The Hartford 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

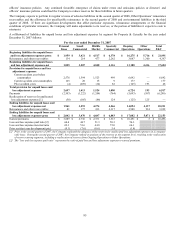

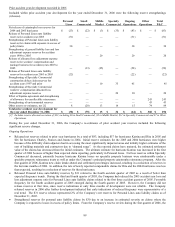

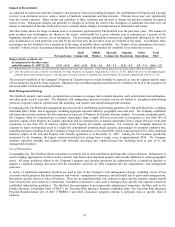

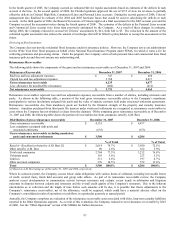

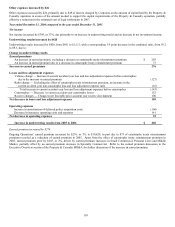

The Company has several catastrophe reinsurance programs, including reinsurance treaties that cover property and workers’

compensation losses aggregating from single catastrophe events. The following table summarizes the primary catastrophe treaty

reinsurance coverages that the Company has in place as of January 1, 2008:

Coverage

Treaty term

% of layer(s)

reinsured

Per occurrence limit

Retention

Principal property catastrophe program covering

property catastrophe losses from a single event

1/1/2008 to

1/1/2009

Varies by layer,

but averages 89%

across all layers

Aggregates to $750

across all layers

$ 250

Layer covering property catastrophe losses from a

single wind or earthquake event affecting the

northeast of the United States from Virginia to

Maine

6/1/2007 to

6/1/2008

90% 300 1,000

Property catastrophe losses from a single event on

excess and surplus property business

1/1/2008 to

1/1/2009

95% Aggregates to $280

across all layers

20

Property catastrophe losses from a single event on

property business written with national accounts

7/1/2007 to

7/1/2008

91% 160 15

Reinsurance with the Florida Hurricane

Catastrophe Fund covering Florida Personal Lines

property catastrophe losses from a single event

6/1/2007 to

6/1/2008

90% 423 [1] 83

Workers’ compensation losses arising from a

single catastrophe event

7/1/2007 to

7/1/2008

95% 280 20

[1] The per occurrence limit on the FHCF treaty increased from $264 for the 6/1/2006 to 6/1/2007 treaty year to $423 for the 6/1/2007 to 6/1/2008

treaty year due to the Company’s election to purchase additional limits under the “Temporary Increase in Coverage Limit (TCIL)” statutory

provision in excess of the coverage the Company is required to purchase from the FHCF.

In addition to the property catastrophe reinsurance coverage described in the above table, the Company has other treaties and facultative

reinsurance agreements that cover property catastrophe losses on an aggregate excess of loss and on a per risk basis. Property

catastrophe losses incurred on property business written with national accounts is also reimbursable under the principal catastrophe

reinsurance program, subject to the overall program limits and retention. In the aftermath of the 2004 and 2005 hurricane season, third-

party catastrophe loss models for hurricane loss events were updated to incorporate medium-term forecasts of increased hurricane

frequency and severity.

The principal property catastrophe reinsurance program and other reinsurance programs include a provision to reinstate limits in the

event that a catastrophe loss exhausts limits on one or more layers under the treaties.

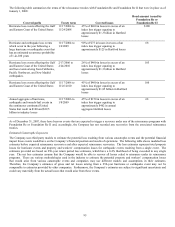

In addition to the reinsurance protection provided by The Hartford’ s reinsurance program described above, the Company has fully

collateralized reinsurance coverages from Foundation Re and Foundation Re II for losses sustained from qualifying hurricane and

earthquake loss events and other qualifying catastrophe losses. Foundation Re and Foundation Re II are Cayman Islands reinsurance

companies which financed the provision of the reinsurance through the issuance of catastrophe bonds. Under the terms of the treaties

with Foundation Re and Foundation Re II, the Company is reimbursed for losses from natural disaster events using a customized

industry index contract designed to replicate The Hartford's own catastrophe losses, with a provision that the actual losses incurred by

the Company for covered events, net of reinsurance recoveries, cannot be less than zero.