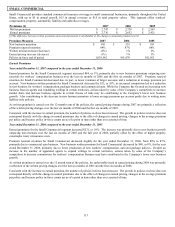

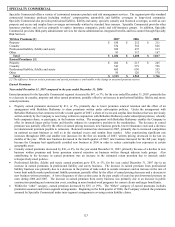

SMALL COMMERCIAL

Small Commercial provides standard commercial insurance coverage to small commercial businesses, primarily throughout the United

States, with up to $5 in annual payroll, $15 in annual revenues or $15 in total property values. This segment offers workers’

compensation, property, automobile, liability and umbrella coverages.

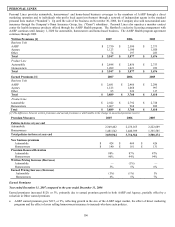

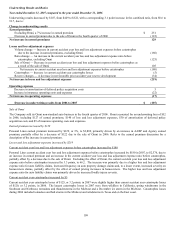

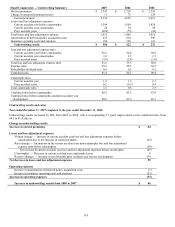

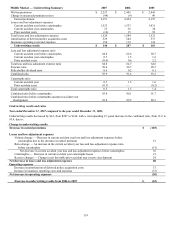

Premiums [1] 2007 2006 2005

Written premiums $ 2,747 $ 2,728 $ 2,545

Earned premiums $ 2,736 $ 2,652 $ 2,421

[1]The difference between written premiums and earned premiums is attributable to the change in unearned premium reserve.

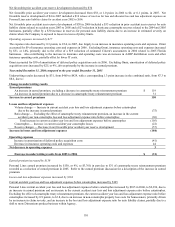

Premium Measures 2007 2006 2005

New business premium $481 $533 $581

Premium renewal retention 84% 87% 88%

Written pricing increase (decrease) (2%) 1% 2%

Earned pricing increase (decrease) (1%) 1% 3%

Policies in-force end of period 1,038,542 991,979 921,952

Earned Premiums

Year ended December 31, 2007 compared to the year ended December 31, 2006

Earned premiums for the Small Commercial segment increased $84, or 3%, primarily due to new business premiums outpacing non-

renewals for workers’ compensation business over the last six months of 2006 and the first six months of 2007. Premium renewal

retention for Small Commercial decreased due, in part, to lower retention of larger accounts and a reduction in average premium per

account. New business written premium for Small Commercial decreased by $52, or 10%, as increased competition led to a reduction

in new business for workers’ compensation, package business and commercial auto. While the Company has focused on increasing new

business from its agents and expanding writings in certain territories, actions taken by some of the Company’ s competitors to increase

market share and increase business appetite in certain classes of risks may be contributing to the Company’ s lower new business

growth. Also contributing to the decrease in new business premium is lower average premium per account partly due to writing more

liability-only policies.

As written premium is earned over the 12-month term of the policies, the earned pricing changes during 2007 are primarily a reflection

of the written pricing changes over the last six months of 2006 and the first six months of 2007.

Consistent with the increase in earned premium, the number of policies in-force has increased. The growth in policies in-force does not

correspond directly with the change in earned premiums due to the effect of changes in earned pricing, changes in the average premium

per policy and because policy in-force counts are as of a point in time rather than over a period of time.

Year ended December 31, 2006 compared to the year ended December 31, 2005

Earned premiums for the Small Commercial segment increased $231, or 10%. The increase was primarily due to new business growth

outpacing non-renewals over the last six months of 2005 and the full year of 2006, partially offset by the effect of higher property

catastrophe treaty reinsurance costs.

Premium renewal retention for Small Commercial decreased slightly for the year ended December 31, 2006, from 88% to 87%,

primarily due to commercial auto business. New business written premium for Small Commercial decreased by $48, or 8%, for the year

ended December 31, 2006, primarily due to lower production of new workers’ compensation, auto and package policies. Despite an

increase in the number of appointed agents to expand writings in certain territories, actions taken by some of the Company’ s

competitors to increase commissions for workers’ compensation business may have contributed to the Company’ s lower new business

growth.

As written premium is earned over the 12 month term of the policies, the unfavorable trend in earned pricing during 2006 was primarily

a reflection of the written pricing changes over the last six months of 2005 and the first six months of 2006.

Consistent with the increase in earned premium, the number of policies in-force has increased. The growth in policies in-force does not

correspond directly with the change in earned premiums due to the effect of changes in earned pricing, changes in the average premium

per policy and because policy in-force counts are as of a point in time rather than over a period of time.