The Hartford 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 46

Valuation of Derivative Instruments

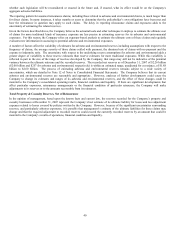

Derivative instruments are recognized on the consolidated balance sheets at fair value. As of December 31, 2007 and 2006,

approximately 89% and 84% of derivatives, respectively, based upon notional values, were priced by valuation models, which utilize

independent market data, while the remaining 11% and 16%, respectively, were priced by broker quotations. The derivatives are valued

using mid-market level inputs that are predominantly observable in the market place. Inputs used to value derivatives include, but are

not limited to, interest swap rates, foreign currency forward and spot rates, credit spreads, interest and equity volatility and equity index

levels. The Company performs a monthly analysis on the derivative valuation which includes both quantitative and qualitative analysis.

Examples of procedures performed include, but are not limited to, review of pricing statistics and trends, back testing recent trades,

analyzing changes in the market environment and monitoring trading volume. This discussion on derivative pricing excludes the

GMWB rider and associated reinsurance contracts as well as the embedded derivatives associated with the GMAB product, which are

discussed in the preceding paragraphs under “Living Benefits Required to be Fair Valued” section.

Evaluation of Other-Than-Temporary Impairments on Available-for-Sale Securities

One of the significant estimates related to available-for-sale securities is the evaluation of investments for other-than-temporary

impairments. If a decline in the fair value of an available-for-sale security is judged to be other-than-temporary, a charge is recorded in

net realized capital losses equal to the difference between the fair value and cost or amortized cost basis of the security. In addition, for

securities expected to be sold, an other-than-temporary impairment charge is recognized if the Company does not expect the fair value

of a security to recover to cost or amortized cost prior to the expected date of sale. The fair value of the other-than-temporarily impaired

investment becomes its new cost basis. For fixed maturities, the Company accretes the new cost basis to par or to the estimated future

value over the expected remaining life of the security by adjusting the security’ s yields.

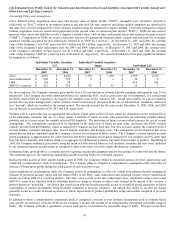

The evaluation of impairments is a quantitative and qualitative process, which is subject to risks and uncertainties and is intended to

determine whether declines in the fair value of investments should be recognized in current period earnings. The risks and uncertainties

include changes in general economic conditions, the issuer’ s financial condition or near term recovery prospects, the effects of changes

in interest rates or credit spreads and the recovery period. The Company has a security monitoring process overseen by a committee of

investment and accounting professionals (“the committee”) that identifies securities that, due to certain characteristics, as described

below, are subjected to an enhanced analysis on a quarterly basis. Based on this evaluation, for the year ended December 31, 2007, the

Company concluded $483 of unrealized losses were other-than-temporarily impaired and as of December 31, 2007, the Company’ s

unrealized losses for fixed maturity and available-for-sale equity securities of $2.8 billion, were temporarily impaired.

Securities not subject to Emerging Issues Task Force (“EITF”) Issue No. 99-20, “Recognition of Interest Income and Impairment on

Purchased Beneficial Interests and Beneficial Interests That Continued to Be Held by a Transferor in Securitized Financial Assets”

(“non-EITF Issue No. 99-20 securities”) that are in an unrealized loss position, are reviewed at least quarterly to determine if an other-

than-temporary impairment is present based on certain quantitative and qualitative factors. The primary factors considered in evaluating

whether a decline in value for non-EITF Issue No. 99-20 securities is other-than-temporary include: (a) the length of time and the extent

to which the fair value has been or is expected to be less than cost or amortized cost, (b) the financial condition, credit rating and near-

term prospects of the issuer, (c) whether the debtor is current on contractually obligated interest and principal payments and (d) the

intent and ability of the Company to retain the investment for a period of time sufficient to allow for recovery.

For certain securitized financial assets with contractual cash flows including ABS, EITF Issue No. 99-20 requires the Company to

periodically update its best estimate of cash flows over the life of the security. If the fair value of a securitized financial asset is less

than its cost or amortized cost and there has been a decrease in the present value of the estimated cash flows since the last revised

estimate, considering both timing and amount, an other-than-temporary impairment charge is recognized. The Company also considers

its intent and ability to retain a temporarily depressed security until recovery. Estimating future cash flows is a quantitative and

qualitative process that incorporates information received from third party sources along with certain internal assumptions and

judgments regarding the future performance of the underlying collateral. In addition, projections of expected future cash flows may

change based upon new information regarding the performance of the underlying collateral.

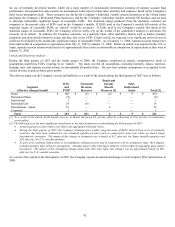

Each quarter, during this analysis, the Company asserts its intent and ability to retain until recovery those securities judged to be

temporarily impaired. Once identified, these securities are systematically restricted from trading unless approved by the committee.

The committee will only authorize the sale of these securities based on predefined criteria that relate to events that could not have been

foreseen. Examples of the criteria include, but are not limited to, the deterioration in the issuer’ s creditworthiness, a change in

regulatory requirements or a major business combination or major disposition.

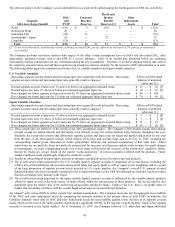

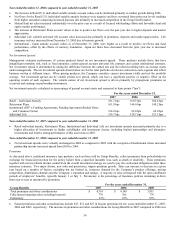

Pension and Other Postretirement Benefit Obligations

The Company maintains a U.S. qualified defined benefit pension plan (the “Plan”) that covers substantially all employees, as well as

unfunded excess plans to provide benefits in excess of amounts permitted to be paid to participants of the Plan under the provisions of

the Internal Revenue Code. The Company has also entered into individual retirement agreements with certain retired directors providing

for unfunded supplemental pension benefits. In addition, the Company provides certain health care and life insurance benefits for

eligible retired employees. The Company maintains international plans which represent an immaterial percentage of total pension

assets, liabilities and expense and, for reporting purposes, are combined with domestic plans.