The Hartford 2007 Annual Report Download - page 231

Download and view the complete annual report

Please find page 231 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-54

9. Separate Accounts, Death Benefits and Other Insurance Benefit Features (continued)

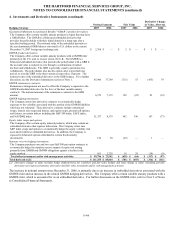

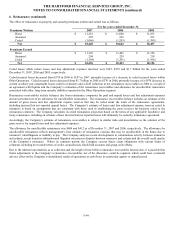

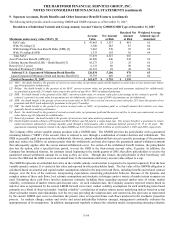

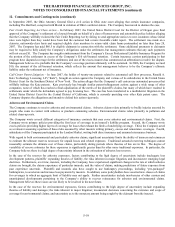

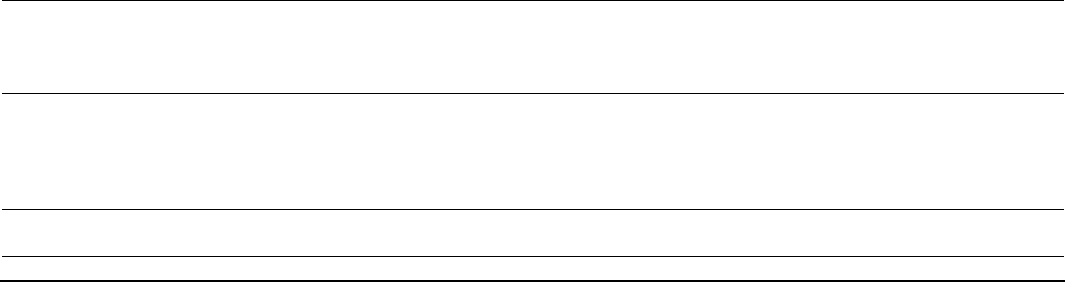

The following table provides details concerning GMDB and GMIB exposure as of December 31, 2007:

Breakdown of Individual Variable and Group Annuity Account Value by GMDB/GMIB Type at December 31, 2007

Maximum anniversary value (MAV) [1]

Account

Value

Net Amount

at Risk

Retained Net

Amount

at Risk

Wei

g

hted Avera

g

e

Attained Age of

Annuitant

MAV only $ 47,463 $ 3,557 $ 419 65

With 5% rollup [2] 3,360 285 67 64

With Earnings Protection Benefit Rider (EPB) [3] 5,463 530 85 62

With 5% rollup & EPB 1,333 155 30 64

Total MAV 57,619 4,527 601

Asset Protection Benefit (APB) [4] 42,489 446 242 62

Lifetime Income Benefit (LIB) - Death Benefit [5] 10,273 25 25 62

Reset [6] (5-7 years) 6,132 80 80 66

Return of Premium [7] /Other 10,321 28 28 54

Subtotal U.S. Guaranteed Minimum Death Benefits 126,834 5,106 976 63

Japan Guaranteed Minimum Death and Income Benefit [8] 35,793 649 419 66

Total at December 31, 2007 $ 162,627 $ 5,755 $ 1,395

[1] MAV: the death benefit is the greatest of current account value, net premiums paid and the highest account value on any anniversary before

age 80 (adjusted for withdrawals).

[2] Rollup: the death benefit is the greatest of the MAV, current account value, net premium paid and premiums (adjusted for withdrawals)

accumulated at generally 5% simple interest up to the earlier of age 80 or 100% of adjusted premiums.

[3] EPB: the death benefit is the greatest of the MAV, current account value, or contract value plus a percentage of the contract’s growth. The

contract’s growth is account value less premiums net of withdrawals, subject to a cap of 200% of premiums net of withdrawals.

[4] APB: the death benefit is the greater of current account value or MAV, not to exceed current account value plus 25% times the greater of net

premiums and MAV (each adjusted for premiums in the past 12 months).

[5] LIB: the death benefit is the greatest of current account value or MAV, net premiums paid, or a benefit amount that ratchets over time,

generally based on market performance.

[6] Reset: the death benefit is the greatest of current account value, net premiums paid and the most recent five to seven year anniversary account

value before age 80 (adjusted for withdrawals).

[7] Return of premium: the death benefit is the greater of current account value and net premiums paid.

[8] Death benefits include a Return of Premium and MAV (before age 80) paid in a single lump sum. The income benefit is a guarantee to return

initial investment, adjusted for earnings liquidity, paid through a fixed annuity, after a minimum deferral period of 10, 15 or 20 years. The

guaranteed remaining balance related to the Japan GMIB was $26.8 billion and $22.6 billion as of December31, 2007 and 2006, respectively.

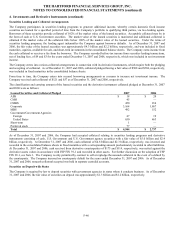

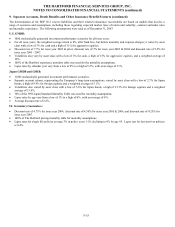

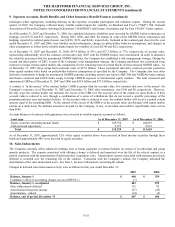

The Company offers certain variable annuity products with a GMWB rider. The GMWB provides the policyholder with a guaranteed

remaining balance (“GRB”) if the account value is reduced to zero through a combination of market declines and withdrawals. The

GRB is generally equal to premiums less withdrawals. However, annual withdrawals that exceed a specific percentage of the premiums

paid may reduce the GRB by an amount greater than the withdrawals and may also impact the guaranteed annual withdrawal amount

that subsequently applies after the excess annual withdrawals occur. For certain of the withdrawal benefit features, the policyholder

also has the option, after a specified time period, to reset the GRB to the then-current account value, if greater. In addition, the

Company has introduced features, for contracts issued beginning in the fourth quarter of 2005, that allow policyholders to receive the

guaranteed annual withdrawal amount for as long as they are alive. Through this feature, the policyholder or their beneficiary will

receive the GRB and the GRB is reset on an annual basis to the maximum anniversary account value subject to a cap.

The GMWB represents an embedded derivative in the variable annuity contracts that is required to be reported separately from the host

variable annuity contract. It is carried at fair value and reported in other policyholder funds. The fair value of the GMWB obligation is

calculated based on actuarial and capital market assumptions related to the projected cash flows, including benefits and related contract

charges, over the lives of the contracts, incorporating expectations concerning policyholder behavior. Because of the dynamic and

complex nature of these cash flows, best estimate assumptions and stochastic techniques under a variety of market return scenarios are

used. Estimating these cash flows involves numerous estimates including those regarding expected market rates of return, market

volatility, correlations of market returns and discount rates. At each valuation date, the Company assumes expected returns based on

risk-free rates as represented by the current LIBOR forward curve rates; market volatility assumptions for each underlying index based

primarily on a blend of observed market “implied volatility”; correlations of market returns across underlying indices based on actual

observed market returns and relationships over the ten years preceding the valuation date; and current risk-free spot rates as represented

by the current LIBOR spot curve to determine the present value of expected future cash flows produced in the stochastic projection

process. As markets change, mature and evolve and actual policyholder behavior emerges, management continually evaluates the

appropriateness of its assumptions. In addition, management regularly evaluates the valuation model, incorporating emerging valuation