The Hartford 2007 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-22

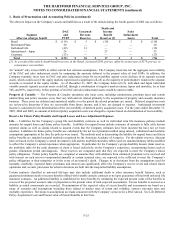

1. Basis of Presentation and Accounting Policies (continued)

Credit Risk

The Company’ s derivative counterparty exposure policy establishes market-based credit limits, favors long-term financial stability and

creditworthiness and typically requires credit enhancement/credit risk reducing agreements. Credit risk is measured as the amount

owed to the Company based on current market conditions and potential payment obligations between the Company and its

counterparties. Credit exposures are generally quantified daily, netted by counterparty for each legal entity of the Company, and

collateral is pledged to and held by, or on behalf of, the Company to the extent the current value of derivatives exceeds the exposure

policy thresholds which do not exceed $10. The Company also minimizes the credit risk in derivative instruments by entering into

transactions with high quality counterparties rated A2/A or better, which are monitored by the Company’ s internal compliance unit and

reviewed frequently by senior management. In addition, the compliance unit monitors counterparty credit exposure on a monthly basis

to ensure compliance with Company policies and statutory limitations. The Company also maintains a policy of requiring that

derivative contracts, other than exchange traded contracts, currency forward contracts, and certain embedded derivatives, be governed

by an International Swaps and Derivatives Association Master Agreement which is structured by legal entity and by counterparty and

permits right of offset. To date, the Company has not incurred any losses on derivative instruments due to counterparty

nonperformance.

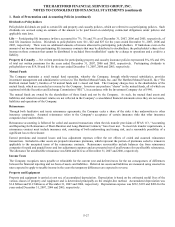

Product Derivatives and Risk Management

The Company offers certain variable annuity products with a guaranteed minimum withdrawal and accumulation benefit (“GMWB”

and “GMAB”) rider. The GMWB and GMAB represent embedded derivatives in the variable annuity contracts that are required to be

reported separately from the host variable annuity contract. They are carried at fair value and reported in other policyholder funds. The

fair value of the GMWB and GMAB obligation is calculated based on actuarial and capital market assumptions related to the projected

cash flows, including benefits and related contract charges, over the lives of the contracts, incorporating expectations concerning

policyholder behavior. Because of the dynamic and complex nature of these cash flows, best estimate assumptions and stochastic

techniques under a variety of market return scenarios are used. Estimating these cash flows involves numerous estimates and

subjective judgments including those regarding expected market rates of return, market volatility, correlations of market returns and

discount rates. At each valuation date, the Company assumes expected returns based on risk-free rates as represented by the current

LIBOR forward curve rates; market volatility assumptions for each underlying index based on a blend of observed market “implied

volatility” data and annualized standard deviations of monthly returns using the most recent 20 years of observed market performance;

correlations of market returns across underlying indices based on actual observed market returns and relationships over the ten years

preceding the valuation date; and current risk-free spot rates as represented by the current LIBOR spot curve to determine the present

value of expected future cash flows produced in the stochastic projection process.

In valuing the embedded derivative, the Company attributes to the derivative a portion of the fees collected from the contract holder

equal to the present value of future GMWB claims (the “Attributed Fees”). All changes in the fair value of the embedded derivative are

recorded in net realized capital gains and losses. The excess of fees collected from the contract holder over the Attributed Fees are

associated with the host variable annuity contract recorded in fee income. Upon adoption of SFAS 157, the Company will revise many

of the assumptions used to value GMWB.

For contracts issued prior to July 2003, the Company has a reinsurance arrangement in place to transfer its risk of loss due to GMWB.

This arrangement is recognized as a derivative and carried at fair value in reinsurance recoverables. Changes in the fair value of the

reinsurance agreement is recorded in net realized capital gains and losses. As of July 2003, the Company had substantially exhausted

all of its reinsurance capacity, with respect to contracts issued after July 2003, and began hedging its exposure to the GMWB rider

using a sophisticated program involving interest rate futures, Standard and Poor’ s (“S&P”) 500 and NASDAQ index put options and

futures contracts and Europe, Australasia and Far East (“EAFE”) Index swaps to hedge GMWB exposure to international equity

markets. During 2007, the Company also purchased customized derivative instruments to hedge capital market risks associated with

GMWB. For the years ended December 31, 2007, 2006 and 2005, net realized capital gains and losses included the change in market

value of the embedded derivative related to the GMWB and GMAB liability, the derivative reinsurance arrangement and the related

derivative contracts that were purchased as economic hedges, the net effect of which was a $277 loss, $26 loss and $46 loss, before

deferred policy acquisition costs and tax effects, respectively.

A contract is ‘in the money’ if the contract holder’s GRB is greater than the account value. For contracts that were ‘in the money’ , the

Company’ s exposure as of December 31, 2007, after reinsurance, was $146. However, the only ways the contract holder can monetize

the excess of the GRB over the account value of the contract is upon death or if their account value is reduced to zero through a

combination of a series of withdrawals that do not exceed a specific percentage of the premiums paid per year and market declines. If

the account value is reduced to zero, the contract holder will receive a period certain annuity equal to the remaining GRB. As the

amount of the excess of the GRB over the account value can fluctuate with equity market returns on a daily basis the ultimate amount

to be paid by the Company, if any, is uncertain and could be significantly more or less than $146.