The Hartford 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 82

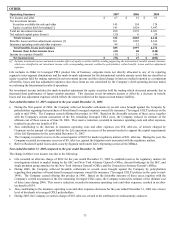

Adjustments to previously established loss and loss expense reserves, if any, are reflected in underwriting results in the period in which

the adjustment is determined to be necessary.

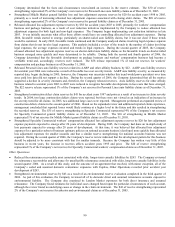

The investment return, or yield, on Property & Casualty’s invested assets is an important element of the Company’s earnings since

insurance products are priced with the assumption that premiums received can be invested for a period of time before loss and loss

adjustment expenses are paid. For longer tail lines, such as workers’ compensation and general liability, claims are paid over several

years and, therefore, the premiums received for these lines of business can generate significant investment income. Due to the emphasis

on preservation of capital and the need to maintain sufficient liquidity to satisfy claim obligations, the vast majority of Property &

Casualty’ s invested assets have been held in fixed maturities, including, among other asset classes, corporate bonds, municipal bonds,

government debt, short-term debt, mortgage-backed securities and asset-backed securities.

Through its Other Operations segment, Property & Casualty is responsible for managing operations of The Hartford that have

discontinued writing new or renewal business as well as managing the claims related to asbestos and environmental exposures.

Definitions of key ratios and measures

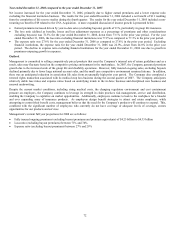

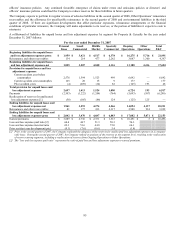

Written and earned premiums

Written premium is a statutory accounting financial measure which represents the amount of premiums charged for policies issued, net

of reinsurance, during a fiscal period. Earned premium is a U.S. GAAP and statutory measure. Premiums are considered earned and are

included in the financial results on a pro rata basis over the policy period. Management believes that written premium is a performance

measure that is useful to investors as it reflects current trends in the Company’ s sale of property and casualty insurance products.

Written and earned premium are recorded net of ceded reinsurance premium.

Reinstatement premiums

Reinstatement premium represents additional ceded premium paid for the reinstatement of the amount of reinsurance coverage that was

reduced as a result of a reinsurance loss payment.

Policies in-force

Policies in-force represent the number of policies with coverage in effect as of the end of the period. The number of policies in-force is

a growth measure used for Personal Lines, Small Commercial and Middle Market and is affected by both new business growth and

premium renewal retention.

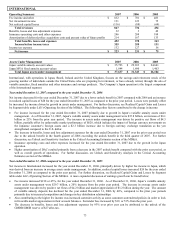

Written pricing increase (decrease)

Written pricing increase (decrease) over the comparable period of the prior year includes the impact of rate filings, the impact of

changes in the value of the rating bases and individual risk pricing decisions. A number of factors impact written pricing increases

(decreases) including expected loss costs as projected by the Company’ s pricing actuaries, rate filings approved by state regulators, risk

selection decisions made by the Company’ s underwriters and marketplace competition. Written pricing changes reflect the property and

casualty insurance market cycle. Prices tend to increase for a particular line of business when insurance carriers have incurred

significant losses in that line of business in the recent past or the industry as a whole commits less of its capital to writing exposures in

that line of business. Prices tend to decrease when recent loss experience has been favorable or when competition among insurance

carriers increases.

Earned pricing increase (decrease)

Written premiums are earned over the policy term, which is six months for certain Personal Lines auto business and 12 months for

substantially all of the remainder of the Company’ s business. Because the Company earns premiums over the 6 to 12 month term of the

policies, earned pricing increases (decreases) lag written pricing increases (decreases) by 6 to 12 months.

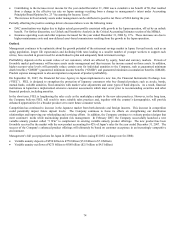

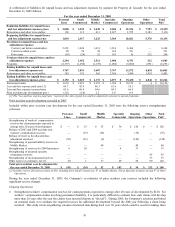

Premium renewal retention

Premium renewal retention represents the ratio of net written premium in the current period that is not derived from new business

divided by total net written premium of the prior period. Accordingly, premium renewal retention includes the effect of written pricing

changes on renewed business. In addition, the renewal retention rate is affected by a number of other factors, including the percentage

of renewal policy quotes accepted and decisions by the Company to non-renew policies because of specific policy underwriting

concerns or because of a decision to reduce premium writings in certain lines of business or states. Premium renewal retention is also

affected by advertising and rate actions taken by competitors.

Loss and loss adjustment expense ratio

The loss and loss adjustment expense ratio is a measure of the cost of claims incurred in the calendar year divided by earned premium

and includes losses incurred for both the current and prior accident years. Among other factors, the loss and loss adjustment expense

ratio needed for the Company to achieve its targeted return on equity fluctuates from year to year based on changes in the expected

investment yield over the claim settlement period, the timing of expected claim settlements and the targeted returns set by management

based on the competitive environment.