The Hartford 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 72

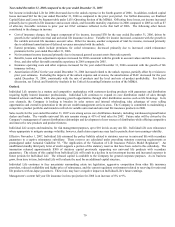

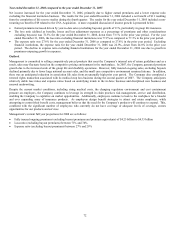

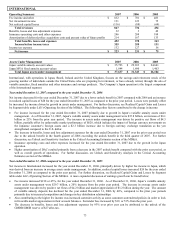

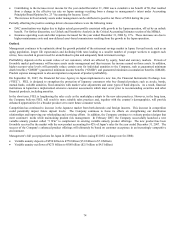

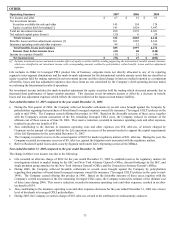

Year ended December 31, 2006 compared to the year ended December 31, 2005

Net income increased for the year ended December 31, 2006, primarily due to higher earned premiums and a lower expense ratio

excluding the financial institution business. The results for the year ended December 31, 2006 included a net benefit of $11 resulting

from the completion of life reserve studies during the fourth quarter. The results for the year ended December 31, 2005 included a non-

recurring tax benefit of $9 related to the CNA Acquisition. A more expanded discussion of income growth is presented below:

• Earned premiums increased driven by year-to-date sales (excluding buyouts) growth of 11%, particularly in group life insurance.

• The loss ratio (defined as benefits, losses and loss adjustment expenses as a percentage of premiums and other considerations

excluding buyouts) was 72.3% for the year ended December 31, 2006, down from 73.1% in the prior year period. For the year

ended December 31, 2006, the loss ratio excluding financial institutions was 77.2% as compared to 77.3% in the prior year period.

• The expense ratio was 27.6% for the year ended December 31, 2006 as compared to 27.8% in the prior year period. Excluding

financial institutions, the expense ratio for the year ended December 31, 2006 was 22.9%, down from 24.0% in the prior year

period. The decline in expense ratio excluding financial institutions for the year ended December 31, 2006 was due to growth in

premiums outpacing growth in expenses.

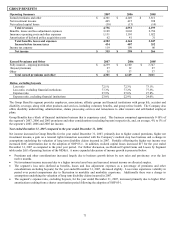

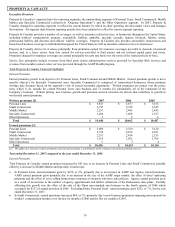

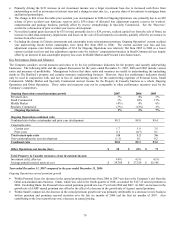

Outlook

Management is committed to selling competitively priced products that meet the Company’ s internal rate of return guidelines and as a

result, sales may fluctuate based on the competitive pricing environment in the marketplace. In 2007, the Company generated premium

growth due to the increased scale of the group life and disability operations. However, fully insured on-going sales, excluding buyouts

declined primarily due to fewer large national account sales, and the small case competitive environment remained intense. In addition,

there was an anticipated reduction in association life sales from an unusually high prior year period. The Company also completed a

renewal rights transaction associated with its medical stop loss business during the second quarter of 2007. The Company anticipates

relatively stable loss ratios and expense ratios based on underlying trends in the in-force business and disciplined new business and

renewal underwriting.

Despite the current market conditions, including rising medical costs, the changing regulatory environment and cost containment

pressure on employers, the Company continues to leverage its strength in claim practices risk management, service and distribution,

enabling the Company to capitalize on market opportunities. Additionally, employees continue to look to the workplace for a broader

and ever expanding array of insurance products. As employers design benefit strategies to attract and retain employees, while

attempting to control their benefit costs, management believes that the need for the Company’ s products will continue to expand. This,

combined with the significant number of employees who currently do not have coverage or adequate levels of coverage, creates

opportunities for our products and services.

Management’ s current full year projections for 2008 are as follows:

• Fully insured ongoing premiums (excluding buyout premiums and premium equivalents) of $4.25 billion to $4.35 billion

• Loss ratio (excluding buyout premiums) between 71% and 74%

• Expense ratio (excluding buyout premiums) between 27% and 29%