The Hartford 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

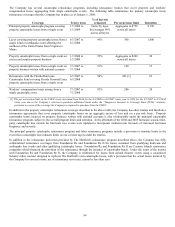

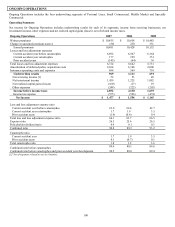

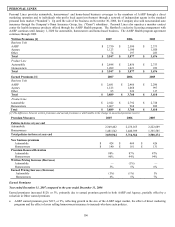

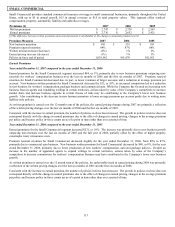

Losses and loss adjustment expenses decreased by $109

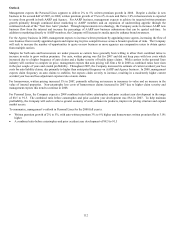

Current accident year loss and loss adjustment expenses before catastrophes increased by $143

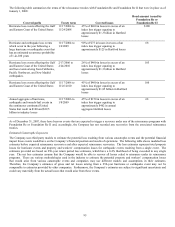

Ongoing Operations’ current accident year loss and loss adjustment expenses before catastrophes increased by $143 in 2006, to $6,507,

due largely to the increase in earned premium. Excluding the effect of catastrophe treaty reinstatement premium, the current accident

year loss and loss adjustment expense ratio before catastrophes increased by 0.2 points, to 62.4, due to an increase in the current

accident year loss and loss adjustment expense ratio before catastrophes of 0.9 points in Personal Lines, 2.1 points in Middle Market and

0.3 points in Specialty Commercial, largely offset by a decrease in the current accident year loss and loss adjustment expense ratio

before catastrophes of 1.8 points in Small Commercial.

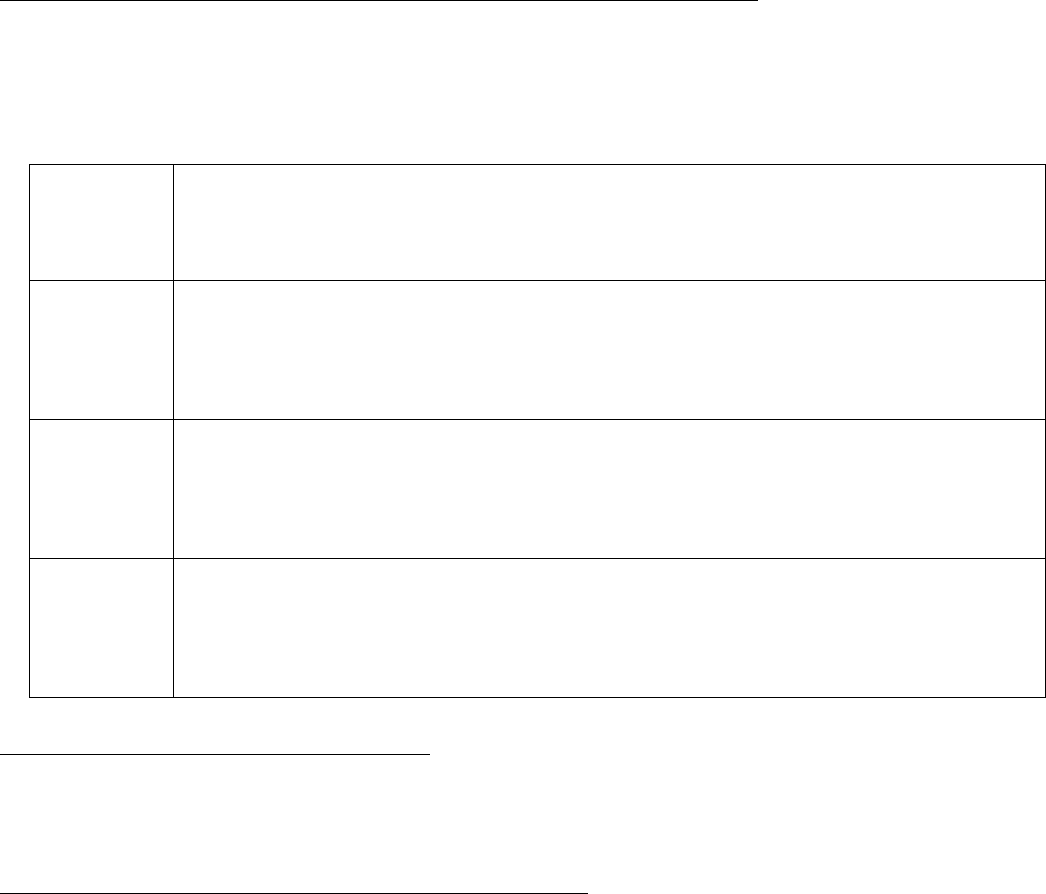

Personal

Lines

Excluding the effect of catastrophe treaty reinstatement premium, the 0.9 point increase in the current

accident year loss and loss adjustment expense ratio before catastrophes in Personal Lines was primarily

due to an increase in non-catastrophe property loss costs for homeowners, primarily driven by an increase

in claim severity, and an increase in the loss and loss adjustment expense ratio for auto liability claims,

partially due to a shift to more Dimensions product business within Agency.

Small

Commercial

Excluding the effect of catastrophe treaty reinstatement premium, the 1.8 point decrease in the current

accident year loss and loss adjustment expense ratio before catastrophes in Small Commercial was

primarily due to a lower loss and loss adjustment expense ratio on workers’ compensation business and a

decrease in non-catastrophe property loss costs, partially offset by a shift to more workers’ compensation

premium which has a higher loss and loss adjustment expense ratio than other business in the segment.

Non-catastrophe property loss costs were favorable primarily due to favorable claim frequency.

Middle

Market

Excluding the effect of catastrophe treaty reinstatement premium, the 2.1 point increase in the current

accident year loss and loss adjustment expense ratio before catastrophes in Middle Market was primarily

due to an increase in non-catastrophe property loss costs, the effect of earned pricing decreases and the

effect of a shift to more workers’ compensation premium which has a higher loss and loss adjustment

expense ratio than other business in the segment. The increase in non-catastrophe property loss costs was

primarily due to increasing claim severity.

Specialty

Commercial

Excluding the effect of catastrophe treaty reinstatement premium, the 0.3 point increase in the current

accident year loss and loss adjustment expense ratio before catastrophes in Specialty Commercial was

primarily due to a higher loss and loss adjustment expense ratio on casualty and professional liability

business and the effect of an increase in the allocation to Specialty Commercial of premiums ceded under

the Company’ s principal property catastrophe reinsurance program, partially offset by lower non-

catastrophe property loss costs.

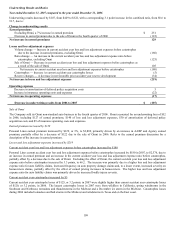

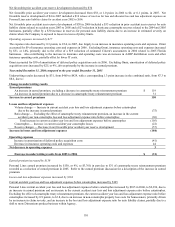

Current accident year catastrophes decreased by $152

Current accident year catastrophe losses decreased by $152, from $351, or 3.5 points, in 2005 to $199, or 1.9 points, in 2006. The

decrease in current accident year catastrophe losses was primarily due to $264 of net losses incurred for hurricanes Katrina, Rita and

Wilma in 2005, partially offset by an increase in non-hurricane related catastrophes in 2006. Catastrophe losses in 2006 included

tornadoes and hail storms in the Midwest and windstorms in Texas and on the East coast.

Change to net favorable prior accident year reserve development by $100

Prior accident year reserve development changed from net unfavorable development of $36, or 0.4 points, in 2005 to net favorable

development of $64, or 0.6 points, in 2006. The $64 of net favorable prior accident year development in 2006 for Ongoing Operations

was primarily due to an $83 release of prior accident year hurricane reserves and a $58 release of allocated loss adjustment expense

reserves for workers’ compensation and package business, partially offset by reserve strengthenings in Specialty Commercial. Net

unfavorable reserve development of $36 in 2005 included a $120 increase in workers’ compensation reserves related to reserves for

claim payments expected to emerge after 20 years of development, a $40 strengthening of general liability reserves within Middle

Market for accident years 2000 to 2003 due to higher than anticipated loss payments beyond four years of development and $33 of

reserve strengthening related to the third quarter 2004 hurricanes. Partially offsetting the reserve increases in 2005 was a $95 reduction

in prior accident year reserves for allocated loss adjustment expenses in Personal Lines, predominantly related to auto liability claims,

and a $75 reduction in workers’ compensation reserves recorded related to accident years 2003 and 2004. See the “Reserves” section of

the MD&A for further discussion of reserve development.