The Hartford 2007 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 112

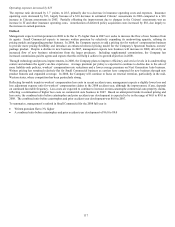

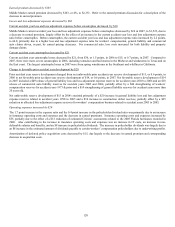

Outlook

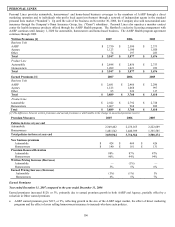

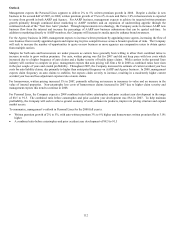

Management expects the Personal Lines segment to deliver 2% to 5% written premium growth in 2008. Despite a decline in new

business in the second half of 2007, in 2008, written premium growth of 3% to 6% in auto and flat to 3.0% in homeowners is expected

to come from growth in both AARP and Agency. For AARP business, management expects to achieve its targeted written premium

growth primarily through continued direct marketing to AARP members and an expansion of underwriting appetite through the

continued roll-out of the “Next Gen Auto” product. Through improvements in technology, the Company seeks to increase AARP new

business flow from the internet and increase the percentage of AARP new business submissions that can be quoted real-time. In

addition to marketing directly to AARP members, the Company will increase its media spend to enhance brand awareness.

For the Agency business in 2008, management expects to increase written premium by appointing more agents, increasing the flow of

new business from recently appointed agents and improving its price competitiveness across a broader spectrum of risks. The Company

will seek to increase the number of opportunities to quote on new business as more agencies use comparative raters to obtain quotes

from multiple carriers.

Margins for both auto and homeowners are under pressure as carriers have generally been willing to allow their combined ratios to

increase in order to grow written premium. For auto, written pricing was flat for 2007 and did not keep pace with loss costs which

increased due to a higher frequency of auto claims and a higher severity of bodily injury claims. While carriers in the personal lines

industry will continue to compete on price, management expects that auto pricing will firm a bit in 2008 as combined ratios have risen

in the past couple of years and eroded profitability. Throughout 2007, the Company increased its estimate of current accident year loss

costs for auto liability claims, due primarily to higher than anticipated frequency on AARP and Agency business. In 2008, management

expects claim frequency on auto claims to stabilize, but expects claim severity to increase, resulting in a moderately higher current

accident year loss and loss adjustment expense ratio on auto claims.

For homeowners, written pricing increased 5% in 2007, primarily reflecting an increase in insurance to value and an increase in the

value of insured properties. Non-catastrophe loss costs of homeowners claims increased in 2007 due to higher claim severity and

management expects this trend to continue in 2008.

For Personal Lines, the Company expects a 2008 combined ratio before catastrophes and prior accident year development in the range

of 88.5 to 91.5. The combined ratio before catastrophes and prior accident year development was 88.6 in 2007. To help maintain

profitability, the Company will seek to achieve greater economy of scale, enhance its products, improve its pricing structure and expand

market access.

To summarize, management’ s outlook in Personal Lines for the 2008 full year is:

• Written premium growth of 2% to 5%, with auto written premium 3% to 6% higher and homeowners written premium flat to 3.0%

higher

• A combined ratio before catastrophes and prior accident year development of 88.5 to 91.5