The Hartford 2007 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-27

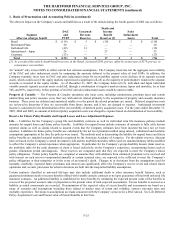

1. Basis of Presentation and Accounting Policies (continued)

Dividends to Policyholders

Policyholder dividends are paid to certain life and property and casualty policies, which are referred to as participating policies. Such

dividends are accrued using an estimate of the amount to be paid based on underlying contractual obligations under policies and

applicable state laws.

Life — Participating life insurance in-force accounted for 7%, 3% and 3% as of December 31, 2007, 2006 and 2005, respectively, of

total life insurance in-force. Dividends to policyholders were $11, $22 and $37 for the years ended December 31, 2007, 2006 and

2005, respectively. There were no additional amounts of income allocated to participating policyholders. If limitations exist on the

amount of net income from participating life insurance contracts that may be distributed to stockholders, the policyholder’ s share of net

income on those contracts that cannot be distributed is excluded from stockholders’ equity by a charge to operations and a credit to a

liability.

Property & Casualty — Net written premiums for participating property and casualty insurance policies represented 8%, 8% and 10%

of total net written premiums for the years ended December 31, 2007, 2006 and 2005, respectively. Participating dividends to

policyholders were $19, $6 and $11 for the years ended December 31, 2007, 2006 and 2005, respectively.

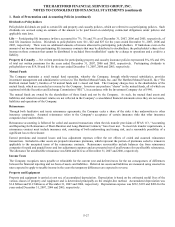

Mutual Funds

The Company maintains a retail mutual fund operation, whereby the Company, through wholly-owned subsidiaries, provides

investment management and administrative services to The Hartford Mutual Funds, Inc. and The Hartford Mutual Funds II, Inc (“The

Hartford mutual funds”), families of 54 mutual funds and 1 closed end fund. The Company charges fees to the shareholders of the

mutual funds, which are recorded as revenue by the Company. Investors can purchase “shares” in the mutual funds, all of which are

registered with the Securities and Exchange Commission (“SEC”), in accordance with the Investment Company Act of 1940.

The mutual funds are owned by the shareholders of those funds and not by the Company. As such, the mutual fund assets and

liabilities and related investment returns are not reflected in the Company’ s consolidated financial statements since they are not assets,

liabilities and operations of the Company.

Reinsurance

Through both facultative and treaty reinsurance agreements, the Company cedes a share of the risks it has underwritten to other

insurance companies. Assumed reinsurance refers to the Company’ s acceptance of certain insurance risks that other insurance

companies have underwritten.

Reinsurance accounting is followed for ceded and assumed transactions when the risk transfer provisions of SFAS 113, “Accounting

and Reporting for Reinsurance of Short-Duration and Long-Duration Contracts,” have been met. To meet risk transfer requirements, a

reinsurance contract must include insurance risk, consisting of both underwriting and timing risk, and a reasonable possibility of a

significant loss to the reinsurer.

Earned premiums and incurred losses and loss adjustment expenses reflect the net effects of ceded and assumed reinsurance

transactions. Included in other assets are prepaid reinsurance premiums, which represent the portion of premiums ceded to reinsurers

applicable to the unexpired terms of the reinsurance contracts. Reinsurance recoverables include balances due from reinsurance

companies for paid and unpaid losses and loss adjustment expenses and are presented net of an allowance for uncollectible reinsurance.

The allowance for uncollectible reinsurance was $404 and $412 as of December 31, 2007 and 2006, respectively.

Income Taxes

The Company recognizes taxes payable or refundable for the current year and deferred taxes for the tax consequences of differences

between the financial reporting and tax basis of assets and liabilities. Deferred tax assets and liabilities are measured using enacted tax

rates expected to apply to taxable income in the years the temporary differences are expected to reverse.

Property and Equipment

Property and equipment is carried at cost net, of accumulated depreciation. Depreciation is based on the estimated useful lives of the

various classes of property and equipment and is determined principally on the straight-line method. Accumulated depreciation was

$1.4 billion and $1.2 billion as of December 31, 2007 and 2006, respectively. Depreciation expense was $232, $193 and $206 for the

years ended December 31, 2007, 2006 and 2005, respectively.