The Hartford 2007 Annual Report Download - page 225

Download and view the complete annual report

Please find page 225 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-48

6. Reinsurance

The Hartford cedes insurance to other insurers in order to limit its maximum losses and to diversify its exposures. Such transfers do

not relieve The Hartford of its primary liability under policies it wrote and, as such, failure of reinsurers to honor their obligations could

result in losses to The Hartford. The Hartford also is a member of and participates in several reinsurance pools and associations. The

Hartford evaluates the financial condition of its reinsurers and monitors concentrations of credit risk. The Hartford’ s property and

casualty reinsurance is placed with reinsurers that meet strict financial criteria established by a credit committee. As of December 31,

2007 and 2006, The Hartford had no reinsurance-related concentrations of credit risk greater than 10% of the Company’ s stockholders’

equity.

Life

In accordance with normal industry practice, Life is involved in both the cession and assumption of insurance with other insurance and

reinsurance companies. As of December 31, 2007 the Company's policy for the largest amount of life insurance retained on any one of

the life operations doubled from $5 to $10 compared to the corresponding 2006 and 2005 periods.

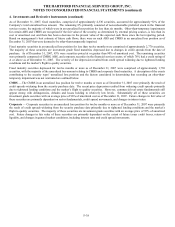

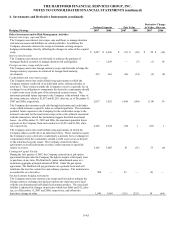

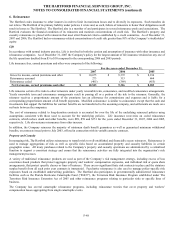

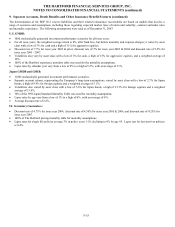

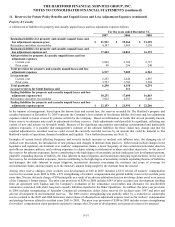

Life insurance fees, earned premiums and other were comprised of the following:

For the years ended December 31,

2007 2006 2005

Gross fee income, earned premiums and other $10,675 $9,372 $ 8,194

Reinsurance assumed 273 313 464

Reinsurance ceded (405) (369) (455)

Net fee income, earned premiums and other $10,543 $9,316 $ 8,203

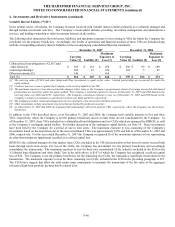

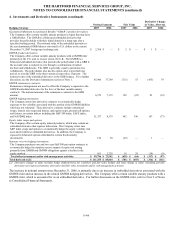

Life reinsures certain of its risks to other reinsurers under yearly renewable term, coinsurance, and modified coinsurance arrangements.

Yearly renewable term and coinsurance arrangements result in passing all or a portion of the risk to the reinsurer. Generally, the

reinsurer receives a proportionate amount of the premiums less an allowance for commissions and expenses and is liable for a

corresponding proportionate amount of all benefit payments. Modified coinsurance is similar to coinsurance except that the cash and

investments that support the liabilities for contract benefits are not transferred to the assuming company, and settlements are made on a

net basis between the companies.

The cost of reinsurance related to long-duration contracts is accounted for over the life of the underlying reinsured policies using

assumptions consistent with those used to account for the underlying policies. Life insurance recoveries on ceded reinsurance

contracts, which reduce death and other benefits, were $89, $59 and $351 for the years ended December 31, 2007, 2006 and 2005,

respectively. Life also assumes reinsurance from other insurers.

In addition, the Company reinsures the majority of minimum death benefit guarantees as well as guaranteed minimum withdrawal

benefits, on contracts issued prior to July 2003, offered in connection with its variable annuity contracts.

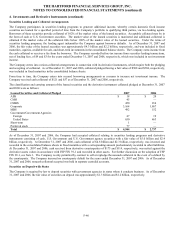

Property and Casualty

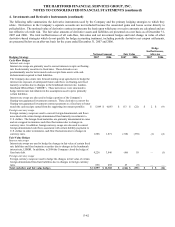

In managing risk, The Hartford utilizes reinsurance to transfer risk to well-established and financially secure reinsurers. Reinsurance is

used to manage aggregations of risk as well as specific risks based on accumulated property and casualty liabilities in certain

geographic zones. All treaty purchases related to the Company’ s property and casualty operations are administered by a centralized

function to support a consistent strategy and ensure that the reinsurance activities are fully integrated into the organization’ s risk

management processes.

A variety of traditional reinsurance products are used as part of the Company’ s risk management strategy, including excess of loss

occurrence-based products that protect aggregate property and workers’ compensation exposures, and individual risk or quota share

arrangements, that protect specific classes or lines of business. There are no significant finite risk contracts in place and the statutory

surplus benefit from all such prior year contracts is immaterial. Facultative reinsurance is also used to manage policy-specific risk

exposures based on established underwriting guidelines. The Hartford also participates in governmentally administered reinsurance

facilities such as the Florida Hurricane Catastrophe Fund (“FHCF”), the Terrorism Risk Insurance Program established under The

Terrorism Risk Insurance Extension Act of 2005 and other reinsurance programs relating to particular risks or specific lines of

business.

The Company has several catastrophe reinsurance programs, including reinsurance treaties that cover property and workers’

compensation losses aggregating from single catastrophe events.