The Hartford 2007 Annual Report Download - page 254

Download and view the complete annual report

Please find page 254 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-77

18. Stock Compensation Plans (continued)

Share Awards

Share awards are valued equal to the market price of the Company’ s common stock on the date of grant, less a discount for those

awards that do not provide for dividends during the vesting period. Share awards granted under the 2005 Stock Plan and outstanding

include restricted stock units, restricted stock and performance shares. Generally, restricted stock units vest after three years and

restricted stock vests in three to five years. Performance shares become payable within a range of 0% to 200% of the number of shares

initially granted based upon the attainment of specific performance goals achieved over a specified period, generally three years. The

maximum award of restricted stock units, restricted stock or performance shares for any individual employee in any year is 200,000

shares or units.

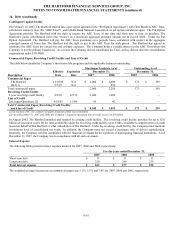

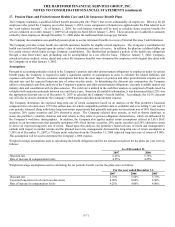

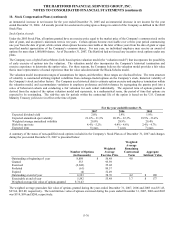

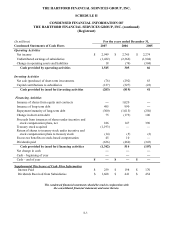

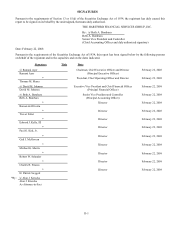

A summary of the status of the Company’s non-vested share awards as of December 31, 2006, and changes during the year ended

December 31, 2007, is presented below:

Non-vested Shares

Shares

(in thousands)

Weighted-Average

Grant-Date Fair Value

Non-vested at beginning of year 1,605 $ 75.23

Granted 641 93.10

Increase for change in estimated performance factors 89 71.27

Vested (256) 68.79

Forfeited (196) 81.88

Non-vested at end of year 1,883 $ 81.69

The total fair value of shares vested during the years ended December 31, 2007, 2006 and 2005 was $23, $29 and $45, respectively,

based on estimated performance factors. The Company, at its discretion, made cash payments in settlement of stock compensation of

$0 and $36 during the years ended December 31, 2007 and 2006, respectively. The Company did not make cash payments in

settlement of stock compensation in the year ended December 31, 2005.

Employee Stock Purchase Plan

In 1996, the Company established The Hartford Employee Stock Purchase Plan (“ESPP”). Under this plan, eligible employees of The

Hartford may purchase common stock of the Company at a 15% discount from the lower of the closing market price at the beginning or

end of the quarterly offering period. Employees purchase a variable number of shares of stock through payroll deductions elected as of

the beginning of the quarter. The Company may sell up to 5,400,000 shares of stock to eligible employees under the ESPP. As of

December 31, 2007, there were 1,629,003 shares available for future issuance. During the years ended December 31, 2007, 2006 and

2005, 372,993, 341,330 and 328,276 shares were sold, respectively. The weighted average per share fair value of the discount under

the ESPP was $18.98, $16.05 and $13.74 during the years ended December 31, 2007, 2006 and 2005, respectively. The fair value is

estimated based on the 15% discount off of the beginning stock price plus the value of three-month European call and put options on

shares of stock at the beginning stock price calculated using the Black-Scholes model and the following weighted average valuation

assumptions:

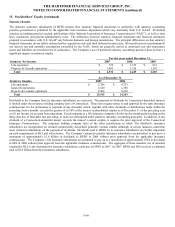

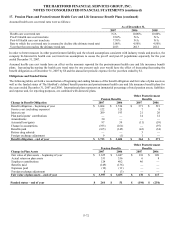

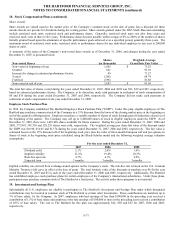

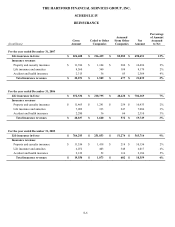

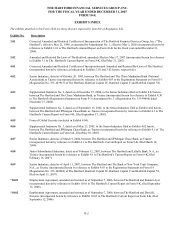

For the year ended December 31,

2007 2006 2005

Dividend yield 2.1% 2.0% 1.6%

Implied volatility 23.2% 19.0% 20.5%

Risk-free spot rate 4.7% 4.7% 2.9%

Expected term 3 months 3 months 3 months

Implied volatility was derived from exchange-traded options on the Company’ s stock. The risk-free rate is based on the U.S. Constant

Maturity Treasury yield curve in effect at the time of grant. The total intrinsic value of the discounts at purchase was $6 for the year

ended December 31, 2007 and $5 in each of the years ended December 31, 2006 and 2005, respectively. Additionally, The Hartford

has established employee stock purchase plans for certain employees of the Company’ s international subsidiaries. Under these plans,

participants may purchase common stock of The Hartford at a fixed price. The activity under these programs is not material.

19. Investment and Savings Plan

Substantially all U.S. employees are eligible to participate in The Hartford’s Investment and Savings Plan under which designated

contributions may be invested in common stock of The Hartford or certain other investments. These contributions are matched, up to

3% of base salary, by the Company. In 2007, employees who had earnings of less than $100,000 in the preceding year received a

contribution of 1.5% of base salary and employees who had earnings of $100,000 or more in the preceding year received a contribution

of 0.5% of base salary. The cost to The Hartford for this plan was approximately $62, $59 and $52 for 2007, 2006 and 2005,

respectively.