The Hartford 2007 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 107

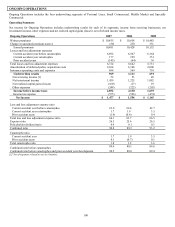

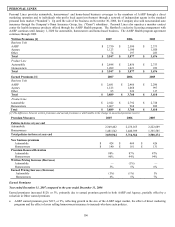

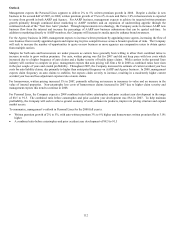

• Agency earned premium grew $55, or 5%, as a result of an increase in the number of agency appointments and further refinement

of the Dimensions class plans first introduced in 2003. Dimensions allows Personal Lines to write a broader class of risks. The

plan, which is available through the Company’ s network of independent agents, was enhanced beginning in the third quarter of

2006 as “Dimensions with Auto Packages” and the enhanced plan is now offered in 34 states with four distinct package offerings as

of December 31, 2007.

• Other earned premium decreased by $141, primarily due to the sale of Omni on November 30, 2006 and a strategic decision to

reduce other affinity business. Omni accounted for earned premiums of $127 for the year ended December 31, 2006.

The earned premium growth in AARP and Agency was primarily due to auto and homeowners new business written premium outpacing

non-renewals over the last six months of 2006 and the first six months of 2007.

Auto earned premium grew slightly, by $30, or 1%, for the year ended December 31, 2007, primarily due to new business outpacing

non-renewals in AARP and Agency over the last six months of 2006 and the first six months of 2007, partially offset by the effect of the

sale of Omni. Before considering the effect of the sale of Omni, auto earned premium grew $152, or 6%, for the year ended December

31, 2007. Homeowners’ earned premium grew $99, or 10%, primarily due to earned pricing increases and due to new business

outpacing non-renewals in AARP business over the last six months of 2006 and the first six months of 2007 and new business outpacing

non-renewals in Agency over the last three months of 2006 and the first six months of 2007. Consistent with the growth in earned

premium, the number of policies in-force has increased in auto and homeowners. The growth in policies in-force does not correspond

directly with the growth in earned premiums due to the effect of earned pricing changes and because policy in-force counts are as of a

point in time rather than over a period of time.

Omni accounted for $25 of new business written premium during the 2006 calendar year. Excluding Omni business, auto new business

written premium decreased by $20, or 5%, to $424, for the year ended December 31, 2007. The decrease in auto new business premium

was due to a decrease in AARP and Agency auto new business as a result of increased competition. Homeowners’ new business written

premium decreased by $21, or 13%, primarily due to a decrease in Agency new business, partially offset by an increase in AARP new

business.

Premium renewal retention for auto increased from 87% to 88% for the year ended December 31, 2007, primarily due to the sale of the

Omni non-standard auto business during 2006, which had a lower premium renewal retention than the Company’ s standard auto

business. Excluding Omni business, premium renewal retention decreased slightly, from 89% to 88%, as renewal retention remained

flat in AARP and decreased in Agency. Premium renewal retention for homeowners increased from 94% to 96% for the year ended

December 31, 2007, primarily due to an increase in retention of Agency business.

The trend in earned pricing during 2007 was primarily a reflection of the written pricing changes in the last six months of 2006 and the

first six months of 2007. Written pricing remained flat in auto primarily due to an extended period of favorable results factoring into the

rate setting process. Homeowners’ written pricing continued to increase due largely to increases in insurance to value and an increase in

the value of insured properties. Insurance to value is the ratio of the amount of insurance purchased to the value of the insured property.

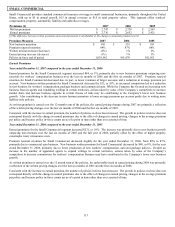

Year ended December 31, 2006 compared to the year ended December 31, 2005

Earned premiums for the Personal Lines segment increased $150, or 4%, due primarily to earned premium growth in both AARP and

Agency business, partially offset by higher property catastrophe treaty reinsurance costs and a reduction in other earned premium. Also

contributing to the increase in earned premiums was $31 of catastrophe treaty reinstatement premium payable to reinsurers recorded as a

reduction of earned premium in 2005. Other earned premium consists of premium earned on non-standard auto business written by

Omni and on business written through affinity partners other than AARP.

• AARP earned premium grew $170, or 7%, reflecting growth in the size of the AARP target market and the effect of direct

marketing programs to increase premium writings of both auto and homeowners.

• Agency earned premium grew $71, or 7%, primarily as a result of an increase in the number of agency appointments and further

refinement of the Dimensions class plans first introduced in 2003. Dimensions, which had been rolled out to 42 states for auto and

39 states for homeowners as of December 31, 2006, enables agents to generate a customized price for each policyholder,

independent of the risks and rates of other members of the same household. The plan, which is available through the company’s

network of independent agents, was enhanced beginning in the third quarter of 2006 as “Dimensions with Auto Packages” and the

enhanced plan was offered in 29 states with four distinct package offerings as of the year ended December 31, 2006.

• Other earned premium decreased by $91, or 29%, because of a strategic decision to reduce other affinity business and limit non-

standard writings to fewer geographic areas. On November 30, 2006, the Company sold Omni and exited the non-standard auto

business. Refer to Note 20 of the Notes to Consolidated Financial Statements for further discussion.

The earned premium growth in AARP and Agency was primarily due to new business written premium outpacing non-renewals over the

last six months of 2005 and the full year of 2006 and to earned pricing increases in homeowners for both AARP and Agency.

Auto earned premium grew $64, or 2%, primarily from new business outpacing non-renewals in both AARP and Agency over the last

six months of 2005 and the year ended December 31, 2006, partially offset by a decline in other auto business. Before considering the

decline in other auto business, auto earned premium grew $154, or 6%. Homeowners’ earned premium grew $86, or 10%, primarily due

to new business outpacing non-renewals in both AARP and Agency business over the last six months of 2005 and the year ended

December 31, 2006 and due to earned pricing increases. Consistent with the growth in earned premium, the number of policies in-force