The Hartford 2007 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-8

1. Basis of Presentation and Accounting Policies (continued)

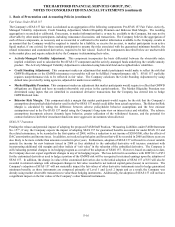

Amendment of FASB Interpretation No. 39

In April 2007, the FASB issued FASB Staff Position No. FIN 39-1, “Amendment of FASB Interpretation No. 39” (“FSP FIN 39-1”).

FSP FIN 39-1 amends FIN 39, “Offsetting of Amounts Related to Certain Contacts”, by permitting a reporting entity to offset fair value

amounts recognized for the right to reclaim cash collateral (a receivable) or the obligation to return cash collateral (a payable) against

fair value amounts recognized for derivative instruments executed with the same counterparty under the same master netting

arrangement that have been offset in the statement of financial position in accordance with FIN 39. FSP FIN 39-1 also amends FIN 39

by modifying certain terms. FSP FIN 39-1 is effective for reporting periods beginning after November 15, 2007, with early application

permitted. The Company early adopted FSP FIN 39-1 on December 31, 2007, by electing to offset cash collateral against amounts

recognized for derivative instruments under the same master netting arrangements. The Company recorded the effect of adopting FSP

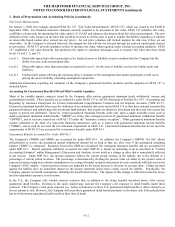

FIN 39-1 as a change in accounting principle through retrospective application. The effect on the consolidated balance sheet as of

December 31, 2006 was a decrease of $166 in the derivative payable included in other liabilities, and corresponding decrease of $2 and

$164, respectively, in other investments and derivative receivable included in other assets. See Note 4 for further discussions on the

adoption of FSP FIN 39-1.

Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements No. 87, 88,

106 and 132(R)

In September 2006, the FASB issued Statement of Financial Accounting Standard (“SFAS”) No. 158, “Employers’ Accounting for

Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106 and 132(R)” (“SFAS

158”). This statement requires an entity to: (a) recognize an asset for the funded status, measured as the difference between the fair

value of plan assets and the benefit obligation, of defined benefit postretirement plans that are overfunded and a liability for plans that

are underfunded, measured as of the employer’ s fiscal year end; and (b) recognize changes in the funded status of defined benefit

postretirement plans, other than for the net periodic benefit cost included in net income, in accumulated other comprehensive income.

For pension plans, the funded status must be based on the projected benefit obligation which includes an assumption for future salary

increases. The provisions of FASB Statement No. 87, “Employers’ Accounting for Pensions” (“SFAS 87”) and FASB Statement No.

106, “Employers’ Accounting for Postretirement Benefits Other Than Pensions” in measuring plan assets and benefit obligations and in

determining the amount of net periodic benefit cost continue to apply upon initial and subsequent application of SFAS 158. SFAS 158

is effective for public entities with years ending after December 15, 2006, with certain exceptions not applicable to The Hartford,

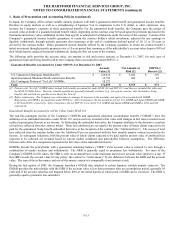

through an adjustment to the ending balance of accumulated other comprehensive income, net of tax. As of December 31, 2006, the

effect of adopting SFAS 158 was a decrease of $717 in the net defined benefit postretirement plan asset and a corresponding after-tax

decrease of $466 in the accumulated other comprehensive income component of equity. Because the Company recorded a decrease of

$560, net of tax, in its additional minimum liability adjustment related to its pension plans, the balance sheet change was an increase of

$145 in the net defined benefit postretirement plan asset and a corresponding after-tax increase of $94 in the accumulated other

comprehensive income component of equity.

Accounting for Certain Hybrid Financial Instruments—an amendment of FASB Statements No. 133 and 140

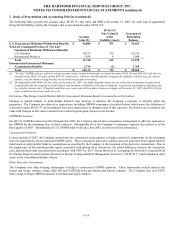

In February 2006, the FASB issued SFAS No. 155, “Accounting for Certain Hybrid Financial Instruments—an amendment of FASB

Statements No. 133 and 140” (“SFAS 155”). This statement amends SFAS No. 133, “Accounting for Derivative Instruments and

Hedging Activities” (“SFAS 133”), and SFAS No. 140, “Accounting for Transfers and Servicing of Financial Assets and

Extinguishments of Liabilities” and resolves issues addressed in SFAS 133 Implementation Issue No. D1, “Application of Statement

133 to Beneficial Interests in Securitized Financial Assets”. SFAS 155: (a) permits fair value remeasurement for any hybrid financial

instrument (asset or liability) that contains an embedded derivative that otherwise would require bifurcation; (b) clarifies which

interest-only strips and principal-only strips are not subject to the requirements of SFAS 133; (c) establishes a requirement to evaluate

beneficial interests in securitized financial assets to identify interests that are freestanding derivatives or that are hybrid financial

instruments that contain an embedded derivative requiring bifurcation; (d) clarifies that concentrations of credit risk in the form of

subordination are not embedded derivatives; and (e) eliminates restrictions on a qualifying special purpose entity’ s ability to hold

passive derivative financial instruments that pertain to beneficial interests that are or contain a derivative financial instrument. SFAS

155 also requires presentation within the financial statements that identifies those hybrid financial instruments for which the fair value

election has been applied and information on the income statement impact of the changes in fair value of those instruments. The

Company began applying SFAS 155 to all financial instruments acquired, issued or subject to a remeasurement event beginning

January 1, 2007. SFAS 155 did not have an effect on the Company’ s consolidated financial condition and results of operations upon

adoption on January 1, 2007.