The Hartford 2007 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

depends on its product offerings, fund performance, successful utilization of wholesaling organizations, quality of customer service,

and relationships with national and regional broker-dealer firms, banks and other financial institutions.

In the 401(k) market, Retirement Plan’ s primary wholesaler of its plans is PLANCO. As a wholesaler, PLANCO distributes Life’ s

401(k) plans by providing sales support to registered representatives, financial planners and broker-dealers at brokerage firms and

banks across the United States. In addition, Life uses internal personnel with extensive experience in the 401(k) market to sell its

products and services in the retirement plan market.

Competition

Retirement Plans competes with numerous other insurance companies as well as certain banks, securities brokerage firms, independent

financial advisors and other financial intermediaries marketing annuities, mutual funds and other retirement-oriented products. Product

sales are affected by competitive factors such as investment performance ratings, product design, visibility in the marketplace, financial

strength ratings, distribution capabilities, levels of charges and credited rates, reputation and customer service.

For the Section 457 and 403(b) as well as the 401(k) markets, which offer mutual funds wrapped in a variable annuity, variable funding

agreement, or mutual fund retirement program, the variety of available funds and their performance is most important to plan sponsors.

The competitors tend to be the major mutual fund companies.

The competitive landscape for providers of group retirement plans has, and will continue, to intensify. The past few years have seen

consolidation among industry providers seeking to increase scale, improve cost efficiencies, and enter new market segments. The

consolidation of providers is expected to continue as smaller providers exit the market.

In addition, many providers are attempting to expand their market share by extending their target markets across plan size- and tax code

segments (401(k), 457, 403(b)), some of which they may not have previously served. Competition increases as the number of providers

selling business in each segment grows.

The long-awaited, landmark 403(b) regulations, finalized in July 2007, have contributed to the increased activity in the 403(b) market.

The regulations, in general, align an employer's responsibilities more closely with those of a 401(k), making 403(b)s more attractive to

providers who have experience with 401(k) plans. Final Pension Provider Act regulations have also increased competition over

features key to those regulations, such as automatic enrollment capabilities and differentiation of target date fund offerings, when used

as qualified default investment alternatives.

Institutional

Life provides structured settlement contracts, institutional annuities, longevity assurance, institutional mutual funds and stable value

investment products through the Institutional Investment Products (“IIP”) business unit. Additionally, Life is a leader in the variable

Private Placement Life Insurance (“PPLI”) market, which includes life insurance policies purchased by a company or a trust on the

lives of employees, with Life or a trust sponsored by Life named as the beneficiary under the policy.

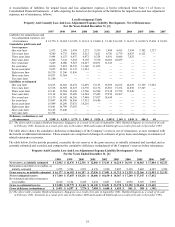

Life’ s total account values related to IIP were $25.1 billion, $22.2 billion and $17.9 billion as of December 31, 2007, 2006 and 2005,

respectively. Variable PPLI products account values were $32.8 billion, $26.1 billion and $23.8 billion as of December 31, 2007, 2006

and 2005, respectively. Institutional total assets were $78.8 billion and $66.2 billion as of December 31, 2007 and 2006, respectively,

excluding mutual funds of $3.6 billion and $2.6 billion for the same respective periods. Institutional generated revenues of $2.3 billion,

$1.7 billion and $1.5 billion in 2007, 2006 and 2005, respectively and net income of $17, $78 and $115 in 2007, 2006 and 2005,

respectively.

Principal Products

IIP — Life sells the following IIP’ s: structured settlements, institutional mutual funds, GICs and other short-term funding agreements,

and other annuity contracts for special purposes such as funding of terminated defined benefit pension plans (institutional annuities

arrangements):

Structured Settlements — Structured settlement annuity contracts provide for periodic payments to an injured person or survivor,

typically in settlement of a claim under a liability policy in lieu of a lump sum settlement. Contracts pay either life contingent or period

certain benefits, which is at the discretion of the contract holder.

Institutional Mutual Funds — Life sells institutional shares of The Hartford Mutual Funds (Class Y shares) to both qualified (i.e.,

section 401(k) and 457 plans) and non-qualified (i.e., endowments and foundations) institutional investors on an "investment only"

basis. Life also sells its Hartford HLS Funds and the Hartford HLS Series II Funds, to qualified retirement plans on an “investment

only” basis. That means that the funds are sold individually, with no recordkeeping services included and not as a part of any bundled

retirement program. The Hartford’s indirect wholly-owned subsidiary, HL Investment Advisors, LLC, serves as the investment advisor

to these funds and contracts with sub-advisors to perform the day-to-day management of the funds. The two primary sub-advisors to

the Hartford HLS Funds are Wellington of Boston, Massachusetts for most of the equity funds and HIMCO for the fixed income funds.

Stable Value Products — GICs are group annuity contracts issued to sponsors of qualified pension or profit-sharing plans or stable

value pooled fund managers. Under these contracts, the client deposits a lump sum with The Hartford for a specified period of time for

a guaranteed interest rate. At the end of the specified period, the client receives principal plus interest earned. Funding agreements are

investment contracts that perform a similar function for non-qualified assets. The Company issues fixed and variable rate funding