The Hartford 2007 Annual Report Download - page 236

Download and view the complete annual report

Please find page 236 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-59

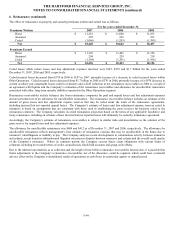

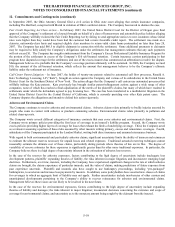

12. Commitments and Contingencies (continued)

In September 2007, the Ohio Attorney General filed a civil action in Ohio state court alleging that certain insurance companies,

including The Hartford, conspired with Marsh in violation of Ohio’ s antitrust statute. The Company has moved to dismiss the case.

Fair Credit Reporting Act Class Action – In February 2007, the United States District Court for the District of Oregon gave final

approval of the Company’ s settlement of a lawsuit brought on behalf of a class of homeowners and automobile policy holders alleging

that the Company willfully violated the Fair Credit Reporting Act by failing to send appropriate notices to new customers whose initial

rates were higher than they would have been had the customer had a more favorable credit report. The settlement was made on a

claim-in, nationwide-class basis and required eligible class members to return valid claim forms postmarked no later than June 28,

2007. The Company has paid $86.5 to eligible claimants in connection with the settlement. Some additional payments to claimants

may be required to fully satisfy the Company’ s obligations under the settlement, but management estimates that any such payments

will not exceed $1. The Company has sought reimbursement from the Company’ s Excess Professional Liability Insurance Program for

the portion of the settlement in excess of the Company’ s $10 self-insured retention. Certain insurance carriers participating in that

program have disputed coverage for the settlement, and one of the excess insurers has commenced an arbitration to resolve the dispute.

Management believes it is probable that the Company’ s coverage position ultimately will be sustained. In 2006, the Company accrued

$10, the amount of the self-insured retention, which reflects the amount that management believes to be the Company’ s ultimate

liability under the settlement net of insurance.

Call-Center Patent Litigation – In June 2007, the holder of twenty-one patents related to automated call flow processes, Ronald A.

Katz Technology Licensing, LP (“Katz”), brought an action against the Company and various of its subsidiaries in the United States

District Court for the Southern District of New York. The action alleges that the Company’ s call centers use automated processes that

willfully infringe the Katz patents. Katz previously has brought similar patent-infringement actions against a wide range of other

companies, none of which has reached a final adjudication of the merits of the plaintiff’ s claims, but many of which have resulted in

settlements under which the defendants agreed to pay licensing fees. The case has been transferred to a multidistrict litigation in the

United States District Court for the Central District of California, which is currently presiding over other Katz patent cases. The

Company disputes the allegations and intends to defend this action vigorously.

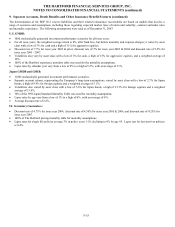

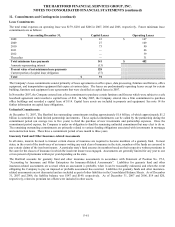

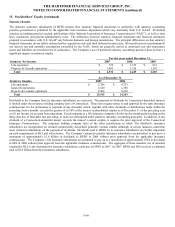

Asbestos and Environmental Claims

The Company continues to receive asbestos and environmental claims. Asbestos claims relate primarily to bodily injuries asserted by

people who came in contact with asbestos or products containing asbestos. Environmental claims relate primarily to pollution and

related clean-up costs.

The Company wrote several different categories of insurance contracts that may cover asbestos and environmental claims. First, the

Company wrote primary policies providing the first layer of coverage in an insured’ s liability program. Second, the Company wrote

excess policies providing higher layers of coverage for losses that exhaust the limits of underlying coverage. Third, the Company acted

as a reinsurer assuming a portion of those risks assumed by other insurers writing primary, excess and reinsurance coverages. Fourth,

subsidiaries of the Company participated in the London Market, writing both direct insurance and assumed reinsurance business.

With regard to both environmental and particularly asbestos claims, significant uncertainty limits the ability of insurers and reinsurers

to estimate the ultimate reserves necessary for unpaid losses and related expenses. Traditional actuarial reserving techniques cannot

reasonably estimate the ultimate cost of these claims, particularly during periods where theories of law are in flux. The degree of

variability of reserve estimates for these exposures is significantly greater than for other more traditional exposures. In particular, the

Company believes there is a high degree of uncertainty inherent in the estimation of asbestos loss reserves.

In the case of the reserves for asbestos exposures, factors contributing to the high degree of uncertainty include inadequate loss

development patterns, plaintiffs’ expanding theories of liability, the risks inherent in major litigation, and inconsistent emerging legal

doctrines. Furthermore, over time, insurers, including the Company, have experienced significant changes in the rate at which asbestos

claims are brought, the claims experience of particular insureds, and the value of claims, making predictions of future exposure from

past experience uncertain. Plaintiffs and insureds also have sought to use bankruptcy proceedings, including “pre-packaged”

bankruptcies, to accelerate and increase loss payments by insurers. In addition, some policyholders have asserted new classes of claims

for coverages to which an aggregate limit of liability may not apply. Further uncertainties include insolvencies of other carriers and

unanticipated developments pertaining to the Company’ s ability to recover reinsurance for asbestos and environmental claims.

Management believes these issues are not likely to be resolved in the near future.

In the case of the reserves for environmental exposures, factors contributing to the high degree of uncertainty include expanding

theories of liability and damages; the risks inherent in major litigation; inconsistent decisions concerning the existence and scope of

coverage for environmental claims; and uncertainty as to the monetary amount being sought by the claimant from the insured.