The Hartford 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

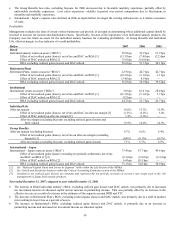

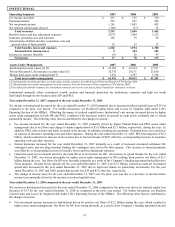

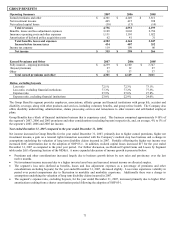

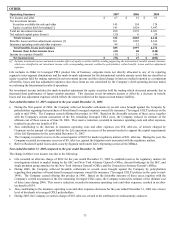

INSTITUTIONAL

Operating Summary 2007 2006 2005

Fee income and other $251 $ 125 $120

Earned premiums 987 607 504

Net investment income 1,241 1,003 802

Net realized capital gains (losses) (188) (37) 36

Total revenues 2,291 1,698 1,462

Benefits, losses and loss adjustment expenses 2,074 1,484 1,212

Insurance operating costs and expenses 185 78 56

Amortization of deferred policy acquisition costs and

present value of future profits

23

32

32

Total benefits, losses and expenses 2,282 1,594 1,300

Income before income taxes 9 104 162

Income tax expense (benefit) (8) 26 47

Net income $17 $ 78 $115

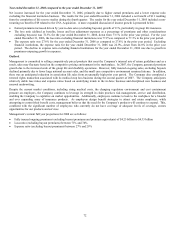

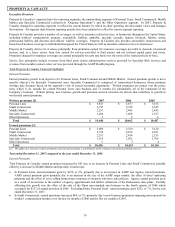

Assets Under Management

2007

2006

2005

Institutional account values [1] [3] $ 25,103 $ 22,214 $ 17,917

Private Placement Life Insurance account values [3] 32,792 26,131 23,836

Mutual fund assets under management [2] 3,581 2,567 1,528

Total assets under management $ 61,476 $ 50,912 $ 43,281

[1] Institutional investment product account values include transfers from Retirement Plans and Retail of $763 during 2006.

[2] Mutual fund assets under management include transfers from the Retirement Plans segment of $178 during 2006.

[3] Includes policyholder balances for investment contracts and reserves for future policy benefits for insurance contracts.

Institutional primarily offers customized wealth creation and financial protection for institutions, corporate and high net worth

individuals through its two business units: IIP and PPLI.

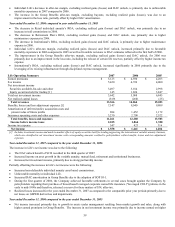

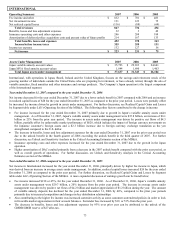

Year ended December 31, 2007 compared to the year ended December 31, 2006

Net income in Institutional decreased for the year ended December 31, 2007 primarily due to increased realized capital losses of $151 as

compared to the prior year period. For further discussion, see Realized Capital Gains and Losses by Segment table under Life’ s

Operating Section of the MD&A. Offsetting the impact of realized capital losses, Institutional’ s net income increased driven by higher

assets under management in both IIP and PPLI, combined with increased returns on general account assets, primarily due to strong

partnership income. The following other factors contributed to the changes in income:

• Fee income increased for the year ended December 31, 2007 primarily driven by higher Mutual Fund and PPLI assets under

management due to net flows and change in market appreciation of $5.8 billion and $2.1 billion, respectively, during the year. In

addition, PPLI collects front-end loads, recorded in fee income, to subsidize premium tax payments. Premium taxes are recorded as

an expense in insurance operating costs and other expenses. During the year ended December 31, 2007, PPLI had deposits of $5.2

billion, which resulted in an increase in fee income due to front-end loads of $107 offset by a corresponding increase in insurance

operating costs and other expenses.

• Earned premiums increased for the year ended December 31, 2007 primarily as a result of increased structured settlement life

contingent sales, and one large terminal funding life contingent case sold in the third quarter. This increase in earned premiums

was offset by a corresponding increase in benefits, losses and loss adjustment expenses.

• General account net investment spread is the main driver of net income for IIP. An increase in spread income for the year ended

December 31, 2007, was driven principally by higher assets under management in IIP resulting from positive net flows of $1.5

billion during the year. Net flows for IIP were favorable primarily as a result of the Company’ s funding agreement backed Investor

Notes program. Investor Notes deposits for the year ended December 31, 2007 were $1.5 billion. General account net investment

spread also increased for the year ended December 31, 2007 due to improved returns on partnership investments. For the year

ended December 31, 2007 and 2006, partnership income was $32 and $15, after-tax, respectively.

• The change in income taxes for the year ended December 31, 2007 over the prior year was due to a decrease in income before

income taxes primarily driven by the increase in realized capital losses.

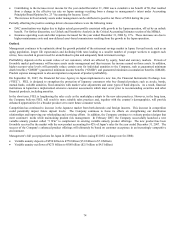

Year ended December 31, 2006 compared to the year ended December 31, 2005

Net income in Institutional decreased for the year ended December 31, 2006 compared to the prior year driven by realized capital loss

increases of $73 for the year ended December 31, 2006 as compared to the prior year period. For further discussion, see Realized

Capital Gains and Losses by Segment table under Life’ s Operating Section of the MD&A. The following other factors contributed to

the changes in income:

• Net investment income increased in Institutional driven by positive net flows of $2.2 billion during the year, which resulted in

higher assets under management. Net flows for IIP were strong primarily as a result of the Company’ s funding agreement backed