The Hartford 2007 Annual Report Download - page 215

Download and view the complete annual report

Please find page 215 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-38

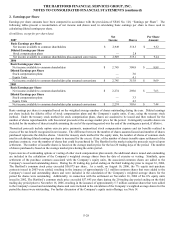

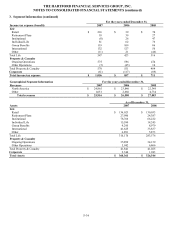

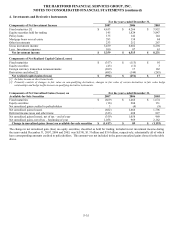

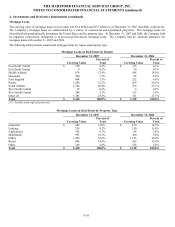

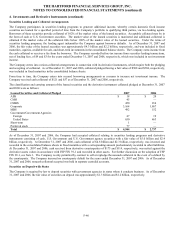

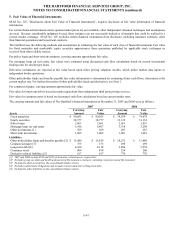

4. Investments and Derivative Instruments (continued)

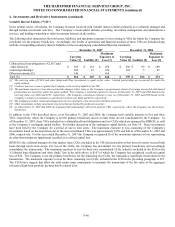

As of December 31, 2007, fixed maturities, comprised of approximately 4,330 securities, accounted for approximately 92% of the

Company’ s total unrealized loss amount. The remaining 8% primarily consisted of non-redeemable preferred stock in the financial

services sector, the majority of which were in an unrealized loss position for less than six months. Other-than-temporary impairments

for certain ABS and CMBS are recognized if the fair value of the security, as determined by external pricing sources, is less than its

cost or amortized cost and there has been a decrease in the present value of the expected cash flows since the last reporting period.

Based on management’ s best estimate of future cash flows, there were no such ABS and CMBS in an unrealized loss position as of

December 31, 2007 that were deemed to be other-than-temporarily impaired.

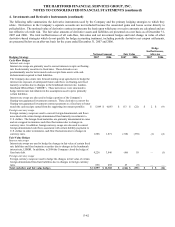

Fixed maturity securities in an unrealized loss position for less than twelve months were comprised of approximately 2,770 securities.

The majority of these securities are investment grade fixed maturities depressed due to changes in credit spreads from the date of

purchase. As of December 31, 2007, 83% were securities priced at or greater than 90% of amortized cost. The remaining securities

were primarily composed of CMBS, ABS, and corporate securities in the financial services sector, of which 76% had a credit rating of

A or above as of December 31, 2007. The severity of the depression resulted from credit spread widening due to tightened lending

conditions and the market’ s flight to quality securities.

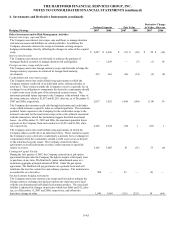

Fixed maturity securities depressed for twelve months or more as of December 31, 2007 were comprised of approximately 1,730

securities, with the majority of the unrealized loss amount relating to CMBS and corporate fixed maturities. A description of the events

contributing to the security types’ unrealized loss position and the factors considered in determining that recording an other-than-

temporary impairment was not warranted are outlined below.

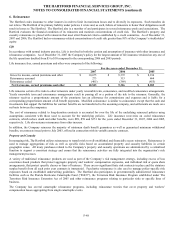

CMBS — The CMBS in an unrealized loss position for twelve months or more as of December 31, 2007 were primarily the result of

credit spreads widening from the security purchase date. The recent price depression resulted from widening credit spreads primarily

due to tightened lending conditions and the market’ s flight to quality securities. However, commercial real estate fundamentals still

appear strong with delinquencies, defaults and losses holding to relatively low levels. Substantially all of these securities are

investment grade securities with an average price of 96% of amortized cost as of December 31, 2007. Future changes in fair value of

these securities are primarily dependent on sector fundamentals, credit spread movements, and changes in interest rates.

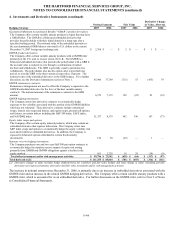

Corporate — Corporate securities in an unrealized loss position for twelve months or more as of December 31, 2007 were primarily

the result of credit spreads widening from the security purchase date primarily due to tightened lending conditions and the market’ s

flight to quality securities. The majority of these securities are investment grade securities with an average price of 95% of amortized

cost. Future changes in fair value of these securities are primarily dependent on the extent of future issuer credit losses, return of

liquidity, and changes in general market conditions, including interest rates and credit spread movements.